Let's be real here, folks. If you're reading this, chances are you've heard about the TJX credit card and want to know what it's all about. In today's world of shopping, having the right credit card can make all the difference. Whether you're a bargain hunter or just someone who loves a good deal, this card could be your ticket to saving big bucks. So, buckle up because we're diving deep into everything you need to know about the TJX credit card!

Now, before we get into the nitty-gritty, let's talk about why this card is worth your attention. The TJX credit card is designed specifically for shoppers who frequent stores like TJ Maxx, Marshalls, and HomeGoods. If you're someone who loves scoring designer finds at affordable prices, this card could be your best friend. But is it really worth it? That's what we're here to figure out.

Shopping isn't just about finding cool stuff; it's also about being smart with your money. The TJX credit card offers a unique set of perks that can help you save while you shop. But like any financial product, it's important to know the ins and outs. So, whether you're a seasoned TJX shopper or just curious, this guide is for you. Let's get started!

Read also:Simon Cowells Son Disabled The Untold Story Behind His Family Life

What Exactly is the TJX Credit Card?

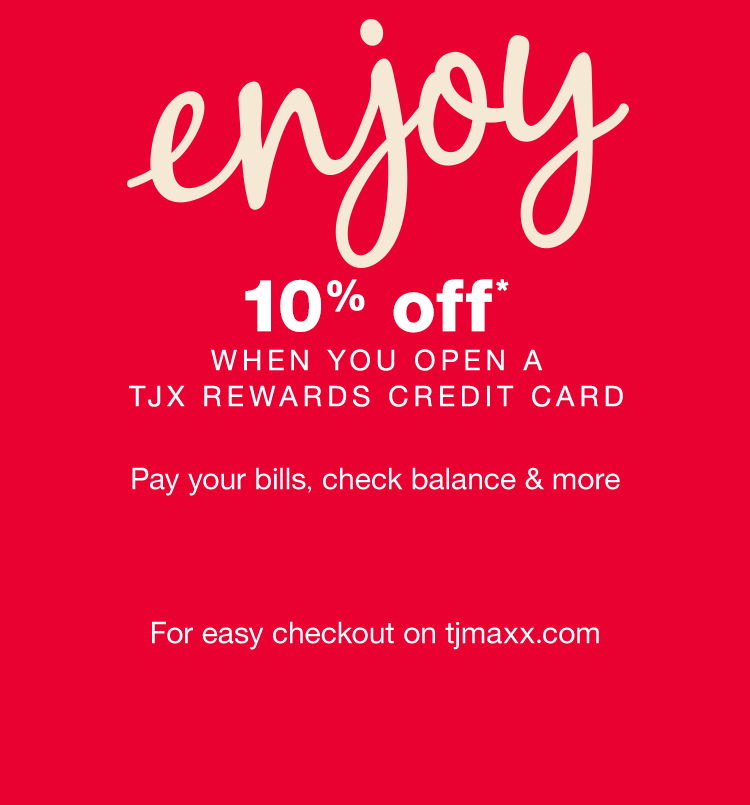

Alright, let's break it down. The TJX credit card is a private label credit card issued by Synchrony Bank. It's designed for people who shop regularly at TJ Maxx, Marshalls, HomeGoods, and Sierra. Think of it as your VIP pass to these stores. With this card, you get access to exclusive discounts, special offers, and even early access to sales. But wait, there's more!

This card isn't just about discounts. It also helps you manage your spending and build credit. If you're someone who's looking to improve your credit score, using this card responsibly can be a great way to do it. Plus, it's super easy to apply for. All you need is a few minutes and some basic information, and you could be on your way to shopping like a pro.

Benefits of the TJX Credit Card

So, what makes the TJX credit card stand out? Let's take a look at some of the key benefits:

- Exclusive Discounts: Cardholders get access to special discounts that aren't available to regular shoppers.

- Early Access to Sales: Be the first to know about upcoming sales and get a head start on snagging the best deals.

- No Annual Fee: You don't have to pay a dime just to have the card. That's a win-win if you ask me.

