Hey there, fellow finance enthusiasts! Are you ready to dive deep into the world of valuation? DCF 45 hours is more than just a phrase; it’s a game-changer for anyone serious about understanding how businesses are valued. Whether you're a student, a finance professional, or someone curious about the nuts and bolts of corporate finance, this guide is your ticket to mastering the Discounted Cash Flow (DCF) model. So, buckle up and let’s get started!

You’ve probably heard whispers about DCF in boardrooms, classrooms, and even casual finance conversations. But what exactly is it? At its core, DCF 45 hours is all about calculating the present value of future cash flows. It’s like peeking into a crystal ball to predict how much a company—or even an asset—could be worth in the long run. This method isn’t just a buzzword; it’s a fundamental tool that drives investment decisions across the globe.

Now, I know what you’re thinking: “Sounds complicated.” And yeah, it can be. But here’s the good news—this guide breaks it down step by step, making it as easy as pie (or maybe not, but close enough). From understanding the basics to applying the model in real-world scenarios, we’ve got you covered. So, grab your favorite beverage, and let’s unravel the mysteries of DCF 45 hours together.

Read also:Prison Break Bellick The Story Of A Ruthless Warden And His Pursuit Of Justice

What is DCF 45 Hours All About?

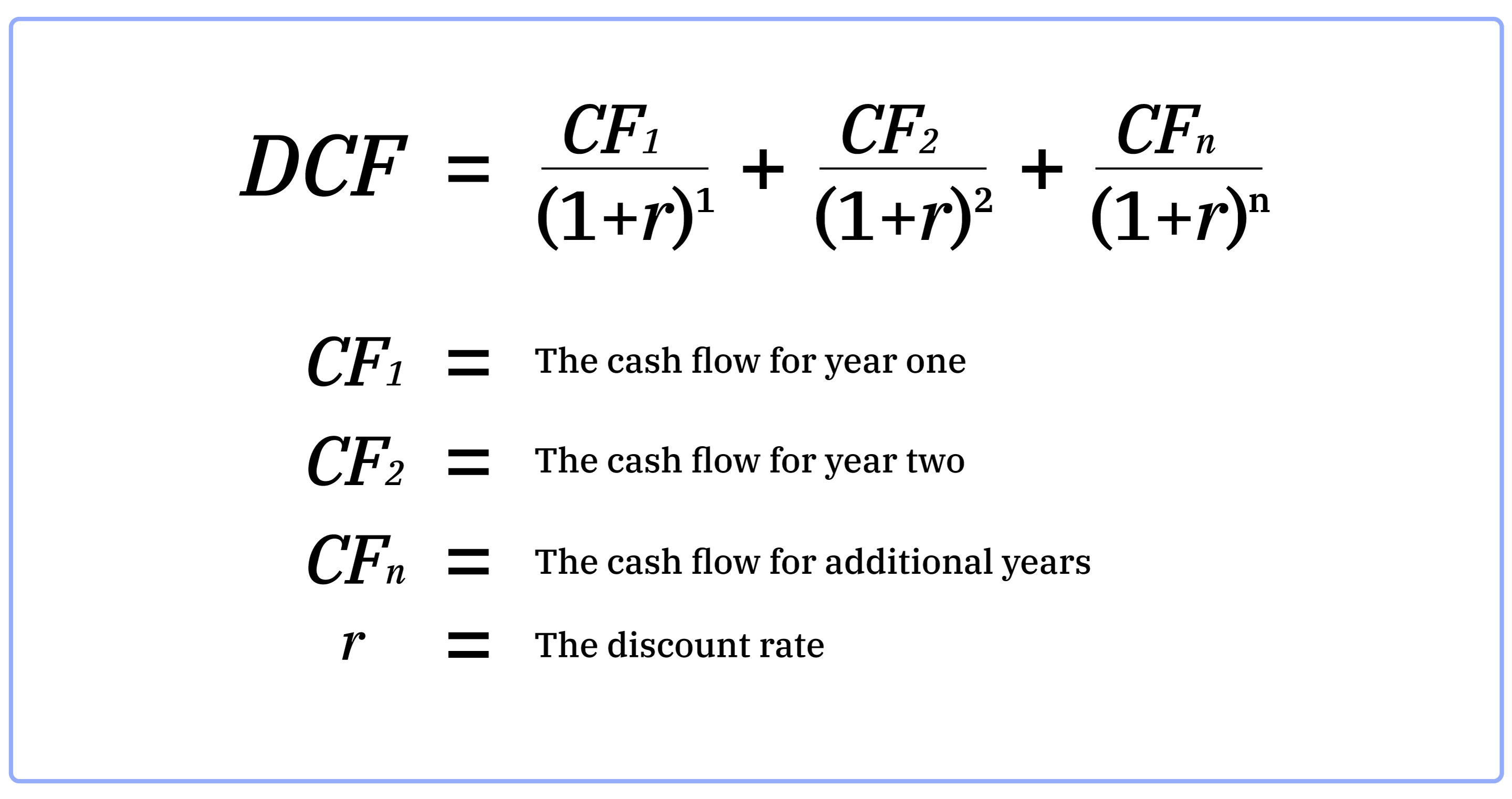

Let’s start with the basics. DCF, or Discounted Cash Flow, is a valuation method used to estimate the value of an investment based on its future cash flows. The "45 hours" part? That’s the time commitment you’ll need to fully grasp the ins and outs of this powerful tool. But trust me, it’s worth it. DCF 45 hours isn’t just about crunching numbers; it’s about understanding the story behind those numbers and how they shape business decisions.

