Let’s face it, folks—banking has gone digital, and Truist Online Banking is at the forefront of this revolution. If you're looking for a seamless, secure, and convenient way to manage your finances, Truist has got you covered. Whether you’re checking your balance, paying bills, or transferring funds, everything is just a few clicks away. But before we dive deep into the nitty-gritty, let’s take a moment to appreciate how far banking has come in the digital age.

Gone are the days when you had to physically visit a bank branch to handle your financial needs. Truist Online Banking offers a user-friendly platform that caters to all your banking requirements. From setting up automatic payments to monitoring your account activity, this service empowers you to take control of your money without stepping foot inside a bank. And trust me, that’s a game-changer.

But hold up—why should you trust Truist with your hard-earned cash? Well, Truist isn’t just another bank; it’s a powerhouse born from the merger of BB&T and SunTrust Banks. This merger has created one of the largest financial institutions in the U.S., and they’re serious about providing top-notch services. So, if you’re curious about what makes Truist Online Banking so special, stick around because we’re about to break it down for you.

Read also:Unveiling Abby Booms Real Name The Ultimate Guide Youve Been Waiting For

What Is Truist Online Banking?

Truist Online Banking is more than just a tool for managing your finances—it’s your digital wallet, your financial advisor, and your personal assistant all rolled into one. Designed with simplicity and security in mind, this platform allows you to perform a wide range of banking activities from the comfort of your own home.

Here’s a quick rundown of what you can do with Truist Online Banking:

- Check account balances and transaction history.

- Transfer funds between accounts or to external accounts.

- Pay bills directly from your account.

- Set up automatic payments for recurring bills.

- Deposit checks using your smartphone.

- Apply for loans or credit cards.

And that’s just scratching the surface! Truist Online Banking also offers advanced features like fraud protection, alerts, and budgeting tools to help you stay on top of your financial game. It’s like having a personal finance guru in your pocket, 24/7.

Why Choose Truist Online Banking?

With so many banking options out there, you might be wondering why Truist stands out. Let’s break it down:

First off, Truist boasts a robust security system that ensures your personal and financial information is protected. They use encryption, multi-factor authentication, and fraud detection technologies to keep your account safe from unauthorized access. And let’s be real, security is a top priority when it comes to online banking.

Secondly, Truist offers a user-friendly interface that’s easy to navigate, even for tech novices. The platform is designed to be intuitive, so you won’t find yourself lost in a sea of complicated menus and options. Plus, their mobile app is just as powerful as the web version, giving you access to all your banking tools on the go.

Read also:Rebecca Muir The Rise Of A Broadcasting Icon

Lastly, Truist provides excellent customer support. If you ever run into any issues, their team is just a phone call or chat away. And with extended hours of operation, you can get help whenever you need it, not just during business hours.

Security Features You Need to Know

Let’s talk security for a sec because, let’s be honest, it’s one of the biggest concerns when it comes to online banking. Truist Online Banking employs several layers of security to keep your account safe:

- **Encryption:** Your data is encrypted both in transit and at rest, making it nearly impossible for hackers to intercept your information.

- **Multi-Factor Authentication (MFA):** To log in, you’ll need more than just a password. Truist uses MFA to verify your identity, adding an extra layer of protection.

- **Fraud Alerts:** Truist monitors your account activity for suspicious transactions and sends you alerts if anything seems off.

