Let’s be real, folks—online banking has become a lifesaver in this fast-paced world. Whether you’re paying bills, transferring funds, or checking your balance, having access to BB&T online banking makes life so much easier. But hey, not everyone knows how to navigate it like a pro, right? That’s where we come in. In this article, we’ll break down everything you need to know about BB&T online banking, from setting up your account to troubleshooting common issues. So, buckle up and let’s dive in!

Nowadays, banking doesn’t have to mean standing in long lines at the branch. With BB&T online banking, you can handle all your financial tasks from the comfort of your couch. Imagine saving hours of your time just by logging into an app or website. Sounds pretty sweet, doesn’t it?

Before we get into the nitty-gritty, let me assure you that this guide is packed with practical tips, step-by-step instructions, and insider info to help you make the most out of BB&T online banking. If you’re ready to level up your digital banking game, keep reading!

Read also:Simon Cowells Son Disabled The Untold Story Behind His Family Life

Why BB&T Online Banking is a Game-Changer

Okay, let’s talk about why BB&T online banking has become such a big deal. First off, it offers convenience like no other. You can access your accounts anytime, anywhere, as long as you’ve got an internet connection. No more worrying about bank hours or missing deadlines because you were stuck in traffic. Plus, the user-friendly interface ensures even tech novices can navigate it without breaking a sweat.

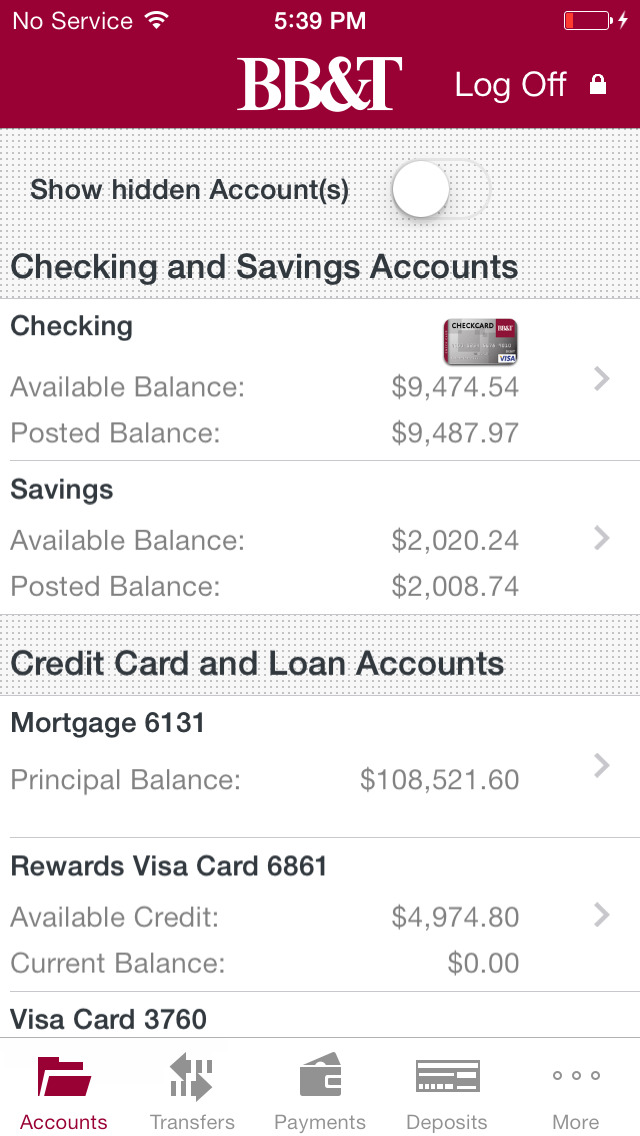

Another awesome feature? The ability to manage multiple accounts seamlessly. Whether you’ve got savings, checking, or investment accounts, BB&T online banking lets you keep track of everything in one place. And let’s not forget the added security measures that protect your info from prying eyes. It’s like having a personal finance assistant working for you 24/7.

Key Features of BB&T Online Banking

Here’s a quick rundown of what makes BB&T online banking stand out:

- Easy-to-use dashboard for quick access to all your accounts

- Bill pay services to automate recurring payments

- Mobile check deposit for hassle-free transactions

- Real-time alerts to keep you updated on account activity

- Robust fraud protection to safeguard your money

These features aren’t just fancy add-ons; they’re designed to simplify your financial life. So, whether you’re a busy professional or a stay-at-home parent, BB&T online banking has got your back.

How to Set Up BB&T Online Banking

Setting up BB&T online banking is easier than you think. Follow these simple steps, and you’ll be up and running in no time:

- Head over to the BB&T website or download the mobile app

- Click on the “Enroll Now” button

- Enter your account information and create a secure password

- Verify your identity through a one-time passcode sent to your email or phone

- Customize your settings and start exploring the platform

And there you go! In just a few minutes, you’ll have access to all the tools and features BB&T online banking has to offer. Trust me, once you experience the convenience, you’ll wonder how you ever lived without it.

