Hey there, digital wanderer! Are you tired of the old-school banking system that keeps your money locked up in a vault? Well, buckle up because we're diving deep into the world of PayPal Prepaid. This isn’t just a payment method; it’s a game-changer. Whether you’re shopping online, traveling abroad, or just trying to keep your finances organized, PayPal Prepaid has got your back. Let’s explore why this service is making waves and how it can transform the way you manage your money.

Let’s be honest—traditional banking can feel like a chore. You’ve got fees, complicated processes, and a lack of flexibility. But with PayPal Prepaid, you’re stepping into the future of finance. It’s all about convenience, security, and control over your money. No more waiting for checks to clear or worrying about hidden charges. This prepaid solution is designed to simplify your life.

Now, before we dive into the nitty-gritty, let’s clear the air. PayPal Prepaid isn’t just another buzzword in the financial world. It’s a powerful tool that gives you the freedom to spend, save, and manage your cash like never before. So, if you’re ready to learn how this service can revolutionize your financial journey, stick around because we’re about to break it down for you.

Read also:Larry Holmes The Boxing Legend Who Left An Indelible Mark On The Ring

What Exactly is PayPal Prepaid?

Alright, let’s start with the basics. PayPal Prepaid is essentially a prepaid card or digital wallet powered by PayPal. Think of it as a reloadable account where you can load funds and use them for various transactions. Unlike credit cards, which rely on credit lines, PayPal Prepaid operates with the money you already have. It’s like carrying cash, but in a much safer and more convenient form.

Here’s the kicker: PayPal Prepaid isn’t just limited to online shopping. You can use it anywhere Visa or Mastercard is accepted, which means it works in stores, restaurants, and even ATMs. Plus, since it’s linked to your PayPal account, managing your funds is as easy as a few taps on your phone. No more carrying around wads of cash or worrying about losing your wallet.

Why Should You Care About PayPal Prepaid?

Let’s face it—money management can be overwhelming. But PayPal Prepaid simplifies the process by offering features that traditional banking simply can’t match. For starters, it’s incredibly secure. Your personal financial information stays protected, and you can set spending limits to avoid overspending. It’s perfect for people who want to stay in control of their finances without the hassle of dealing with banks.

Another big advantage? No credit checks. Whether you have a stellar credit score or none at all, PayPal Prepaid is open to everyone. This makes it an excellent option for students, young professionals, or anyone looking to build their financial independence. And let’s not forget the perks—cashback, rewards, and exclusive discounts make this service even more appealing.

PayPal Prepaid vs. Traditional Banking: Who Wins?

Comparing PayPal Prepaid to traditional banking is like comparing a sleek sports car to an old clunker. Sure, both get you from point A to point B, but one does it with style and efficiency. Traditional banking often comes with hefty fees, complicated processes, and limited accessibility. PayPal Prepaid, on the other hand, offers:

- No monthly maintenance fees

- Instant access to your funds

- Global acceptance

- Enhanced security features

- Easy-to-use mobile app

And let’s not forget the convenience factor. With PayPal Prepaid, you don’t have to visit a physical bank branch or wait for checks to clear. Everything is done online, saving you time and effort. Plus, the ability to use it worldwide makes it a top choice for frequent travelers.

Read also:Winona Ryder In The 90s The Iconic Rise Of A Decades Darling

How Does PayPal Prepaid Work?

