Buying a car is one of the biggest financial decisions you'll ever make, and having access to competitive navy federal car loan rates can turn that dream into reality faster than you think. Whether you're eyeing that shiny new sedan or hunting for a pre-owned gem, understanding loan rates is the key to unlocking great deals. Navy Federal Credit Union stands out as a trusted financial institution offering some of the most attractive car loan rates in the market, making it easier for members to secure their dream rides.

So, why should you care about navy federal car loan rates? Well, if you're like most people, buying a car involves more than just picking out colors and features. It's about securing the best financing options that fit your budget. Navy Federal Credit Union has been helping millions of members achieve their car-buying goals by offering competitive interest rates and flexible loan terms. Let's dive deeper into what makes their loan rates so appealing.

Before we get into the nitty-gritty, it's important to note that Navy Federal isn't just another financial institution. They're a member-focused credit union that prioritizes your financial well-being. Their car loan rates are designed to help you save money while ensuring you drive away with confidence. So, buckle up, and let's explore how you can benefit from their top-notch offerings!

Read also:Hakeem Lyon The Rising Star You Need To Know About

Understanding Navy Federal Car Loan Rates

Let's break it down. Navy Federal car loan rates are more than just numbers on a page; they're a reflection of the credit union's commitment to helping members achieve their financial goals. When you apply for a car loan through Navy Federal, you're not just getting a loan; you're gaining access to a range of benefits that set them apart from traditional banks.

One of the standout features of Navy Federal's car loan rates is their competitive pricing. Unlike some banks that charge sky-high interest rates, Navy Federal offers rates that are often lower than the industry average. This means you could end up paying less over the life of your loan, which is a big win for your wallet.

Why Choose Navy Federal for Your Car Loan?

When it comes to choosing a lender, trust is everything. Navy Federal Credit Union has built a reputation for being reliable and member-focused. Here are some reasons why they're the go-to choice for many car buyers:

- Competitive interest rates that save you money

- Flexible loan terms to suit your financial situation

- Excellent customer service with a focus on member satisfaction

- Access to a wide range of financial tools and resources

But don't just take our word for it. Navy Federal has been recognized by numerous industry experts for their exceptional service and commitment to member success. With over 7 million members worldwide, they've proven time and again that they know how to deliver value.

Current Navy Federal Car Loan Rates

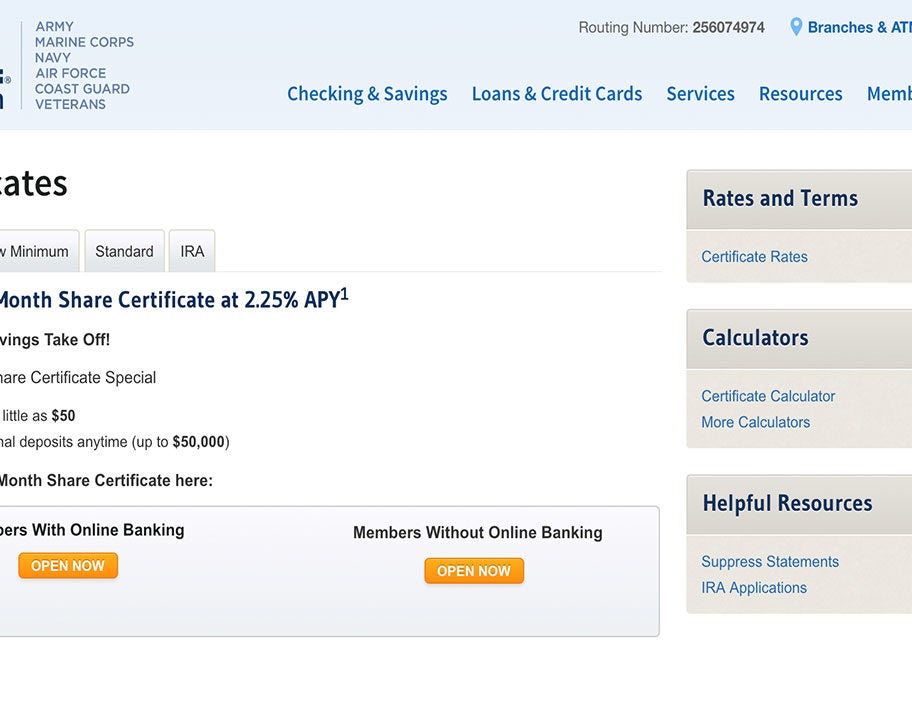

As of 2023, Navy Federal's car loan rates continue to impress. While rates can vary based on factors like credit score, loan term, and vehicle type, you can generally expect to find some of the lowest rates in the market. For example, new car loan rates start as low as 2.49% APR, while used car loans start at 3.49% APR. These rates are subject to change, so it's always a good idea to check directly with Navy Federal for the most up-to-date information.

But here's the thing: these rates aren't just low for the sake of being low. They're designed to help you manage your finances better. By offering lower interest rates, Navy Federal ensures that more of your monthly payment goes toward reducing the principal balance, helping you pay off your loan faster.

Read also:Unveiling Abby Booms Real Name The Ultimate Guide Youve Been Waiting For

Factors Affecting Navy Federal Car Loan Rates

While Navy Federal's car loan rates are generally competitive, there are several factors that can influence the rate you receive:

- Credit Score: A higher credit score typically qualifies you for lower interest rates.

- Loan Term: Shorter loan terms often come with lower rates, but they require higher monthly payments.