- Flexible Payment Options: If you can't pay off your balance in full, you can choose from different payment plans to suit your budget.

- Credit Building: Responsible use of the card can help improve your credit score over time.

These benefits make the TJX credit card a great option for anyone who shops at TJX stores regularly. But remember, with great power comes great responsibility. Use the card wisely, and you'll reap the rewards.

How to Apply for the TJX Credit Card

Applying for the TJX credit card is a breeze. You can do it online or in-store. Here's how:

Online Application

Head over to the official TJX credit card website and click on "Apply Now." You'll need to provide some basic information like your name, address, and social security number. The whole process takes about five minutes, and you'll get an instant decision. If you're approved, your card will be shipped to you in a few days.

Read also:Hakeem Lyon The Rising Star You Need To Know About

In-Store Application

If you prefer the old-school way, you can apply for the card at any TJ Maxx, Marshalls, HomeGoods, or Sierra store. Just ask a sales associate for an application form, fill it out, and submit it. You'll get your decision on the spot, and if you're approved, you can start using the card right away.

Either way, the application process is quick and painless. So, if you're ready to level up your shopping game, go ahead and apply!

Understanding the Interest Rates

Now, let's talk about the elephant in the room – interest rates. If you don't pay off your balance in full each month, you'll be charged interest. The good news is that the TJX credit card offers a competitive interest rate. As of 2023, the APR ranges from 23.99% to 28.99%, depending on your creditworthiness.

But here's the thing – if you pay off your balance in full every month, you won't have to worry about interest. So, it's important to manage your spending and make sure you can afford to pay off your card. If you're not sure how much you can afford, use the card's payment calculator to help you plan.

