Hey there, folks! If you've been searching for a safe and convenient way to handle your finances, PayPal prepaid might just be the answer you've been looking for. Whether you're managing personal expenses or running a business, this innovative payment method offers flexibility and security like no other. In today's fast-paced world, having access to a reliable prepaid solution can make all the difference in how you manage your money. So, buckle up and let's dive into everything you need to know about PayPal prepaid!

Let's face it—traditional banking isn't always the most convenient option for everyone. For those who prefer a hassle-free and secure way to handle transactions, PayPal prepaid provides an excellent alternative. It's like having a virtual wallet that gives you control over your spending without the need for a traditional bank account. This guide will walk you through the ins and outs of PayPal prepaid, from its benefits to how you can get started.

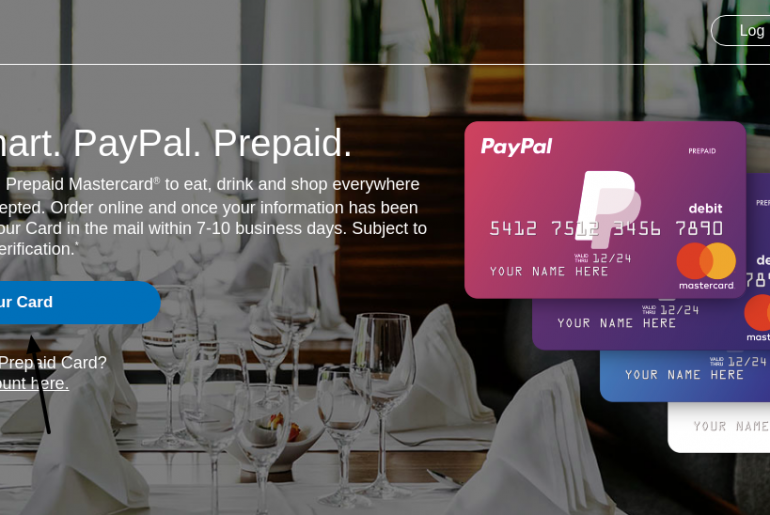

Now, before we get too far ahead of ourselves, it's important to understand what exactly PayPal prepaid is and why it's becoming increasingly popular. In simple terms, it's a prepaid card or account linked to PayPal that allows you to load funds and use them wherever PayPal is accepted. Whether you're shopping online, paying bills, or even traveling abroad, PayPal prepaid has got you covered. So, let's explore why this could be the perfect solution for your financial needs.

Read also:One Direction Ages A Dive Into The Fab Fives Journey Through Time

What Exactly is PayPal Prepaid?

Alright, let's break it down. PayPal prepaid refers to a payment method offered by PayPal that lets you preload funds onto a card or account. Unlike traditional credit or debit cards, PayPal prepaid doesn't require a bank account or credit check. Instead, you load the card with the amount you want to spend, and that's it—no overspending, no hidden fees, and no surprises. It's like carrying cash, but in a much safer and more convenient form.

Here are some key features of PayPal prepaid:

- No credit checks required

- Load funds as needed

- Use it wherever PayPal is accepted

- Protect your personal financial information

For many people, especially those who don't have access to traditional banking services, PayPal prepaid offers a level of freedom and control that's hard to find elsewhere. Plus, it's perfect for those who want to avoid the risks associated with using credit cards online. So, whether you're a digital nomad or just someone looking for a better way to manage their finances, PayPal prepaid is definitely worth considering.

Benefits of Using PayPal Prepaid

Now that we've covered the basics, let's talk about why you should consider using PayPal prepaid. There are plenty of reasons why this payment method has gained so much traction in recent years. Here are some of the top benefits:

1. Enhanced Security

One of the biggest advantages of PayPal prepaid is the added layer of security it provides. When you use a traditional credit card online, you're essentially exposing your personal financial information to potential risks. With PayPal prepaid, you can shop online without ever revealing your bank account or credit card details. It's like having a shield that protects your sensitive information from prying eyes.

2. No Credit Checks

Let's be real—credit checks can be a real pain, especially if you have a less-than-perfect credit history. The beauty of PayPal prepaid is that it doesn't require a credit check to sign up. This makes it an ideal option for people who may not qualify for traditional credit cards or loans. All you need is a PayPal account, and you're good to go.

Read also:Vince Gill Net Worth Exploring The Wealth Behind The Country Music Legend

3. Global Acceptance

PayPal is accepted by millions of merchants worldwide, which means you can use your prepaid card almost anywhere. Whether you're shopping at your favorite online store or booking a hotel in another country, PayPal prepaid has got you covered. It's like having a universal currency that works wherever you go.

How Does PayPal Prepaid Work?

Alright, so you're probably wondering how exactly PayPal prepaid works. Well, it's pretty straightforward. First, you need to sign up for a PayPal account if you don't already have one. Once you're all set up, you can load funds onto your prepaid account or card. From there, you can use it to make purchases online, pay bills, or even withdraw cash from ATMs.