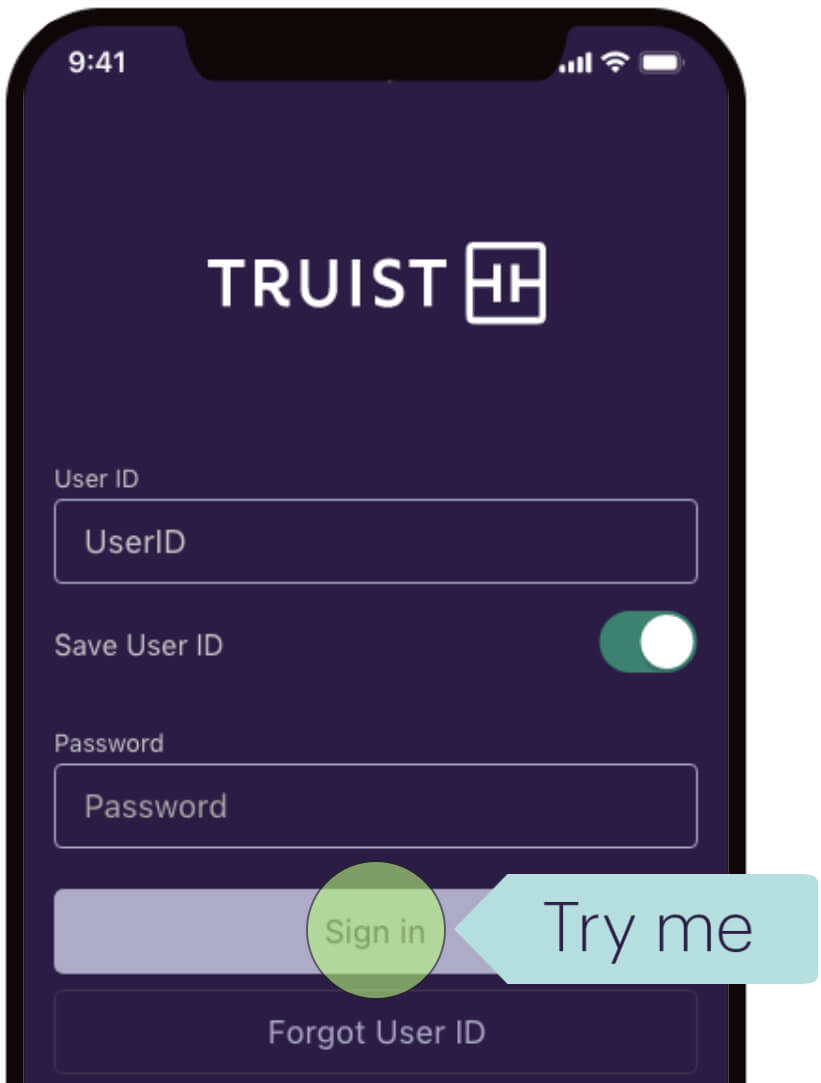

- **Secure Login:** The login process is designed to be secure, with options for fingerprint or facial recognition on supported devices.

These features give you peace of mind knowing that your money is in good hands. And trust me, peace of mind is priceless when it comes to your finances.

How to Sign Up for Truist Online Banking

Signing up for Truist Online Banking is a breeze. Here’s a step-by-step guide to get you started:

- Visit the Truist website or download the Truist mobile app.

- Click on the “Sign Up” button and follow the prompts.

- Enter your personal information, including your Social Security number and date of birth.

- Set up your username and password.

- Verify your account using the verification code sent to your email or phone.

Once you’ve completed these steps, you’ll have access to all the features of Truist Online Banking. It’s that simple!

Tips for a Smooth Sign-Up Process

Here are a few tips to ensure your sign-up process goes smoothly:

- Make sure you have all your personal information handy before starting the process.

- Choose a strong password that includes a mix of letters, numbers, and special characters.

- Enable multi-factor authentication for added security.

- Double-check your email and phone number to ensure you receive the verification code.

By following these tips, you’ll be up and running in no time.

Features of Truist Online Banking

Now that you’re signed up, let’s explore the features that make Truist Online Banking so awesome:

