Ever wondered what makes the Synchrony Lowes credit card such a game-changer for homeowners and DIY enthusiasts? Well, buckle up because we're diving deep into the world of this powerful financial tool. Whether you're remodeling your kitchen or just need some basic home improvements, this card could be your new best friend. Stick around, and let's break it all down together!

Let's face it—home improvement projects can get expensive fast. That's where the Synchrony Lowes credit card steps in like a superhero, offering a range of perks and benefits that make your wallet happier. But hold on—before you jump in, there's a lot to unpack about how it works, its pros, cons, and hidden gems. This guide will be your trusty companion through it all.

Now, you might be thinking, "Why should I care about a credit card specifically for Lowes?" Great question! The answer lies in the exclusive deals, financing options, and rewards that cater directly to people who love improving their homes. If you're someone who spends a fair amount at Lowes, this card could save you serious cash. Let's explore everything you need to know!

Read also:Simon Cowells Son Disabled The Untold Story Behind His Family Life

What is Synchrony Lowes Credit Card?

Alright, let's start with the basics. The Synchrony Lowes credit card is a co-branded credit card issued by Synchrony Bank specifically for Lowes customers. It’s designed to make your shopping experience at Lowes smoother, more rewarding, and, most importantly, budget-friendly. Think of it as your VIP pass to exclusive discounts, financing offers, and cashback rewards at one of the biggest home improvement retailers in the country.

Here's the kicker: this card isn't just for big-ticket items. Whether you're buying a new drill or a pack of nails, the Synchrony Lowes card has got your back. Plus, it offers no annual fee, which is always a win in my book. Let’s dig deeper into how it can benefit you.

Key Features of the Synchrony Lowes Card

So, what exactly do you get when you sign up for the Synchrony Lowes credit card? Here's a quick rundown:

- No annual fee

- Special financing offers on purchases

- Cashback rewards on eligible purchases

- Exclusive Lowes coupons and discounts

- Price Protection Program

These features are tailored to help you save money while upgrading your home. Who doesn't love that, right? But wait, there's more! Let's dive into the specifics of each feature in the sections below.

How Does the Synchrony Lowes Card Work?

Understanding how the Synchrony Lowes card works is crucial before you apply. Essentially, it functions like any other credit card, but with a focus on Lowes transactions. You can use it to make purchases at Lowes stores or online, and it comes with perks that you won’t find with other cards.

