Are you tired of being left in the dark when it comes to managing your finances with TJX Synchrony Bank? Well, buckle up because we're about to dive deep into everything you need to know. Whether you're a seasoned shopper or just starting out, understanding how this financial powerhouse works can save you big bucks and help you make smarter choices.

Let's face it, in today's fast-paced world, having a solid grasp on personal finance is more important than ever. And when it comes to retail credit, TJX Synchrony Bank has carved out a pretty sweet spot for itself. But what exactly does that mean for you? We'll break it down step by step so you can feel confident in your financial decisions.

Now, before we get too far ahead of ourselves, let's set the stage. This isn't just another boring article filled with financial jargon. Oh no, we're going to make this journey fun, informative, and most importantly, actionable. So grab your favorite snack, get comfy, and let's explore the world of TJX Synchrony Bank together.

Read also:Ari Melber Wedding Pictures A Sneak Peek Into The Love Story

What Exactly is TJX Synchrony Bank Anyway?

Alright, let's start with the basics. TJX Synchrony Bank is not your typical bank. Think of it more like a financial partner that helps you shop smarter. They offer a range of credit products, including store credit cards, installment loans, and financing options tailored to TJX Corporation's brands like T.J. Maxx, Marshalls, and HomeGoods. It's like having a personal shopper, but for your finances.

Here’s the deal: Synchrony Financial partners with major retailers to provide customized credit solutions. And when it comes to TJX, they’ve nailed it. By offering exclusive discounts, cash back, and flexible payment options, they make shopping a little less stressful and a lot more rewarding.

But why does this matter? Because understanding how these financial tools work can help you save money and avoid unnecessary debt. And who doesn’t want that, right?

How Does TJX Synchrony Bank Work for You?

Let's get into the nitty-gritty. When you sign up for a TJX Synchrony Bank credit card, you're essentially getting access to a whole suite of benefits. Here's a quick rundown:

- Exclusive Discounts: Yep, you'll get access to special promotions and discounts that aren't available to the general public.

- No Annual Fee: That's right, no pesky annual fees to worry about. Your wallet will thank you.

- Cash Back Rewards: Spend money, earn cash back. It's like getting paid to shop.

- Flexible Payment Plans: Can't pay off your balance all at once? No problem. Synchrony offers various payment plans to make it easier.

But remember, with great power comes great responsibility. While these perks can be awesome, it's important to use them wisely and not get carried away with the shopping bug.

The Benefits of Partnering with TJX Synchrony Bank

Now that we've covered the basics, let's talk about why you might want to consider teaming up with TJX Synchrony Bank. Spoiler alert: there are plenty of good reasons.

Read also:Jude Bellingham Parents A Closer Look Into The Family That Shapes A Rising Star

First and foremost, the convenience factor is huge. With a single card, you can access all your favorite TJX stores and take advantage of their exclusive offers. Plus, the cash back rewards are a nice little bonus that can add up over time.

And let's not forget about the peace of mind that comes with having a reliable financial partner. Knowing that you have flexible payment options can make a big difference, especially during those unexpected moments in life.

Is TJX Synchrony Bank Right for You?

Here's the million-dollar question: should you sign up for a TJX Synchrony Bank credit card? Well, it depends on your shopping habits and financial goals. If you're a regular shopper at T.J. Maxx or Marshalls, then it might be worth considering. But if you're not a frequent visitor, you might want to think twice.

Another thing to keep in mind is your credit score. While Synchrony offers various credit products, some may require a good or excellent credit score. So, it's always a good idea to check your credit report before applying.

How to Maximize Your TJX Synchrony Bank Experience

Alright, let's say you've decided to give TJX Synchrony Bank a try. Now what? Here are a few tips to help you make the most of your experience:

- Pay on Time: This one's a no-brainer. Late payments can hurt your credit score and cost you unnecessary fees.

- Track Your Spending: Keep an eye on your purchases to avoid overspending and accumulating debt.

- Use Rewards Wisely: Cash back rewards are great, but don't let them tempt you into buying things you don't need.

- Stay Informed: Sign up for email alerts and notifications to stay on top of your account activity and special offers.

By following these simple tips, you can enjoy the benefits of TJX Synchrony Bank without the stress of financial mismanagement.

Common Misconceptions About TJX Synchrony Bank

There are a few myths floating around about TJX Synchrony Bank that we need to clear up. For starters, some people think that using a store credit card is automatically bad for your credit score. Not true! As long as you use it responsibly, it can actually help improve your credit.

Another misconception is that you'll get stuck in a cycle of debt. While it's true that some people misuse credit cards, it's not an inherent flaw of the system. With a little discipline and smart financial planning, you can avoid this pitfall.

Understanding the Fine Print of TJX Synchrony Bank

Before we move on, let's talk about the fine print. It's important to understand the terms and conditions of any financial product you're considering. With TJX Synchrony Bank, here are a few key points to keep in mind:

- Interest Rates: Make sure you know the APR (Annual Percentage Rate) and how it affects your balance.

