Listen up, folks! If you're looking for a smart way to manage your tax refunds and get more control over your finances, the H&R Block Emerald Card might just be the answer you've been searching for. This prepaid Mastercard is more than just a plastic card; it's a financial tool designed to help you take charge of your money. Whether you're someone who prefers prepaid cards or simply wants a convenient way to access your tax refund, this card has got you covered.

Now, I know what you're thinking—prepaid cards? Are they really worth it? Well, buckle up because we're about to dive deep into the world of the H&R Block Emerald Card. In this guide, we'll break down everything you need to know, from its features and benefits to potential drawbacks. Think of it as your go-to resource when deciding if this card is right for you.

Let's face it, managing finances can be tricky, especially when you're trying to keep track of multiple accounts and payments. That's where the H&R Block Emerald Card steps in, offering a seamless solution for those looking to simplify their financial life. So, without further ado, let's get started!

Read also:Ari Melber Wedding Pictures A Sneak Peek Into The Love Story

What is the H&R Block Emerald Card?

First things first, let's clear the air about what exactly the H&R Block Emerald Card is. Simply put, it's a prepaid Mastercard designed specifically for H&R Block customers. When you file your taxes with H&R Block, you have the option to receive your refund directly onto this card. It's like having a personal financial assistant right in your pocket!

Here's the kicker: unlike traditional bank accounts, the Emerald Card doesn't require a credit check. That means even if your credit history isn't exactly spotless, you can still enjoy the benefits of this card. Plus, it comes with a host of features that make managing your money a breeze.

Key Features of the H&R Block Emerald Card

- Direct Deposit: Get your tax refund faster by having it deposited directly onto your card.

- No Credit Check: Anyone can apply, regardless of their credit score.

- Mobile App: Stay on top of your finances with the user-friendly mobile app.

- ATM Access: Withdraw cash at over 21,000 in-network ATMs for free.

- Card-to-Card Transfers: Send money to other H&R Block Emerald Card holders easily.

These features make the Emerald Card a solid choice for anyone looking for a hassle-free way to manage their money. But wait, there's more! Let's take a closer look at some of the benefits that come with this card.

Benefits of Using the H&R Block Emerald Card

So, why should you consider the H&R Block Emerald Card over other prepaid cards? Well, there are quite a few reasons. First off, it's incredibly convenient. With direct deposit, you can have your tax refund in your hands faster than ever. No more waiting for checks to arrive in the mail. Plus, the card is accepted anywhere Mastercard is, which is pretty much everywhere!

Another huge benefit is the lack of a credit check. For those with less-than-perfect credit, this is a game-changer. It allows you to have access to a financial tool without the stress of worrying about your credit score. And let's not forget the mobile app, which makes managing your money a breeze. You can check your balance, view transactions, and even set up alerts—all from the palm of your hand.

Security Features You Can Trust

When it comes to financial tools, security is always a top concern. The H&R Block Emerald Card has got you covered in that department too. With features like zero liability protection and fraud monitoring, you can rest easy knowing your money is safe. Plus, the card is PIN-protected, adding an extra layer of security.

Read also:Brandon Sklenar Wife The Untold Story You Need To Know

Here's a quick rundown of the security features:

- Zero Liability Protection: You won't be held responsible for unauthorized transactions.

- Fraud Monitoring: The card issuer keeps an eye out for suspicious activity.

- PIN Protection: Use a unique PIN to protect your card from unauthorized use.

These features make the H&R Block Emerald Card a secure option for those looking to protect their finances.

How Does the H&R Block Emerald Card Work?

Alright, so you're sold on the idea of the H&R Block Emerald Card, but how exactly does it work? It's pretty straightforward, actually. When you file your taxes with H&R Block, you can choose to have your refund deposited directly onto the card. Once the refund is processed, the funds are transferred to your card, and you're good to go!

But that's not all. You can also use the card for everyday purchases, pay bills, and even withdraw cash at ATMs. Plus, with the mobile app, you can manage your card from anywhere. It's like having a mini bank in your pocket. And the best part? No monthly fees as long as you use the card regularly.

