Listen up, folks! If you're a PNC Bank customer, understanding your PNC bank atm withdrawal limit is crucial for managing your finances effectively. Imagine running to an ATM only to realize you've hit your daily limit – not ideal, right? Well, today we're diving deep into everything you need to know about PNC Bank's ATM withdrawal policies. So, buckle up and let's get started!

Managing money in today's fast-paced world can be tricky, especially when unexpected expenses pop up. Knowing your PNC bank atm withdrawal limit can help you avoid awkward situations at the ATM. Whether you're withdrawing cash for groceries, emergencies, or just because, it's essential to stay informed.

This article isn't just about numbers and limits; it's about empowering you with knowledge so you can make smarter financial decisions. Stick around, and we'll break it all down for you in simple terms. No jargon, just the facts you need to know. Ready? Let's go!

Read also:Ambika Mod Husband The Story Yoursquove Been Waiting For

Understanding PNC Bank ATM Withdrawal Policies

First things first, PNC Bank has specific rules around how much money you can withdraw from an ATM in a single day. These policies are designed to protect both you and the bank from fraud and overspending. So, what exactly is the PNC bank atm withdrawal limit? Well, the standard daily limit is typically $500. However, this can vary depending on your account type and personal settings.

Here's the deal: if you have a premium account or a longer history with PNC, your limit might be higher. But don't worry, we'll cover all the variations in just a bit. For now, let's focus on why these limits exist and how they impact your daily transactions.

Why Does PNC Bank Set Withdrawal Limits?

Ever wonder why banks impose withdrawal limits? It's not just to annoy you; there's a method to the madness. PNC Bank, like most financial institutions, sets these limits to protect your account from unauthorized access. Think about it – if someone gets ahold of your card, they can't clean out your account in one go. Plus, it helps you manage your spending and avoid overdraft fees.

Another reason is fraud prevention. By limiting the amount you can withdraw in a day, PNC reduces the risk of large-scale fraud. It's a win-win for both you and the bank. So, while it might feel restrictive at times, remember that these limits are there for your own good.

How Are Withdrawal Limits Determined?

Now, let's talk about how PNC determines your personal withdrawal limit. It's not a one-size-fits-all deal. Factors like your account type, transaction history, and even your credit score can influence your limit. For example, if you've been a loyal PNC customer for years, you might enjoy a higher limit than a new account holder.

Additionally, PNC considers your financial behavior. If you frequently make large withdrawals, they might adjust your limit accordingly. It's all about balancing convenience with security. Makes sense, right?

Read also:Is Dan Levy Gay Exploring The Curious World Of Dan Levys Personal Life

Checking Your Personal PNC Bank ATM Withdrawal Limit

So, how do you find out your specific PNC bank atm withdrawal limit? It's easier than you think. You can check it through your online banking account or by giving PNC a call. Here's a quick guide:

- Log in to your PNC Online Banking account.

- Go to the "Accounts" section and select your account.

- Look for the "Transaction Limits" tab – there you'll find your daily ATM withdrawal limit.

Alternatively, you can call PNC's customer service hotline and ask a representative to confirm your limit. They're pretty helpful, so don't hesitate to reach out if you're unsure.

Can You Increase Your ATM Withdrawal Limit?

