Investing in mutual funds can be a game-changer for your financial future, but where do you start? Fidelity mutual funds list is your golden ticket to understanding the vast world of investment opportunities offered by one of the most trusted names in finance. Whether you're a seasoned investor or just dipping your toes into the market, Fidelity has something for everyone. So, buckle up and let’s explore the ins and outs of this incredible investment platform.

When it comes to growing your wealth, Fidelity mutual funds have been paving the way for decades. With a reputation built on trust, transparency, and exceptional returns, they’ve become a go-to choice for millions of investors worldwide. But navigating the sea of options can feel overwhelming. That’s why we’ve put together this comprehensive guide to help you make informed decisions.

Our goal here is simple: to break down the complexities of mutual funds into bite-sized, actionable insights. We’ll walk you through the top funds, how to choose the right ones for your needs, and strategies to maximize your returns. By the end of this article, you’ll not only know what Fidelity mutual funds list offers but also how to leverage them for long-term success.

Read also:Jude Bellingham Parents A Closer Look Into The Family That Shapes A Rising Star

What Are Fidelity Mutual Funds?

Let’s start with the basics. Fidelity mutual funds are investment vehicles managed by Fidelity Investments, one of the largest financial services companies globally. These funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. The idea is simple: diversification reduces risk, and professional management ensures your money works smarter, not harder.

Now, why should you care? Well, mutual funds offer several advantages:

- Diversification: Spread your investments across various asset classes to minimize risk.

- Professional Management: Let experts handle the heavy lifting while you focus on other priorities.

- Accessibility: Even small investors can access high-quality investment opportunities.

- Flexibility: Choose from a wide range of funds tailored to different goals and risk appetites.

But remember, not all mutual funds are created equal. That’s where the Fidelity mutual funds list comes in – it’s your roadmap to finding the perfect fit for your financial journey.

Why Choose Fidelity Mutual Funds?

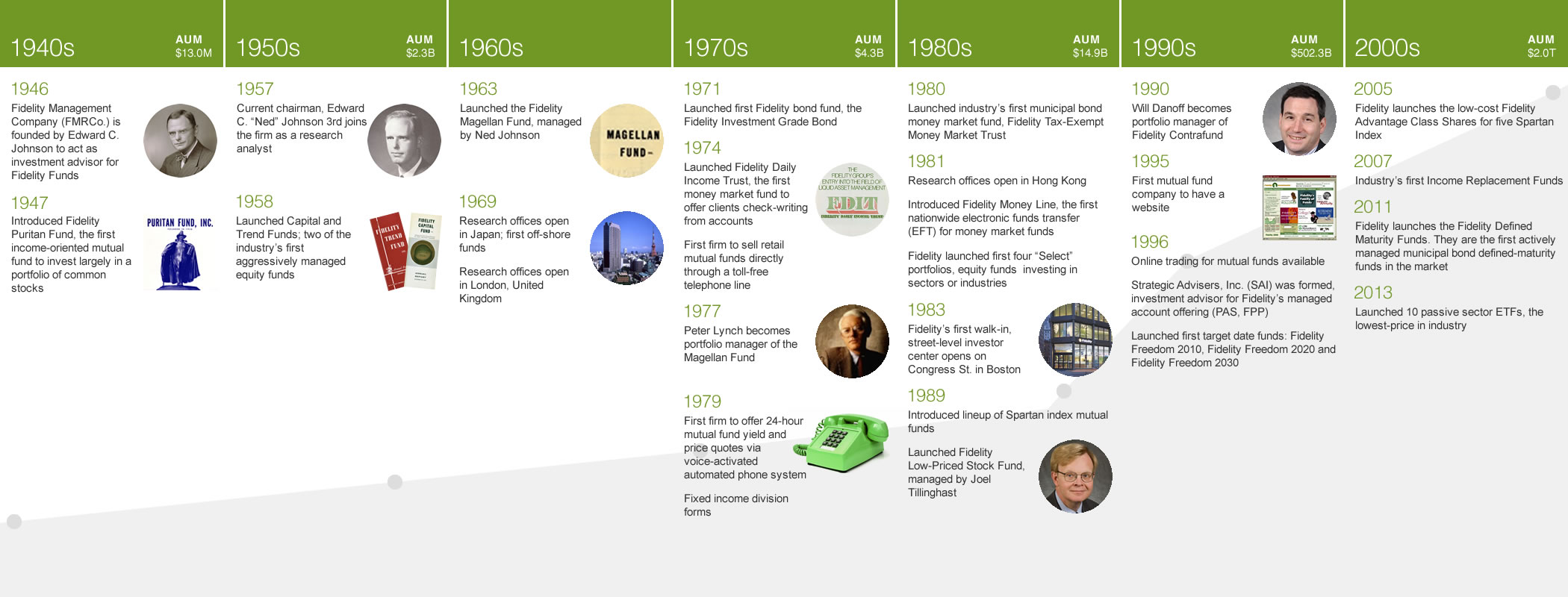

With so many investment platforms out there, what makes Fidelity stand out? For starters, their track record speaks volumes. Established in 1946, Fidelity has consistently delivered strong performance across its fund offerings. But that’s not all – here’s why investors love them:

- Low fees compared to competitors, making your money go further.

- A robust selection of no-load funds, meaning no upfront sales charges.

- Access to cutting-edge research tools and resources to guide your decisions.

- Exceptional customer service, ensuring you’re never alone on your investment journey.

Plus, Fidelity’s commitment to innovation keeps them ahead of the curve. From user-friendly platforms to advanced analytics, they’ve got everything you need to succeed in today’s fast-paced market.