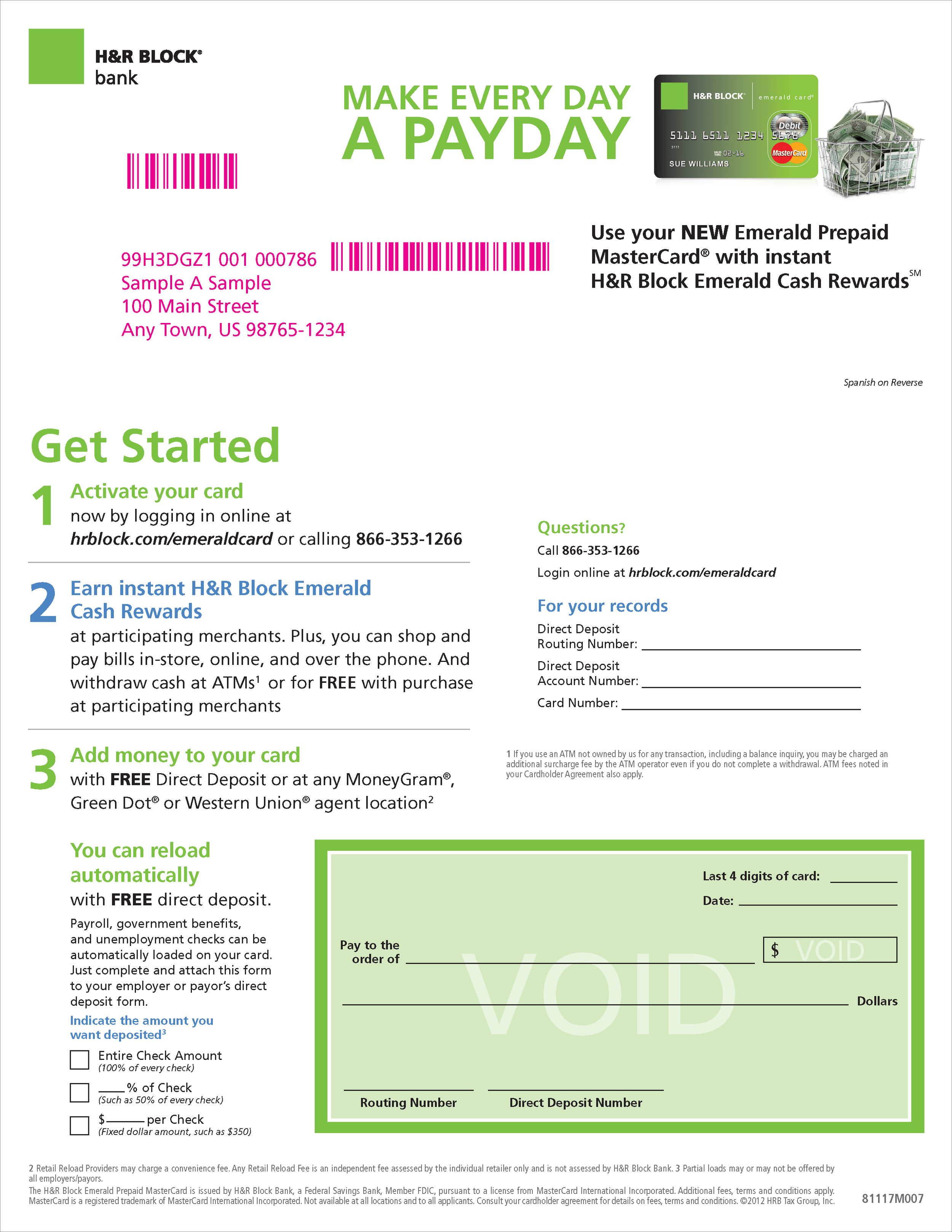

Step-by-Step Guide to Using the Card

Let's break it down step by step:

- File your taxes with H&R Block and opt for the Emerald Card.

- Once your refund is processed, it will be deposited onto your card.

- Activate your card and download the mobile app.

- Start using your card for purchases, bill payments, and ATM withdrawals.

It's really that simple. With just a few steps, you can have a powerful financial tool at your disposal.

Costs and Fees Associated with the Card

Now, let's talk about the elephant in the room—fees. While the H&R Block Emerald Card offers a lot of great features, it does come with some costs. However, many of these fees can be avoided if you use the card regularly. For example, there's no monthly fee as long as you make at least one purchase with the card each month.

Here's a breakdown of some of the fees:

- Monthly Fee: $4.95 if you don't make a purchase in a 30-day period.

- ATM Withdrawal Fee: $2.50 for out-of-network ATMs.