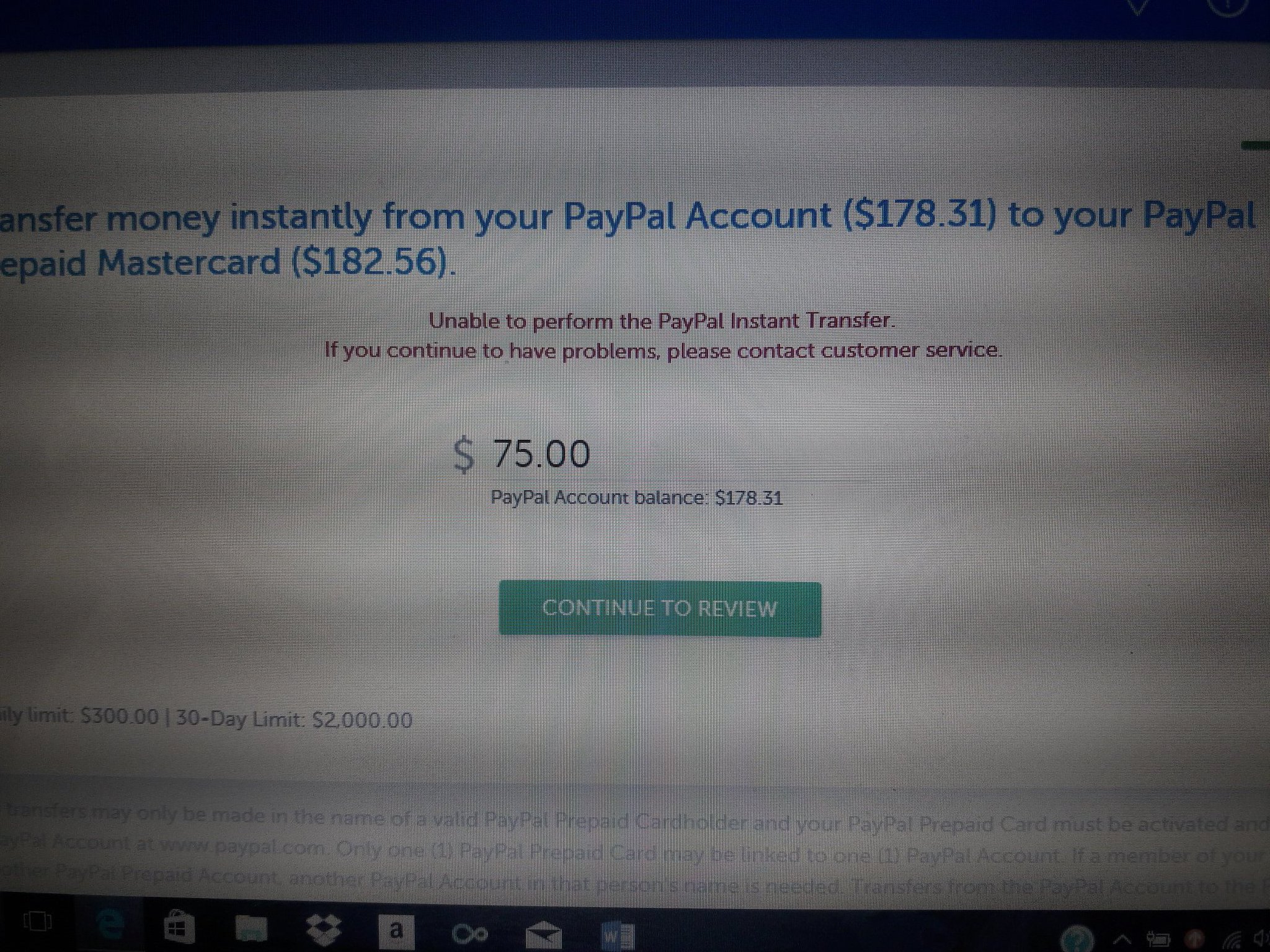

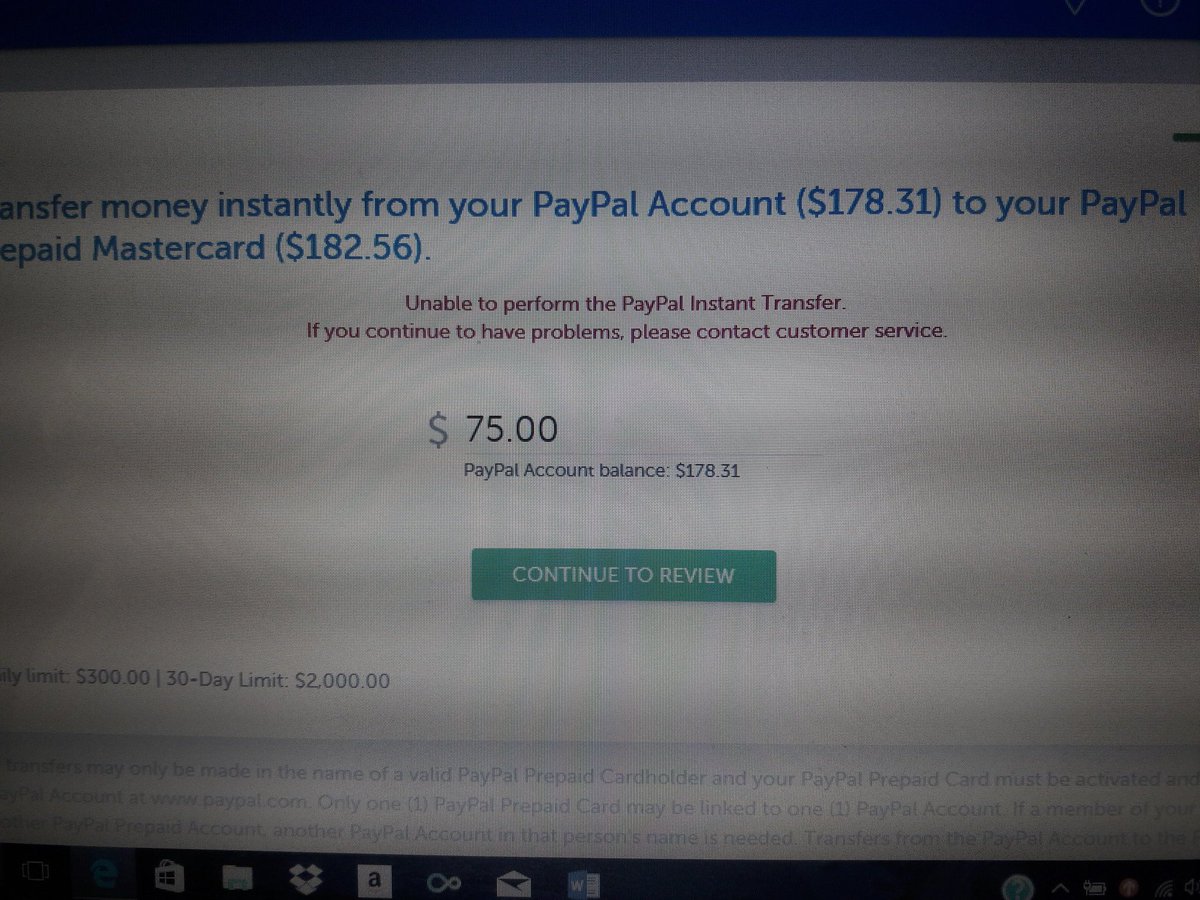

Now that we’ve established why PayPal Prepaid is such a big deal, let’s talk about how it works. First, you’ll need to sign up for a PayPal account if you don’t already have one. Once you’re set up, you can link your bank account or add funds directly to your PayPal balance. From there, you can request a PayPal Prepaid card, which will arrive in the mail within a few days.

Once you have your card, you can start using it wherever Visa or Mastercard is accepted. You can also make online purchases, pay bills, and even withdraw cash from ATMs. The best part? You can monitor all your transactions through the PayPal app, ensuring you always know where your money is going.

Benefits of Using PayPal Prepaid

So, what’s in it for you? Plenty! Here are some of the top benefits of using PayPal Prepaid:

- Security: Your personal information stays protected, and you can freeze your card instantly if it’s lost or stolen.

- Convenience: Use your card anywhere Visa or Mastercard is accepted, both online and offline.

- No Credit Checks: Anyone can use PayPal Prepaid, regardless of their credit history.

- Control: Set spending limits, monitor transactions, and manage your account from your phone.

- Perks: Enjoy cashback, rewards, and exclusive discounts when you use your PayPal Prepaid card.

Let’s not forget the peace of mind that comes with knowing your money is safe and accessible whenever you need it. Whether you’re shopping online, paying bills, or traveling abroad, PayPal Prepaid has got your back.

Who Can Use PayPal Prepaid?

PayPal Prepaid is designed for everyone, regardless of age, income, or credit history. Here are some groups that can benefit the most:

- Students: Perfect for managing a tight budget and avoiding overspending.

- Young Professionals: Great for building financial independence without relying on credit cards.

- Travelers: Ideal for using in foreign countries without worrying about currency exchange fees.

- Entrepreneurs: Useful for separating personal and business expenses.

No matter who you are, PayPal Prepaid offers a solution that fits your lifestyle. It’s flexible, secure, and easy to use, making it a top choice for people from all walks of life.