Read also:Unveiling The Mysteries Of People From Whoville

Tips for Securing Your BB&T Online Banking Account

Security should always be a top priority when it comes to online banking. Here are some tips to keep your BB&T account safe:

- Use a strong, unique password that combines letters, numbers, and symbols

- Enable two-factor authentication for an extra layer of protection

- Regularly monitor your account for any suspicious activity

- Avoid logging in on public Wi-Fi networks unless absolutely necessary

- Keep your software and antivirus programs updated

By following these best practices, you can rest easy knowing your financial info is in good hands. Remember, prevention is key when it comes to online security.

Managing Finances with BB&T Online Banking

One of the coolest things about BB&T online banking is how it helps you stay on top of your finances. With tools like budgeting trackers and spending reports, you can gain valuable insights into your financial habits. This empowers you to make smarter decisions and work towards your financial goals.

Plus, the ability to set up automatic transfers between accounts means you’ll never miss a payment or let your savings slip through the cracks. It’s like having a financial planner in your pocket, ready to help whenever you need it.

Common Questions About BB&T Online Banking

Let’s address some of the most frequently asked questions about BB&T online banking:

- Q: Can I access my account from any device? A: Absolutely! As long as you’ve got an internet connection, you can log in from your computer, tablet, or smartphone.

- Q: Is my information safe? A: Yes! BB&T employs state-of-the-art encryption and security protocols to protect your data.

- Q: How do I reset my password? A: Simply click on the “Forgot Password” link and follow the prompts to create a new one.

These FAQs should cover the basics, but if you have more questions, don’t hesitate to reach out to BB&T customer support. They’re always happy to help!

Troubleshooting Common Issues

Even the best technology can have hiccups now and then. If you run into any issues with BB&T online banking, here’s what you can do:

- Check your internet connection to ensure it’s stable

- Clear your browser cache and cookies

- Try logging in from a different device or browser

- Refer to the BB&T help center for troubleshooting tips

If none of these solutions work, contacting customer support is always a good idea. They’re trained to handle all sorts of technical issues and can provide personalized assistance.

Maximizing Your BB&T Online Banking Experience

Once you’ve got the basics down, it’s time to take your BB&T online banking experience to the next level. Here are a few ideas:

- Set up bill pay for recurring expenses like rent, utilities, and subscriptions

- Utilize mobile deposit to deposit checks without leaving home

- Explore investment options through BB&T Wealth Management

By taking advantage of these features, you can streamline your finances and focus on what truly matters—living your best life!

Customer Reviews and Feedback

What do real people think about BB&T online banking? Let’s take a look at some reviews:

“I’ve been using BB&T online banking for years, and it’s been a game-changer. The app is super intuitive, and I love how easy it is to manage my accounts on the go.” — Sarah J.

“The security features are top-notch, and I feel confident knowing my money is protected. Plus, the customer support team is always quick to respond.” — Michael R.

These testimonials highlight the positive experiences many users have had with BB&T online banking. Of course, everyone’s needs are different, so it’s always a good idea to try it out for yourself.

Comparing BB&T Online Banking to Other Banks

When it comes to online banking, BB&T stacks up pretty well against the competition. Here’s how it compares:

- User Experience: BB&T’s platform is user-friendly and packed with features

- Security: Strong encryption and fraud protection measures

- Customer Support: Responsive and knowledgeable support team

While other banks may offer similar services, BB&T’s commitment to innovation and customer satisfaction sets it apart. If you’re looking for a reliable online banking solution, BB&T deserves serious consideration.

The Future of BB&T Online Banking

As technology continues to evolve, so does BB&T online banking. Expect to see even more advanced features and tools in the near future. From AI-driven financial advice to enhanced mobile capabilities, the possibilities are endless. Stay tuned for what’s coming next!

And remember, BB&T is always listening to customer feedback to improve their services. So, if you have any suggestions or ideas, don’t hesitate to share them. After all, your input could help shape the future of online banking.

Final Thoughts and Call to Action

There you have it—a comprehensive guide to BB&T online banking. From setup to troubleshooting, we’ve covered everything you need to know to make the most out of this amazing tool. Whether you’re new to online banking or a seasoned pro, BB&T has something to offer everyone.

So, what are you waiting for? Sign up today and start enjoying the convenience and security of BB&T online banking. And don’t forget to leave a comment below sharing your thoughts or asking any questions you may have. We’d love to hear from you!

Table of Contents

- Why BB&T Online Banking is a Game-Changer

- Key Features of BB&T Online Banking

- How to Set Up BB&T Online Banking

- Tips for Securing Your BB&T Online Banking Account

- Managing Finances with BB&T Online Banking

- Common Questions About BB&T Online Banking

- Troubleshooting Common Issues

- Maximizing Your BB&T Online Banking Experience

- Customer Reviews and Feedback

- Comparing BB&T Online Banking to Other Banks