- Card-to-Card Transfer Fee: $0.50 per transfer.

- Balance Inquiry Fee: $0.50 per inquiry at an ATM.

While these fees might seem steep, they can be managed with smart usage. By making regular purchases and using in-network ATMs, you can keep your costs to a minimum.

Ways to Minimize Fees

Here are some tips to help you minimize fees:

- Make at least one purchase per month to avoid the monthly fee.

- Use in-network ATMs for free withdrawals.

- Check your balance through the mobile app instead of at an ATM.

- Limit card-to-card transfers to reduce fees.

By following these tips, you can enjoy the benefits of the H&R Block Emerald Card without breaking the bank.

Who is the H&R Block Emerald Card Best For?

Now that we've covered the features, benefits, and fees, let's talk about who this card is best suited for. The H&R Block Emerald Card is ideal for anyone looking for a convenient way to access their tax refund. It's particularly useful for those who prefer prepaid cards or don't have a traditional bank account. Plus, it's a great option for those with less-than-perfect credit who still want access to a financial tool.

But that's not all. The card is also a good choice for those who want a simple way to manage their money. With the mobile app and security features, it offers a lot of value for anyone looking to take control of their finances.

Is the H&R Block Emerald Card Right for You?

Here are some questions to ask yourself:

- Do you file your taxes with H&R Block?

- Do you prefer prepaid cards over traditional bank accounts?

- Do you want a convenient way to access your tax refund?

- Are you looking for a secure and easy-to-use financial tool?

If you answered yes to any of these questions, the H&R Block Emerald Card might be the perfect fit for you.

Alternatives to the H&R Block Emerald Card

Of course, the H&R Block Emerald Card isn't the only prepaid card on the market. There are plenty of other options out there, each with its own set of features and fees. Some popular alternatives include the Green Dot Prepaid Debit Card and the Netspend Prepaid Mastercard. It's important to compare these options to find the one that best suits your needs.

Here's a quick comparison:

- Green Dot Prepaid Debit Card: Offers no monthly fees and free ATM withdrawals at in-network ATMs.

- Netspend Prepaid Mastercard: Provides cash back at select retailers and no monthly fees with direct deposit.

While these cards have their own benefits, the H&R Block Emerald Card stands out for its tax refund direct deposit feature and user-friendly mobile app.

Why Choose the H&R Block Emerald Card?

Here are a few reasons:

- Direct deposit for tax refunds.

- No credit check required.

- Free ATM withdrawals at in-network ATMs.

- Secure mobile app for managing your card.

These features make the H&R Block Emerald Card a strong contender in the prepaid card market.

Customer Reviews and Ratings

So, what do real people think about the H&R Block Emerald Card? Overall, the reviews are positive. Many users appreciate the convenience of having their tax refund deposited directly onto the card. Others love the security features and mobile app. However, some users have expressed concerns about the fees, particularly the monthly fee if the card isn't used regularly.

Here are some common praises and criticisms:

- Praises: Easy to use, secure, convenient for tax refunds.

- Criticisms: Fees can add up if not used regularly, limited customer support.

It's always a good idea to read reviews and ratings before making a decision. This can give you a better understanding of what to expect from the card.

How to Make the Most of Your Card

To get the most out of your H&R Block Emerald Card, here are a few tips:

- Use the card regularly to avoid monthly fees.

- Take advantage of the mobile app for easy management.

- Stick to in-network ATMs for free withdrawals.

- Monitor your account for any suspicious activity.

By following these tips, you can make the most of your card and enjoy all the benefits it has to offer.

Conclusion: Is the H&R Block Emerald Card Worth It?

So, is the H&R Block Emerald Card worth it? In short, yes! It offers a convenient way to access your tax refund, no credit check required, and a host of features that make managing your money a breeze. While there are fees associated with the card, they can be managed with smart usage. Plus, the security features and mobile app add extra value to the card.

Before you make a decision, take some time to compare the H&R Block Emerald Card with other prepaid cards on the market. Consider your financial needs and how the card fits into your overall financial strategy. And don't forget to read reviews and ratings to get a better understanding of what to expect.

So, what are you waiting for? If the H&R Block Emerald Card sounds like the right fit for you, go ahead and give it a try. And don't forget to share your experience with us in the comments below. Your feedback could help others make an informed decision!

Table of Contents