PayPal Prepaid Fees: What You Need to Know

Now, let’s talk about the elephant in the room—fees. While PayPal Prepaid is generally more affordable than traditional banking, there are still some costs to be aware of. Here’s a breakdown of the most common fees:

- Card Activation Fee: A one-time fee when you first activate your card.

- ATM Withdrawal Fee: Charged when you withdraw cash from an ATM.

- Foreign Transaction Fee: Applied when using your card in a foreign currency.

- Card Replacement Fee: Charged if you need to replace a lost or stolen card.

While these fees may seem like a downside, they’re actually quite reasonable compared to traditional banking. Plus, many of them can be avoided with careful planning. For example, you can minimize ATM fees by using PayPal-affiliated ATMs or withdrawing larger amounts less frequently.

Is PayPal Prepaid Worth the Cost?

Absolutely! When you consider the convenience, security, and flexibility that PayPal Prepaid offers, the fees are more than justified. Plus, many of the features, like cashback and rewards, can help offset the costs. It’s all about finding the right balance and using the service wisely.

Think of it this way: would you rather pay a small fee for a service that keeps your money safe and accessible, or deal with the headaches of traditional banking? For most people, the answer is clear.

PayPal Prepaid Security: How Safe is It?

Security is a top priority for PayPal, and PayPal Prepaid is no exception. Here are some of the ways your money stays protected:

- Zero Liability Protection: You’re not responsible for unauthorized transactions.

- Two-Factor Authentication: An extra layer of security when logging into your account.

- Card Freezing: Instantly freeze your card if it’s lost or stolen.

- Encryption: All transactions are encrypted to prevent data breaches.

With these features in place, you can rest assured that your money is safe. Whether you’re shopping online or using your card in a store, PayPal Prepaid has your back.

What Happens if My Card is Lost or Stolen?

If your PayPal Prepaid card is lost or stolen, don’t panic. Simply log into your PayPal account and freeze the card immediately. Once you’ve done that, you can request a replacement card, and your funds will be transferred to the new card automatically. It’s quick, easy, and hassle-free.

Plus, with zero liability protection, you won’t be on the hook for any unauthorized transactions. This peace of mind is one of the many reasons why PayPal Prepaid is such a popular choice.

How to Get the Most Out of PayPal Prepaid

Ready to make the most of your PayPal Prepaid experience? Here are some tips to help you get started:

- Set Spending Limits: Control your spending by setting limits on your card.

- Monitor Transactions: Keep an eye on your account to catch any suspicious activity.

- Use Rewards Wisely: Take advantage of cashback and discounts to save money.

- Plan Ahead: Avoid ATM fees by withdrawing larger amounts less frequently.

By following these tips, you can maximize the benefits of PayPal Prepaid and ensure a smooth financial journey. Remember, it’s all about finding the right balance and using the service to your advantage.

Common Misconceptions About PayPal Prepaid

There are a few misconceptions about PayPal Prepaid that we need to clear up. First, some people think it’s only for people with bad credit. Not true! Anyone can use PayPal Prepaid, regardless of their credit history. Second, there’s a belief that it’s more expensive than traditional banking. Again, not true! While there are some fees, they’re generally much lower than what you’d pay at a traditional bank.

Finally, some people worry about the security of their money. Rest assured, PayPal Prepaid offers top-notch security features to protect your funds. So, don’t let these misconceptions hold you back from experiencing the benefits of this amazing service.

Conclusion: Is PayPal Prepaid Right for You?

Let’s recap what we’ve learned. PayPal Prepaid is a powerful tool that offers convenience, security, and flexibility for managing your finances. Whether you’re a student, traveler, or entrepreneur, there’s something for everyone. With features like zero liability protection, two-factor authentication, and a user-friendly app, PayPal Prepaid is a top choice for anyone looking to simplify their financial life.

So, what are you waiting for? Sign up for a PayPal account today and take the first step toward financial freedom. And don’t forget to share this article with your friends and family. Together, we can help others discover the power of PayPal Prepaid.

Call to Action

Ready to take control of your finances? Leave a comment below and let us know how PayPal Prepaid has changed your life. Or, if you’re just getting started, share your questions and concerns with our community. We’re here to help!

And remember, knowledge is power. Stay informed, stay ahead, and most importantly, stay financially savvy. Until next time, keep crushing those financial goals!

Table of Contents