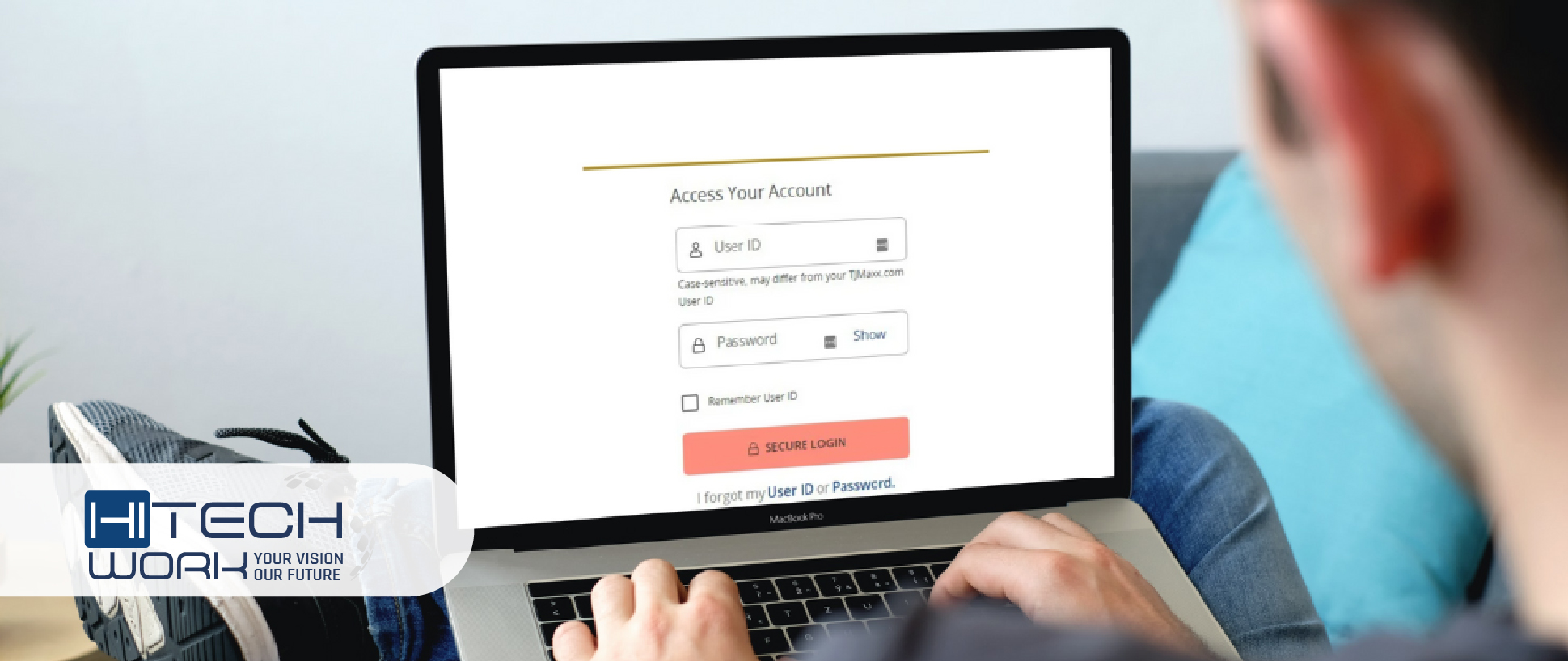

Managing Your TJX Credit Card Account

Once you have your card, it's important to keep track of your account. The good news is that managing your TJX credit card is super easy. You can do everything online, from checking your balance to making payments. Here are some tips to help you stay on top of things:

- Set Up Auto-Pay: Never miss a payment by setting up automatic payments.

- Monitor Your Account Regularly: Keep an eye on your account for any suspicious activity.

- Use the App: The TJX credit card app makes it easy to manage your account on the go.

- Stay Within Your Limits: Don't max out your card – it's bad for your credit score and your wallet.

By following these tips, you'll be able to use your card responsibly and avoid any nasty surprises.

Is the TJX Credit Card Right for You?

Now that you know all about the TJX credit card, you might be wondering if it's the right choice for you. Here are a few things to consider:

Pros

- Exclusive discounts and early access to sales.

- No annual fee.

- Helps build credit.

- Easy application process.

Cons - High interest rates if you don't pay off your balance in full.

- Only usable at TJX stores.

- Requires responsible spending habits.

Ultimately, the decision comes down to your shopping habits and financial situation. If you shop at TJX stores regularly and can manage your spending, this card could be a great addition to your wallet.

How to Maximize Your Benefits

Ready to make the most of your TJX credit card? Here are some tips to help you maximize your benefits:

- Sign Up for Email Alerts: Get notified about upcoming sales and exclusive offers.

- Use the Card for Big Purchases: If you're planning to make a big purchase, use the card to take advantage of the discounts.

- Pay Off Your Balance in Full: Avoid interest charges by paying off your balance every month.

- Refer Friends: Some cardholders get rewards for referring friends – check if this is an option for you.

By following these tips, you'll be able to enjoy all the perks of the TJX credit card without any downsides.

Common Questions About the TJX Credit Card

Let's address some of the most common questions people have about the TJX credit card:

Can I Use the Card at Other Stores?

No, the TJX credit card can only be used at TJ Maxx, Marshalls, HomeGoods, and Sierra. It's a private label card, so it's limited to these stores.

What Happens If I Miss a Payment?

If you miss a payment, you'll be charged a late fee, and it could negatively impact your credit score. To avoid this, set up auto-pay or reminders to make sure you never miss a payment.

Can I Transfer My Balance?

No, the TJX credit card doesn't offer balance transfer options. It's designed for use at TJX stores only.

These are just a few of the questions people have about the card. If you have more, check out the official website or contact customer service.

Final Thoughts

So, there you have it – everything you need to know about the TJX credit card. Whether you're a seasoned shopper or just starting out, this card could be a great addition to your wallet. Just remember to use it responsibly and take advantage of all the perks it offers.

Now, it's your turn. Have you used the TJX credit card? What do you think? Leave a comment below and let us know. And if you found this guide helpful, don't forget to share it with your friends. Happy shopping, folks!

Table of Contents

Unlocking the Power of TJX Credit Card: A Comprehensive Guide

What Exactly is the TJX Credit Card?

Benefits of the TJX Credit Card

How to Apply for the TJX Credit Card

Understanding the Interest Rates

Managing Your TJX Credit Card Account

Is the TJX Credit Card Right for You?