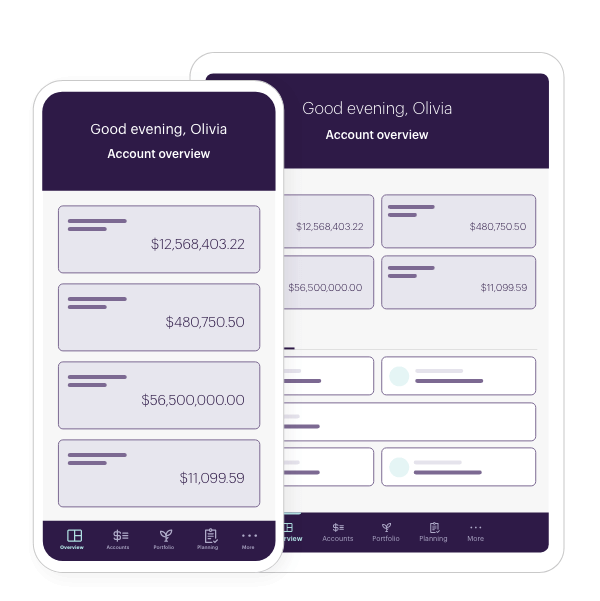

Account Management

With Truist Online Banking, managing your accounts has never been easier. You can view your balances, transaction history, and account details at a glance. Need to transfer funds? No problem! You can move money between your accounts or send it to external accounts with just a few clicks.

Bill Payment

Who has time to write checks anymore? Truist Online Banking lets you pay your bills directly from your account. You can set up one-time payments or schedule recurring payments for bills like rent, utilities, and subscriptions. It’s like having a personal assistant handle your payments for you.

Mobile Check Deposit

Forget about running to the bank to deposit checks. With Truist’s mobile check deposit feature, you can deposit checks using your smartphone. Just snap a picture of the check, enter the amount, and you’re done. It’s fast, easy, and convenient.

Budgeting Tools

Staying on top of your finances is a breeze with Truist’s budgeting tools. You can track your spending, set financial goals, and monitor your progress. It’s like having a personal finance coach in your pocket, helping you make smarter financial decisions.

Benefits of Using Truist Online Banking

There are countless benefits to using Truist Online Banking. Here are just a few:

Convenience: With Truist Online Banking, you can access your accounts anytime, anywhere. Whether you’re at home, at work, or on vacation, you’ll always have control over your finances.

Security: As we mentioned earlier, Truist employs top-of-the-line security measures to protect your account. You can rest assured knowing your information is safe.

Cost-Effective: Many of Truist’s online banking features are free, saving you money on fees and charges.

Customer Support: Truist’s customer support team is available to assist you with any issues you may encounter, ensuring a hassle-free experience.

How Truist Online Banking Saves You Time

Time is money, and Truist Online Banking helps you save both. By automating tasks like bill payments and transfers, you’ll spend less time managing your finances and more time doing the things you love. Plus, with 24/7 access to your accounts, you can handle your banking on your schedule, not the bank’s.

Common Questions About Truist Online Banking

Still have questions? Here are some frequently asked questions about Truist Online Banking:

Is Truist Online Banking Safe?

Absolutely! Truist uses advanced security measures to protect your account, including encryption, multi-factor authentication, and fraud detection. Your information is safe with Truist.

Can I Access Truist Online Banking on My Mobile Device?

Yes, you can access Truist Online Banking through their mobile app. The app offers all the features of the web version, so you can manage your finances on the go.

What Happens If I Forget My Password?

No worries! If you forget your password, you can reset it using the “Forgot Password” option on the login page. You’ll receive a verification code via email or text to confirm your identity.

Conclusion: Why Truist Online Banking Is a Must-Have

In conclusion, Truist Online Banking offers a comprehensive suite of tools to help you manage your finances with ease and confidence. From its robust security features to its user-friendly interface, Truist has thought of everything to make your banking experience seamless.

So, what are you waiting for? Sign up for Truist Online Banking today and take the first step towards financial freedom. And don’t forget to share this article with your friends and family so they can benefit from Truist’s amazing services too!

Table of Contents:

- What Is Truist Online Banking?

- Why Choose Truist Online Banking?

- Security Features You Need to Know

- How to Sign Up for Truist Online Banking

- Tips for a Smooth Sign-Up Process

- Features of Truist Online Banking

- Account Management

- Bill Payment

- Mobile Check Deposit

- Budgeting Tools

- Benefits of Using Truist Online Banking

- How Truist Online Banking Saves You Time

- Common Questions About Truist Online Banking