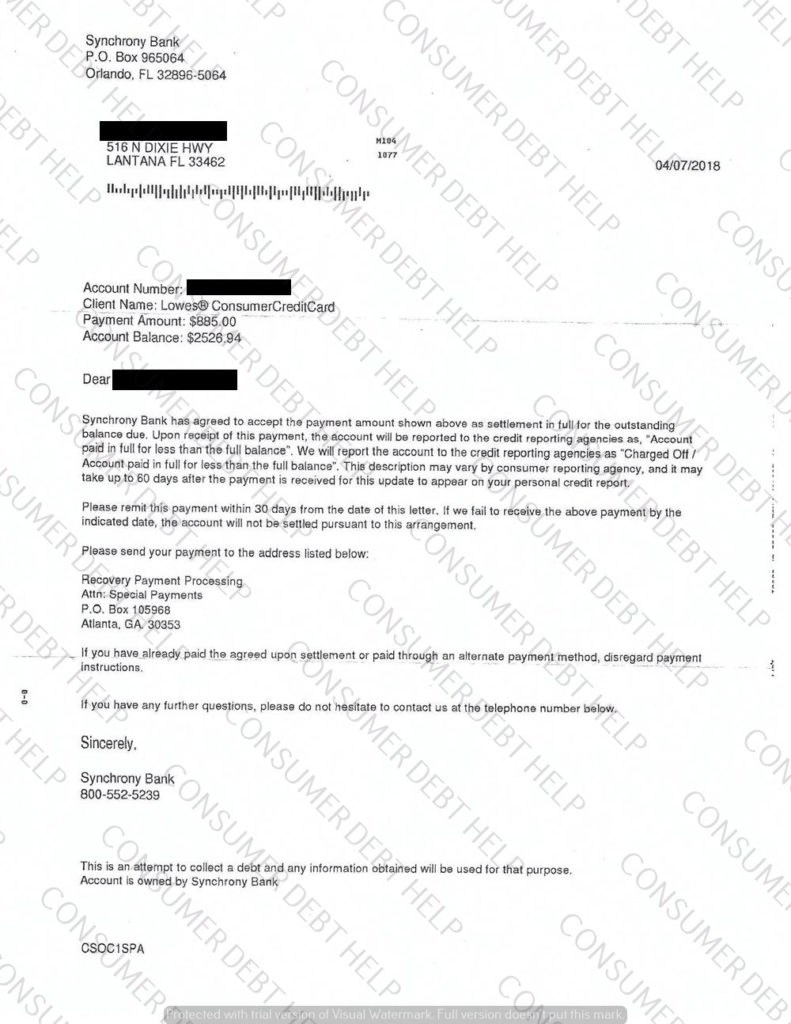

One of the standout features is the special financing options. Depending on your creditworthiness, you might qualify for 0% APR on certain purchases for a limited time. This can be a huge money-saver if you're planning a big project. Just remember, once the promotional period ends, the regular APR kicks in, so it’s essential to pay off your balance before then.

Read also:Does Joe Rogan Have Kids Unveiling The Truth Behind The Legend

Eligibility and Application Process

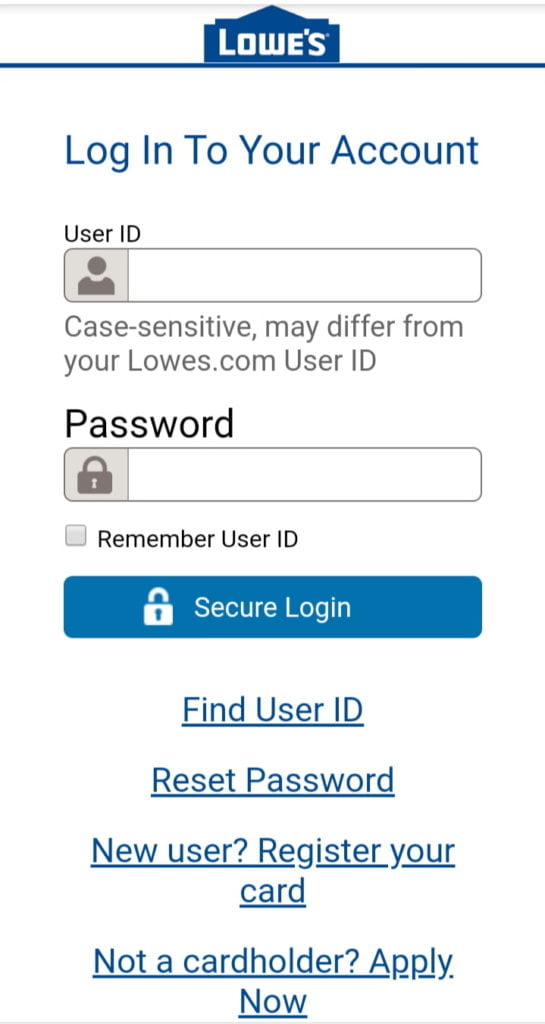

Now, let's talk about who can get this card and how to apply. Generally, anyone with decent credit can apply for the Synchrony Lowes credit card. The application process is pretty straightforward—you can do it online or in-store. Just be prepared to provide some personal information, like your Social Security number and income details.

Here’s a pro tip: before applying, check your credit score to gauge your chances of approval. A higher credit score increases your likelihood of getting approved with better terms. If you're not sure where to start, there are plenty of free resources online to check your credit score without affecting it.

Benefits of Using Synchrony Lowes Credit Card

Alright, let’s talk about the good stuff—the benefits of using the Synchrony Lowes credit card. There are several reasons why this card stands out from the crowd. First and foremost, the cashback rewards are a major draw. You can earn cashback on eligible purchases, which is like getting paid to shop for your home improvements.

Then there’s the exclusive Lowes coupons. These aren’t just any coupons—they’re tailored for cardholders and can add up to significant savings over time. Plus, the Price Protection Program ensures you’re never overpaying for an item. If the price drops within 60 days of your purchase, you can get the difference refunded. Pretty sweet, huh?

Special Financing Offers

One of the biggest perks of the Synchrony Lowes credit card is the special financing offers. Depending on the promotion, you might qualify for 0% APR on purchases for a set period. This is particularly useful if you’re planning a large home improvement project. Imagine buying a new fridge or installing a new deck without worrying about interest payments for six months or more. That’s the power of this card!

However, it’s crucial to manage these financing offers wisely. Make sure you pay off the balance before the promotional period ends to avoid getting hit with high interest rates. It’s all about planning ahead and sticking to your budget.