- Grace Period: Find out if there's a grace period for new purchases before interest kicks in.

- Balance Transfer Options: If you're looking to consolidate debt, check if there are any balance transfer offers available.

Reading the fine print might not be the most exciting part of the process, but it's crucial for making informed decisions.

How Does TJX Synchrony Bank Compare to Other Retail Credit Cards?

When it comes to retail credit cards, there are plenty of options out there. So, how does TJX Synchrony Bank stack up? Well, it depends on what you're looking for. If you're a fan of TJX stores, then their card is hard to beat. But if you shop at other retailers, you might want to explore other options.

Some key factors to consider when comparing cards include rewards programs, interest rates, and customer service. Do your research and find the card that best aligns with your shopping habits and financial goals.

Customer Service: The Heart of TJX Synchrony Bank

One of the things that sets TJX Synchrony Bank apart is their commitment to customer service. Whether you need help with your account, have questions about your rewards, or want to dispute a charge, their team is ready to assist you.

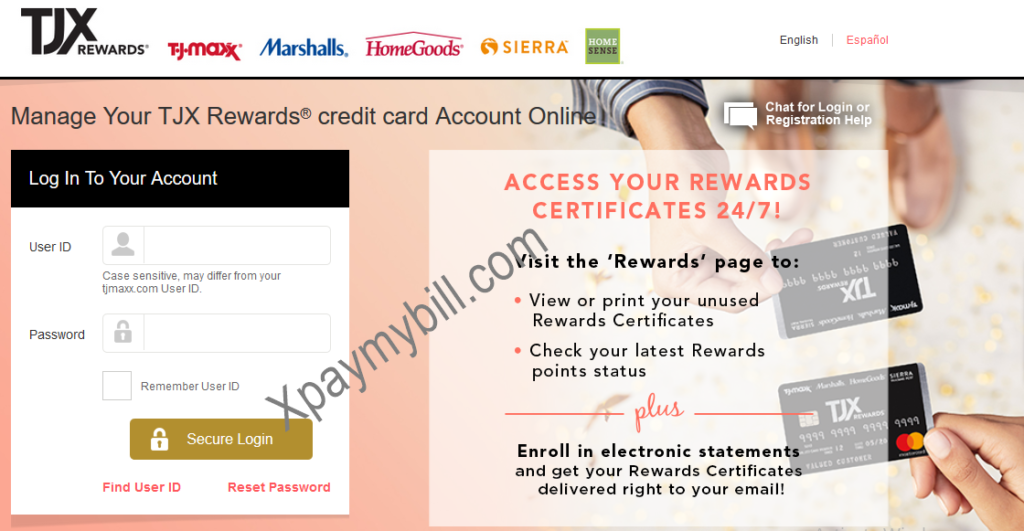

And here's the kicker: they make it easy to get in touch. You can call their customer service hotline, chat with them online, or even visit a store location for in-person assistance. That kind of accessibility is a game-changer in today's digital age.

Real Customer Reviews of TJX Synchrony Bank

Let's hear from some real people who have used TJX Synchrony Bank. According to a recent survey, most customers are satisfied with their experience. They appreciate the convenience, rewards, and customer service.

Of course, no system is perfect. Some customers have reported issues with high interest rates or difficulty managing their balances. But overall, the feedback has been positive, which speaks volumes about the quality of their service.

Final Thoughts: Is TJX Synchrony Bank Worth It?

So, after all that, is TJX Synchrony Bank worth it? The answer is a resounding yes, but with a caveat. If you're a regular shopper at T.J. Maxx, Marshalls, or HomeGoods, then it can be a great tool for saving money and earning rewards. But if you're not a frequent shopper, you might want to explore other options.

Remember, the key to success with any financial product is using it wisely. Pay your bills on time, track your spending, and stay informed about your account activity. By doing so, you can enjoy the benefits of TJX Synchrony Bank without the stress.

Take Action Today!

Now that you know everything there is to know about TJX Synchrony Bank, it's time to take action. Whether you're ready to sign up for a card or just want to learn more, the choice is yours. And don't forget to share this article with your friends and family – knowledge is power!

So, what are you waiting for? Dive into the world of TJX Synchrony Bank and start shopping smarter today!

Table of Contents

- What Exactly is TJX Synchrony Bank Anyway?

- How Does TJX Synchrony Bank Work for You?

- The Benefits of Partnering with TJX Synchrony Bank

- Is TJX Synchrony Bank Right for You?

- How to Maximize Your TJX Synchrony Bank Experience

- Common Misconceptions About TJX Synchrony Bank

- Understanding the Fine Print of TJX Synchrony Bank

- How Does TJX Synchrony Bank Compare to Other Retail Credit Cards?

- Customer Service: The Heart of TJX Synchrony Bank

- Final Thoughts: Is TJX Synchrony Bank Worth It?