- Vehicle Type: New cars usually have lower rates compared to used cars.

- Down Payment: A larger down payment can reduce your loan amount and improve your rate.

Understanding these factors can help you make informed decisions when applying for a car loan. Navy Federal provides resources to help you improve your credit score and manage your finances better, ensuring you get the best possible rate.

How to Apply for a Navy Federal Car Loan

Applying for a car loan with Navy Federal is a breeze. Whether you're buying a new car or a used one, the process is straightforward and designed to be member-friendly. Here's a quick rundown of how you can get started:

First, visit Navy Federal's official website and navigate to the car loan section. From there, you can use their loan calculator to estimate your monthly payments based on the car's price, down payment, and loan term. Once you have an idea of what you can afford, you can proceed to apply online or visit a branch in person.

During the application process, you'll need to provide some basic information, such as your personal details, income, and employment history. Navy Federal will review your application and provide you with a decision, often within minutes. If approved, you can move forward with purchasing your dream car.

Tips for Securing the Best Navy Federal Car Loan Rates

Getting the best navy federal car loan rates isn't just about applying; it's about preparing. Here are some tips to help you secure the most favorable rates:

- Boost your credit score by paying bills on time and reducing debt

- Consider making a larger down payment to lower your loan amount

- Shop around and compare rates to ensure you're getting the best deal

- Talk to a Navy Federal representative for personalized advice

Remember, the better your financial health, the better your chances of getting a great rate. Navy Federal is committed to helping you succeed, so don't hesitate to reach out if you have questions or need guidance.

Benefits of Using Navy Federal for Your Car Loan

Choosing Navy Federal for your car loan comes with a host of benefits that go beyond just competitive rates. As a member-focused credit union, they offer a range of perks that make the car-buying process smoother and more enjoyable:

- Exclusive member discounts on vehicles through their Auto Buying Program

- Access to a nationwide network of dealerships

- Free resources like credit monitoring and financial education

- Convenient online tools for managing your loan

These benefits are just the tip of the iceberg. Navy Federal is constantly innovating to provide members with the best possible experience. Whether you're a first-time car buyer or a seasoned pro, they have something to offer you.

How Navy Federal Supports Your Financial Journey

Navy Federal doesn't just stop at offering great car loan rates. They're committed to supporting your overall financial journey. Through their educational resources and personalized advice, they help members build better financial habits and achieve long-term stability.

For example, their credit monitoring service alerts you to any changes in your credit report, helping you stay on top of your financial health. Their financial education workshops cover topics like budgeting, saving, and investing, empowering you to make smarter financial decisions.

Comparing Navy Federal Car Loan Rates with Other Lenders

When it comes to car loans, it's important to compare lenders to ensure you're getting the best deal. While many banks and credit unions offer car loans, Navy Federal stands out for several reasons:

- Lower interest rates compared to traditional banks

- More flexible loan terms tailored to your needs

- Superior customer service with a focus on member satisfaction

For instance, while a major bank might charge 5% APR on a new car loan, Navy Federal could offer the same loan at 2.49% APR. That's a significant difference that can save you thousands of dollars over the life of the loan. Plus, their commitment to member satisfaction means you'll receive personalized service every step of the way.

Why Navy Federal Outshines the Competition

What sets Navy Federal apart from other lenders is their member-first approach. They prioritize your financial well-being above all else, ensuring that you receive the best possible rates and terms. Unlike traditional banks that are profit-driven, Navy Federal is a not-for-profit organization, which means any earnings are reinvested back into the credit union to benefit its members.

This focus on member satisfaction has earned Navy Federal numerous accolades, including being named one of the best credit unions in the country. When you choose Navy Federal for your car loan, you're choosing a partner that truly cares about your financial success.

Common Questions About Navy Federal Car Loan Rates

Let's address some frequently asked questions about navy federal car loan rates:

Q: Can I apply for a car loan if I'm not a member?

A: Yes, you can apply for a car loan through Navy Federal even if you're not a member. However, becoming a member gives you access to exclusive benefits and discounts.

Q: How long does it take to get approved for a car loan?

A: Navy Federal offers quick decisions, often within minutes, so you can move forward with your car purchase without delay.

Q: Are there any hidden fees with Navy Federal car loans?

A: Navy Federal is transparent about their fees, and there are no hidden costs. You'll know exactly what you're paying upfront.

Final Thoughts on Navy Federal Car Loan Rates

In conclusion, navy federal car loan rates are a game-changer for anyone looking to buy a car. With competitive rates, flexible terms, and excellent customer service, Navy Federal sets the standard for what a car loan should be. Whether you're buying a new or used car, they have options that fit your budget and lifestyle.

So, what are you waiting for? Visit Navy Federal's website today and start your car-buying journey with confidence. Don't forget to share this article with friends and family who might benefit from the information. Together, let's make smarter financial decisions and drive toward a brighter future!

Table of Contents

- Understanding Navy Federal Car Loan Rates

- Why Choose Navy Federal for Your Car Loan?

- Current Navy Federal Car Loan Rates

- Factors Affecting Navy Federal Car Loan Rates

- How to Apply for a Navy Federal Car Loan

- Tips for Securing the Best Navy Federal Car Loan Rates

- Benefits of Using Navy Federal for Your Car Loan

- How Navy Federal Supports Your Financial Journey

- Comparing Navy Federal Car Loan Rates with Other Lenders

- Common Questions About Navy Federal Car Loan Rates