Drawbacks of the Synchrony Lowes Credit Card

While the Synchrony Lowes credit card has plenty of advantages, it’s not without its drawbacks. One potential downside is the relatively high APR once the promotional period ends. If you don’t pay off your balance in time, you could end up paying a lot in interest. So, if you’re not disciplined with your spending, this card might not be the best choice for you.

Another thing to keep in mind is that the rewards are pretty specific to Lowes purchases. If you’re not a frequent shopper at Lowes, you might not get as much value out of the card. Additionally, the cashback rewards aren’t as generous as some other cards out there. It’s important to weigh these factors before committing.

How to Maximize Your Card Usage

So, how do you get the most out of your Synchrony Lowes credit card? Here are a few tips:

- Always pay your balance in full to avoid interest charges

- Take advantage of the special financing offers for big purchases

- Keep an eye out for exclusive Lowes coupons and deals

- Use the Price Protection Program to ensure you’re getting the best price

By following these strategies, you can maximize the benefits of your card and minimize any potential downsides. It’s all about using the card smartly and responsibly.

Comparing Synchrony Lowes with Other Retail Credit Cards

Now, let’s compare the Synchrony Lowes credit card with other retail credit cards on the market. While many retail cards offer similar perks, the Synchrony Lowes card stands out in a few key areas. For one, the special financing offers are hard to beat. Not many cards offer 0% APR for such an extended period.

However, when it comes to cashback rewards, some other cards might offer better rates. For example, cards from big-box retailers like Home Depot or Walmart might give you a higher percentage back on purchases. It’s important to evaluate your spending habits and choose the card that aligns best with your needs.

Who Should Consider the Synchrony Lowes Card?

The Synchrony Lowes credit card is ideal for people who regularly shop at Lowes. If you’re a homeowner or a DIY enthusiast who spends a fair amount on home improvements, this card could save you a lot of money. Plus, the special financing offers make it a great choice for big-ticket items.

That said, if you don’t shop at Lowes often, you might not get as much value out of the card. It’s also worth considering if you’re disciplined enough to pay off your balance on time to avoid interest charges. If you fit these criteria, the Synchrony Lowes card could be a great addition to your wallet.

Customer Reviews and Feedback

Let’s take a look at what real customers are saying about the Synchrony Lowes credit card. Overall, the reviews are pretty positive. Many users appreciate the special financing offers and cashback rewards. They also love the exclusive Lowes coupons and the Price Protection Program.

However, some customers have expressed concerns about the high APR after the promotional period ends. A few have also mentioned difficulties with customer service, though this seems to be more of an exception than the rule. As with any credit card, your experience may vary, so it’s always a good idea to do your research and read reviews from multiple sources.

Tips for Choosing the Right Credit Card

Choosing the right credit card can feel overwhelming, especially with so many options out there. Here are a few tips to help you make the best decision:

- Assess your spending habits and choose a card that aligns with them

- Look for cards with no annual fee if you’re on a budget

- Prioritize cards with special financing offers if you plan to make big purchases

- Consider the rewards program and how it fits into your lifestyle

By taking the time to evaluate your needs and comparing different cards, you can find the one that works best for you. The Synchrony Lowes credit card might just be the perfect fit!

Final Thoughts and Call to Action

Well, there you have it—everything you need to know about the Synchrony Lowes credit card. Whether you’re a seasoned homeowner or a DIY newbie, this card can be a valuable tool in your financial arsenal. With its special financing offers, cashback rewards, and exclusive discounts, it’s hard to beat.

So, what’s next? If you think the Synchrony Lowes card might be right for you, head over to the Lowes website or your local store to apply. And don’t forget to share this article with your friends and family who might benefit from it. Who knows—you could be helping them save some serious cash on their next home improvement project!

Remember, managing credit responsibly is key to maximizing the benefits of any credit card. Use it wisely, and you’ll be on your way to a happier, more stylish home in no time. Happy shopping!

Table of Contents

- Synchrony Lowes Credit Card: Your Ultimate Guide to Unlocking Exclusive Benefits

- What is Synchrony Lowes Credit Card?

- Key Features of the Synchrony Lowes Card

- How Does the Synchrony Lowes Card Work?

- Eligibility and Application Process

- Benefits of Using Synchrony Lowes Credit Card

- Special Financing Offers

- Drawbacks of the Synchrony Lowes Credit Card

- How to Maximize Your Card Usage

- Comparing Synchrony Lowes with Other Retail Credit Cards

- Who Should Consider the Synchrony Lowes Card?

- Customer Reviews and Feedback

- Tips for Choosing the Right Credit Card

- Final Thoughts and Call to Action