Here's a step-by-step guide to getting started with PayPal prepaid:

- Create a PayPal account (if you don't have one)

- Apply for a PayPal prepaid card or account

- Load funds onto your account or card

- Start using it wherever PayPal is accepted

It's that simple! And the best part is, you can manage everything through the PayPal app, which means you can keep track of your spending and reload your card whenever you need to. It's like having a personal financial assistant in your pocket.

Who Can Use PayPal Prepaid?

PayPal prepaid is designed to be accessible to just about anyone. Whether you're a student, a small business owner, or someone who prefers to avoid traditional banking, this payment method can work for you. Here are a few examples of who might benefit from using PayPal prepaid:

- Students who need a safe way to manage their finances

- Small business owners who want to simplify their payment processes

- Travelers who need a convenient way to pay for expenses abroad

- People who don't have access to traditional banking services

No matter who you are or what your financial situation looks like, PayPal prepaid offers a solution that's tailored to your needs. It's all about giving you the freedom and flexibility to manage your money on your terms.

Costs and Fees Associated with PayPal Prepaid

Now, let's talk about the elephant in the room—fees. Like most financial services, PayPal prepaid does come with some costs. However, these fees are generally quite reasonable, especially when you consider the benefits you're getting in return. Here's a breakdown of the most common fees you might encounter:

- Card issuance fee: $4.95 (one-time fee)

- Monthly maintenance fee: $9.95 (waived if you load at least $100 each month)

- ATM withdrawal fee: $2.50 per transaction

- International transaction fee: 2.9% + fixed fee (varies by currency)

It's worth noting that PayPal often offers promotions and discounts on these fees, so it's a good idea to keep an eye out for special offers. Additionally, if you use your card frequently, you may be able to avoid some of the recurring fees altogether. It's all about finding the plan that works best for you.

Is PayPal Prepaid Safe?

Security is always a top concern when it comes to handling finances online. Fortunately, PayPal prepaid is designed with safety in mind. Here are some of the ways PayPal ensures your money is protected:

1. Zero Liability Policy

PayPal has a zero liability policy, which means you're not responsible for unauthorized transactions. If someone manages to access your account or card, PayPal will cover any losses as long as you report the issue promptly.

2. Fraud Detection Technology

PayPal uses advanced fraud detection technology to monitor your account for suspicious activity. If anything seems out of the ordinary, they'll notify you immediately so you can take action.

3. Two-Factor Authentication

To add an extra layer of security, PayPal offers two-factor authentication for your account. This means that even if someone gets hold of your login credentials, they won't be able to access your account without the second form of verification.

With all these safeguards in place, you can rest assured that your money is in good hands with PayPal prepaid.

How to Get the Most Out of Your PayPal Prepaid Account

Now that you know the basics, here are a few tips to help you get the most out of your PayPal prepaid account:

1. Set a Budget

One of the great things about PayPal prepaid is that it makes it easy to stick to a budget. Since you're only spending the money you've loaded onto the card, you can avoid the temptation to overspend. Set a budget for yourself and stick to it—it'll help you stay on track financially.

2. Take Advantage of Discounts

PayPal often partners with merchants to offer exclusive discounts and deals for prepaid cardholders. Be sure to check out the PayPal website or app for the latest offers—you might be surprised at how much you can save.

3. Use the PayPal App

The PayPal app is a powerful tool for managing your prepaid account. You can check your balance, view transaction history, and even reload your card—all from the convenience of your smartphone. It's like having a personal financial assistant in your pocket.

Common Misconceptions About PayPal Prepaid

There are a few misconceptions about PayPal prepaid that we should address. Let's set the record straight:

1. It's Only for People Without Bank Accounts

While PayPal prepaid is a great option for those who don't have access to traditional banking, it's not the only group that benefits. Many people choose PayPal prepaid simply because it offers more flexibility and security than traditional banking methods.

2. It's Expensive

While there are some fees associated with PayPal prepaid, they're generally quite reasonable, especially when you consider the value you're getting in return. Plus, if you use your card frequently, you may be able to avoid some of the recurring fees altogether.

3. It's Difficult to Use

On the contrary, PayPal prepaid is incredibly user-friendly. With the PayPal app, you can manage your account and card from virtually anywhere. It's as easy as loading funds and swiping your card at checkout.

Conclusion: Why PayPal Prepaid is the Way to Go

Alright, folks, that wraps up our ultimate guide to PayPal prepaid. As you can see, this payment method offers a lot of benefits, from enhanced security to global acceptance. Whether you're managing personal expenses or running a business, PayPal prepaid provides a flexible and convenient way to handle your finances.

So, what are you waiting for? Sign up for a PayPal account today and start exploring the world of prepaid payments. And don't forget to leave a comment or share this article with your friends and family. Who knows? You might just help someone discover a better way to manage their money.

Thanks for reading, and happy spending!

Table of Contents

- What Exactly is PayPal Prepaid?

- Benefits of Using PayPal Prepaid

- How Does PayPal Prepaid Work?

- Who Can Use PayPal Prepaid?

- Costs and Fees Associated with PayPal Prepaid

- Is PayPal Prepaid Safe?

- How to Get the Most Out of Your PayPal Prepaid Account

- Common Misconceptions About PayPal Prepaid

- Conclusion: Why PayPal Prepaid is the Way to Go