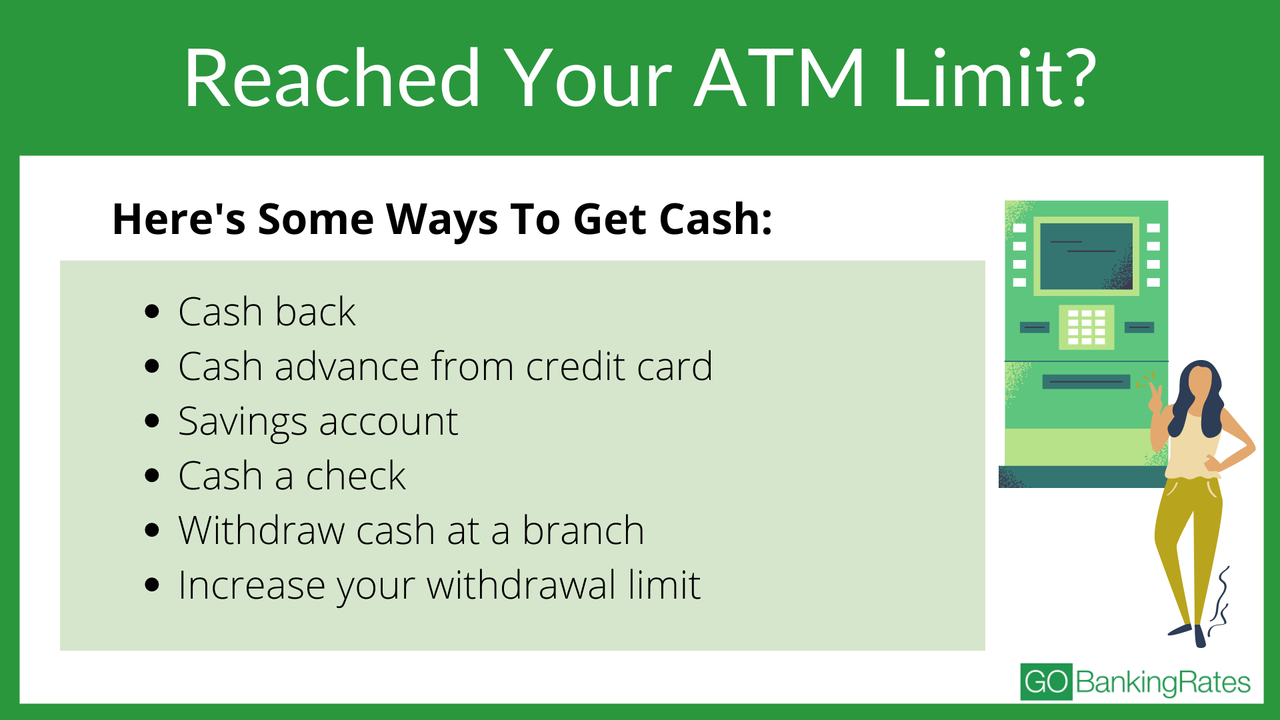

What if $500 isn't enough for your needs? Can you request a higher limit? Absolutely! PNC allows customers to request an increase in their withdrawal limit, but there are a few steps involved. Here's what you need to do:

- Contact PNC customer service and explain your situation.

- Be prepared to provide documentation, such as proof of income or a letter explaining why you need a higher limit.

- Wait for PNC to review your request – this can take a few days.

Keep in mind that not all requests are approved. PNC will consider your account history and financial behavior before making a decision. But if you've been a responsible customer, chances are good you'll get the bump you need.

What Happens If You Exceed Your Withdrawal Limit?

Okay, let's say you accidentally go over your PNC bank atm withdrawal limit. What happens next? Well, it depends on your account settings. Some accounts will simply deny the transaction, while others might allow it but charge you an overdraft fee. Not ideal, right?

To avoid this headache, it's a good idea to set up alerts on your PNC account. This way, you'll get a notification when you're approaching your limit. It's like having a financial guardian angel watching over your transactions.

Managing Your Finances Within the Limit

Staying within your withdrawal limit is all about planning ahead. Here are a few tips to help you manage your cash flow:

- Set a budget for your daily expenses and stick to it.

- Use your debit card for purchases instead of withdrawing cash whenever possible.

- Keep track of your withdrawals using PNC's mobile app – it's super convenient.

By being proactive, you can avoid those pesky overdraft fees and keep your finances in check. Plus, it'll give you peace of mind knowing you're in control of your money.

ATM Fees: The Hidden Cost of Withdrawals

While we're on the topic of PNC bank atm withdrawal limits, let's talk about ATM fees. Did you know that using an out-of-network ATM can cost you extra? It's true! PNC charges a fee for using non-PNC ATMs, and some ATMs even tack on their own surcharges. Ouch!

But here's the good news: PNC offers fee reimbursement for up to $15 per month if you have a qualifying account. So, if you're a frequent traveler or just prefer using other ATMs, this perk can save you a pretty penny. Just make sure your account is eligible – not all accounts come with this benefit.

How to Avoid ATM Fees

Want to dodge those annoying ATM fees altogether? Here are a few strategies:

- Stick to PNC ATMs whenever possible – they're widely available, so it's not too hard.

- Use your debit card instead of withdrawing cash – many retailers offer cashback without fees.

- Plan your withdrawals carefully to minimize trips to the ATM.

By being smart about where and how you withdraw cash, you can keep more of your hard-earned money in your pocket. Who doesn't love that?

Security Tips for Using ATMs

While we're all about convenience, safety should always be a priority when using ATMs. Here are a few tips to keep your transactions secure:

- Choose ATMs in well-lit, public locations to reduce the risk of theft.

- Be aware of your surroundings – if something feels off, trust your instincts and find another ATM.

- Cover the keypad when entering your PIN to prevent prying eyes from catching your number.

PNC also offers fraud protection services, so if you suspect any suspicious activity on your account, report it immediately. They'll work with you to resolve the issue and keep your account safe.

What to Do If Your Card Is Lost or Stolen

Uh-oh, what if your card gets lost or stolen? Don't panic – PNC has you covered. Here's what you need to do:

- Call PNC's customer service immediately to report the loss.

- Monitor your account closely for any unauthorized transactions.

- Request a replacement card – it usually arrives within a few days.

PNC takes security seriously, so they'll work quickly to resolve the issue and get you back on track. Just remember to act fast – the sooner you report the loss, the better.

Conclusion: Take Control of Your Finances

And there you have it – everything you need to know about PNC bank atm withdrawal limits. Whether you're a long-time customer or just starting out, understanding these policies can help you manage your finances more effectively. Remember, knowledge is power!

So, what's next? If you haven't already, check your withdrawal limit through your PNC Online Banking account. And if you need a higher limit, don't hesitate to reach out to customer service. They're there to help you succeed financially.

Before you go, we'd love to hear from you! Have you ever hit your PNC bank atm withdrawal limit? How did you handle it? Share your thoughts in the comments below, and don't forget to share this article with your friends. Together, let's spread the word about smart financial management. Cheers!

Table of Contents

- Understanding PNC Bank ATM Withdrawal Policies

- Why Does PNC Bank Set Withdrawal Limits?

- How Are Withdrawal Limits Determined?

- Checking Your Personal PNC Bank ATM Withdrawal Limit

- Can You Increase Your ATM Withdrawal Limit?

- What Happens If You Exceed Your Withdrawal Limit?

- Managing Your Finances Within the Limit

- ATM Fees: The Hidden Cost of Withdrawals

- How to Avoid ATM Fees

- Security Tips for Using ATMs

:max_bytes(150000):strip_icc()/atm-withdrawal-limits-c31d0fd30b9b404a90379804a6d9cb9c.png)