Here’s a quick breakdown:

- DCF focuses on future cash flows, not just profits.

- It considers the time value of money, meaning a dollar today is worth more than a dollar tomorrow.

- By discounting these future cash flows back to their present value, you get a clearer picture of an investment’s true worth.

Why Should You Care About DCF 45 Hours?

Let’s face it—numbers can be intimidating. But when it comes to DCF 45 hours, the benefits far outweigh the initial learning curve. This method is widely used by analysts, investors, and corporate finance professionals to make informed decisions. Whether you’re evaluating a potential acquisition, deciding on a stock investment, or even figuring out if that new business idea is worth pursuing, DCF 45 hours gives you the tools to do it right.

Advantages of Using DCF

So, what makes DCF so special? Here are a few reasons:

- Accuracy: By focusing on cash flows rather than just profits, DCF provides a more accurate picture of a company’s value.

- Flexibility: It can be applied to a wide range of scenarios, from startups to established corporations.

- Transparency: The model is based on clear assumptions and inputs, making it easier to understand and adjust as needed.

How Does DCF 45 Hours Work?

Now that we’ve covered the “what” and “why,” let’s dive into the “how.” The DCF model involves a few key steps:

Step 1: Forecasting Cash Flows

This is where the magic happens. To use DCF 45 hours effectively, you need to predict a company’s future cash flows. This involves analyzing historical data, market trends, and growth projections. It’s not an exact science, but with the right tools and data, you can make educated guesses.

Read also:Hakeem Lyon The Rising Star You Need To Know About

Step 2: Determining the Discount Rate

The discount rate is the rate used to calculate the present value of future cash flows. It reflects the risk associated with the investment. A higher discount rate means a lower present value, and vice versa. This step is crucial because it directly impacts the final valuation.

Step 3: Calculating the Terminal Value

Since businesses are expected to last beyond the forecast period, you’ll need to estimate the terminal value. This is the value of the company beyond the forecast horizon, assuming a stable growth rate. It’s like adding a safety net to your calculations.

Common Mistakes in DCF 45 Hours

Even the best analysts can stumble when working with DCF 45 hours. Here are a few common mistakes to avoid:

- Overestimating Growth: Being too optimistic about future growth can lead to inflated valuations.

- Underestimating Risks: Ignoring potential risks can result in an overly optimistic discount rate.

- Ignoring Market Conditions: Failing to consider broader economic factors can skew your results.

Real-World Applications of DCF 45 Hours

Enough theory—let’s see DCF 45 hours in action. Imagine you’re evaluating a tech startup. By forecasting its cash flows, determining a realistic discount rate, and calculating the terminal value, you can arrive at a valuation that helps you decide whether to invest. This process isn’t limited to startups, though. It’s equally applicable to mergers and acquisitions, capital budgeting, and even personal finance decisions.

Case Study: Valuing a Tech Company

Let’s take a look at a hypothetical tech company. After analyzing its financials and market position, you forecast cash flows for the next five years. Using a discount rate of 10% and a terminal growth rate of 3%, you calculate the present value of these cash flows. The result? A valuation that aligns with the company’s potential and risks.

Tips for Mastering DCF 45 Hours

Want to become a DCF pro? Here are a few tips:

- Practice makes perfect. The more you work with DCF, the better you’ll get at it.

- Stay updated on market trends and economic indicators. These factors can significantly impact your assumptions.

- Don’t be afraid to ask for help. Whether it’s consulting a mentor or joining a finance community, collaboration can accelerate your learning.

Resources for Learning DCF 45 Hours

There’s no shortage of resources to help you master DCF 45 hours. From online courses to books and articles, the options are endless. Some of my favorites include:

- Investopedia: A great starting point for beginners.

- CFI (Corporate Finance Institute): Offers comprehensive courses on DCF and other finance topics.

- Books: Titles like “Damodaran on Valuation” and “The Valuation Handbook” are must-reads for anyone serious about finance.

Conclusion: Embrace the Power of DCF 45 Hours

And there you have it—a comprehensive guide to DCF 45 hours. By now, you should have a solid understanding of what it is, why it matters, and how to apply it in real-world scenarios. Remember, mastering DCF isn’t just about the numbers; it’s about developing a mindset that values accuracy, flexibility, and transparency.

So, what’s next? Take action! Whether it’s diving deeper into the resources mentioned above or applying DCF to your own projects, the choice is yours. And hey, don’t forget to share this article with your friends and colleagues. Together, we can demystify the world of finance one DCF at a time.

Got questions or feedback? Drop a comment below, and let’s keep the conversation going. Happy valuing!

Table of Contents

What is DCF 45 Hours All About?

Why Should You Care About DCF 45 Hours?

Step 1: Forecasting Cash Flows

Step 2: Determining the Discount Rate

Step 3: Calculating the Terminal Value

Common Mistakes in DCF 45 Hours

Real-World Applications of DCF 45 Hours

Case Study: Valuing a Tech Company

Tips for Mastering DCF 45 Hours