Understanding the Fidelity Mutual Funds List

So, what exactly does the Fidelity mutual funds list look like? It’s a comprehensive catalog of funds categorized by type, risk level, and investment objective. Here’s a quick breakdown to help you navigate:

Read also:Ambika Mod Husband The Story Yoursquove Been Waiting For

Types of Mutual Funds Offered by Fidelity

Fidelity offers a wide array of mutual funds to suit every investor’s needs. Let’s dive into the main categories:

- Stock Funds: Invest primarily in equities, offering growth potential with varying levels of risk.

- Bond Funds: Focus on fixed-income securities, providing stability and income.

- Index Funds: Track specific market indices, offering low-cost, passive investment options.

- Target-Date Funds: Designed for retirement planning, these funds adjust their asset allocation over time.

- International Funds: Provide exposure to global markets, diversifying your portfolio beyond US borders.

Each category has its own set of subcategories, allowing you to fine-tune your investment strategy. For instance, within stock funds, you’ll find options like growth funds, value funds, and sector-specific funds.

Key Metrics to Evaluate Fidelity Mutual Funds

Before adding any fund to your portfolio, it’s crucial to evaluate it based on key metrics. Here’s what to look for:

- Expense Ratio: Lower ratios mean more of your money stays invested.

- Performance History: Check past returns, but remember, past performance doesn’t guarantee future results.

- Management Team: Experienced managers often deliver better outcomes.

- Minimum Investment: Some funds require higher initial investments, so plan accordingly.

- Risk Level: Ensure the fund’s risk profile aligns with your tolerance.

By analyzing these factors, you can identify funds that align with your financial goals and risk appetite.

Top Fidelity Mutual Funds to Consider

Now that you know what to look for, let’s highlight some standout options from the Fidelity mutual funds list:

1. Fidelity Contrafund (FCNTX)

This actively managed fund is a favorite among growth investors. With a focus on undervalued companies, it’s delivered impressive returns over the years. Key highlights include:

- Expense ratio: 0.74%

- Minimum investment: $2,500

- Top holdings: Apple, Microsoft, Amazon

2. Fidelity 500 Index Fund (FXAIX)

For those who prefer a hands-off approach, this index fund tracks the S&P 500. Its rock-bottom expense ratio makes it an attractive option for long-term investors. Features include:

- Expense ratio: 0.015%

- Minimum investment: $0 (with automatic investments)

- Annual returns: Consistently outperforms peers

3. Fidelity Total Bond Fund (FTBFX)

Seeking stability? This bond fund provides steady income with moderate risk. It’s ideal for investors looking to balance their portfolios. Key details:

- Expense ratio: 0.44%

- Minimum investment: $1,000

- Asset allocation: Primarily US government and corporate bonds

These are just a few examples, but the Fidelity mutual funds list offers hundreds of options to explore.

How to Choose the Right Fidelity Mutual Fund

Selecting the perfect fund involves understanding your financial goals and risk tolerance. Ask yourself:

- What am I investing for? Retirement, education, or general wealth-building?

- How much risk am I willing to take? High, moderate, or low?

- What’s my time horizon? Short-term or long-term?

Once you’ve answered these questions, use Fidelity’s tools to filter funds based on your criteria. You can also consult with a financial advisor for personalized guidance.

Common Mistakes to Avoid

Investing can be tricky, and mistakes happen. Here’s what to steer clear of:

- Chasing high returns without considering risk.

- Ignoring fees and expense ratios.

- Not diversifying your portfolio.

By staying disciplined and informed, you’ll set yourself up for success.

Maximizing Your Returns with Fidelity Mutual Funds

Once you’ve chosen your funds, it’s time to optimize your strategy. Here’s how:

1. Dollar-Cost Averaging

Instead of investing a lump sum, spread your contributions over time. This reduces the impact of market volatility and helps you buy more shares when prices are low.

2. Reinvest Dividends

Reinvesting dividends compounds your returns over time. It’s like giving your investments a turbo boost.

3. Regularly Review Your Portfolio

Markets change, and so should your strategy. Periodically reassess your holdings to ensure they still align with your goals.

By implementing these strategies, you’ll make the most of your Fidelity mutual funds list investments.

Investing in Fidelity Mutual Funds: Step-by-Step Guide

Ready to get started? Follow these simple steps:

- Open a Fidelity account if you don’t already have one.

- Research and select funds from the Fidelity mutual funds list.

- Fund your account and place your order.

- Monitor your investments and adjust as needed.

It’s that easy! With Fidelity’s user-friendly platform, you’ll be up and running in no time.

Conclusion: Your Journey to Financial Freedom Starts Here

There you have it – everything you need to know about the Fidelity mutual funds list. From understanding the basics to selecting the right funds, we’ve covered it all. Remember, investing is a marathon, not a sprint. Stay patient, disciplined, and informed, and you’ll be well on your way to achieving your financial dreams.

Now it’s your turn. Share your thoughts in the comments below or check out our other articles for more investing insights. Together, let’s make your money work harder for you!

Table of Contents

- What Are Fidelity Mutual Funds?

- Why Choose Fidelity Mutual Funds?

- Understanding the Fidelity Mutual Funds List

- Types of Mutual Funds Offered by Fidelity

- Key Metrics to Evaluate Fidelity Mutual Funds

- Top Fidelity Mutual Funds to Consider

- How to Choose the Right Fidelity Mutual Fund

- Common Mistakes to Avoid

- Maximizing Your Returns with Fidelity Mutual Funds

- Investing in Fidelity Mutual Funds: Step-by-Step Guide