So, here's the deal. If you're reading this, chances are you're looking to get the scoop on BB&T Online. Whether you're a first-timer or just trying to level up your digital banking game, you're in the right place. BB&T Online isn't just another banking platform—it's a game-changer that can simplify your financial life. Let’s dive in and break it down for you, step by step. No fluff, just the real deal.

Let’s face it, managing finances can feel like navigating a maze. But with BB&T Online, things get a whole lot clearer. This platform offers tools and features that cater to both personal and business needs. From bill payments to account monitoring, it’s designed to make your life easier. Stick around, because we’re about to spill all the tea on how you can harness its full potential.

Now, here’s the kicker. The financial world is evolving faster than ever, and staying ahead of the curve is crucial. BB&T Online isn’t just about convenience—it’s about empowering you with the knowledge and tools to take control of your money. So, whether you’re trying to save smarter, invest better, or just keep an eye on your spending, this guide has got your back.

Read also:Ambika Mod Husband The Story Yoursquove Been Waiting For

What Exactly is BB&T Online?

Alright, let’s start with the basics. BB&T Online is more than just an app or a website—it’s a full-service digital banking solution. It allows you to access your accounts, make transactions, pay bills, and manage your finances all from the comfort of your phone or laptop. No more waiting in line at the bank or worrying about missing deadlines. It’s banking reimagined for the digital age.

Here’s why BB&T Online stands out: it’s secure, user-friendly, and packed with features that cater to your everyday banking needs. Whether you’re checking your balance, transferring funds, or setting up automatic payments, everything is just a few clicks away. And guess what? It’s available 24/7, so you can bank whenever it suits you best.

Why Choose BB&T Online for Your Banking Needs?

Let’s break it down. There are plenty of online banking platforms out there, but BB&T Online has some serious advantages. First off, it’s backed by one of the largest financial institutions in the U.S., so you know you’re in good hands. Plus, it offers a seamless integration of services that cater to both individuals and businesses.

Here’s a quick rundown of what makes BB&T Online worth considering:

- Advanced security features to protect your data

- User-friendly interface for easy navigation

- Wide range of services, from personal banking to business solutions

- 24/7 accessibility with real-time updates

- Customer support that’s always ready to assist

Setting Up Your BB&T Online Account: Step by Step

Alright, let’s get practical. Setting up your BB&T Online account is simpler than you think. Here’s how you can get started:

First things first, head over to the official BB&T website or download the app on your smartphone. Once you’re there, click on the ‘Enroll Now’ button. You’ll need some basic info like your account number, Social Security number, and a valid email address. Don’t sweat it—this process is quick and secure.

Read also:Vince Gill Net Worth Exploring The Wealth Behind The Country Music Legend

After you’ve entered your details, you’ll set up a username and password. Pro tip: make sure your password is strong but something you can remember. Once you’re all set, you’ll get an email confirmation, and you’re good to go. Easy peasy, right?

Tips for a Smooth Enrollment Process

Here are a few tips to make your enrollment process smoother:

- Make sure you have all your account details handy

- Choose a strong but memorable password

- Double-check your email address during enrollment

- Enable two-factor authentication for added security

Exploring the Features of BB&T Online

So, you’ve signed up—now what? BB&T Online comes with a bunch of features that are designed to make your life easier. Let’s take a closer look at some of the standout ones:

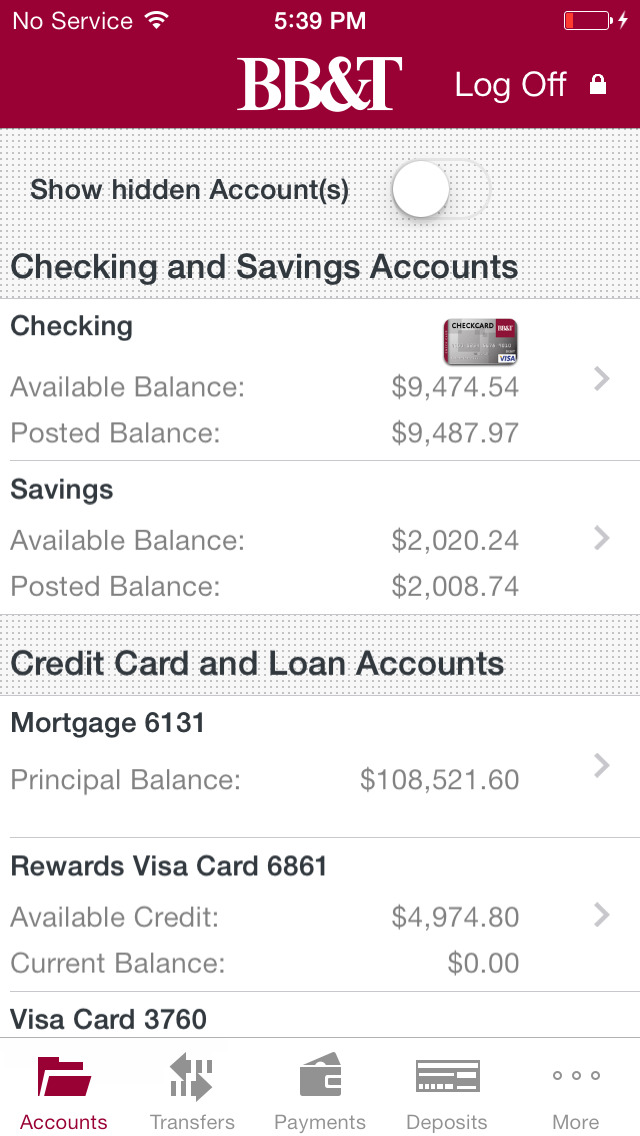

First up, we’ve got account management. You can view all your accounts in one place, check balances, and monitor transactions in real time. This is a game-changer for keeping track of your finances. Next, there’s bill pay. Say goodbye to late fees and hello to automated payments. You can schedule payments, set reminders, and even pay multiple bills at once.

Mobile Banking with BB&T Online

Let’s talk mobile. The BB&T Online app is a powerhouse. It lets you do pretty much everything you can do on the website, but with the added convenience of being on the go. You can deposit checks using your phone’s camera, transfer funds between accounts, and even locate nearby ATMs. It’s like having a personal banker in your pocket.

Security Features: Keeping Your Data Safe

Security is a top priority, and BB&T Online doesn’t mess around when it comes to protecting your info. From encryption to two-factor authentication, they’ve got all the bases covered. Here’s a quick look at some of the security features you can expect:

- Data encryption for secure transactions

- Two-factor authentication for added protection

- Real-time fraud monitoring

- Secure login with biometric options

And if something does go wrong, BB&T’s customer support team is always ready to help. They’ve got your back, no matter what.

Common Security Concerns and How BB&T Addresses Them

Let’s address some common concerns. A lot of people worry about online banking security, but with BB&T Online, you can rest easy. They use cutting-edge technology to ensure your data stays safe. If you ever notice any suspicious activity, you can report it instantly, and their team will jump into action. It’s all about peace of mind.

Managing Finances with BB&T Online

Now, let’s talk about the nitty-gritty of managing your finances. BB&T Online offers tools that can help you save smarter, spend wiser, and plan better. From budgeting tools to investment options, it’s all there at your fingertips.

One of the coolest features is the ability to set financial goals. Whether you’re saving for a vacation, a new car, or retirement, BB&T Online can help you track your progress and stay on track. Plus, with real-time updates, you’ll always know where you stand.

Budgeting Made Easy with BB&T Tools

Here’s how BB&T Online simplifies budgeting:

- Track your spending across categories

- Set custom alerts for overspending

- View detailed reports on your financial habits

- Adjust your budget as needed

It’s like having a personal finance coach, but without the hefty price tag.

Customer Support: Your Go-To Team

Let’s not forget about customer support. BB&T Online offers top-notch support that’s available whenever you need it. Whether you’re dealing with a technical issue or just have a question, their team is ready to assist. You can reach them via phone, email, or even live chat.

And here’s the best part: they’re knowledgeable, friendly, and always willing to go the extra mile to help you out. It’s not just about solving problems—it’s about building trust.

How to Get the Most Out of Customer Support

Here are some tips for making the most of BB&T’s customer support:

- Be clear about your issue when reaching out

- Have all relevant info ready, like account numbers

- Use live chat for quick resolutions

- Don’t hesitate to ask for clarification if needed

Common FAQs About BB&T Online

Got questions? We’ve got answers. Here are some of the most common FAQs about BB&T Online:

- Is BB&T Online secure? Absolutely! They use advanced encryption and two-factor authentication to keep your data safe.

- Can I access my accounts 24/7? Yes, BB&T Online is available around the clock.

- What happens if I forget my password? No worries! You can reset your password easily through the app or website.

- Is there a mobile app? Yep! The BB&T Online app is available for both iOS and Android.

Final Thoughts: Why BB&T Online is Worth It

So, there you have it—the lowdown on BB&T Online. It’s more than just a banking platform—it’s a tool that can help you take control of your finances and simplify your life. From its user-friendly interface to its advanced security features, BB&T Online has everything you need to bank smarter.

Ready to give it a try? Sign up today and experience the convenience of digital banking. And don’t forget to share this guide with your friends and family. After all, knowledge is power, and the more people who know about BB&T Online, the better.

Drop a comment below if you’ve got any questions or feedback. We’d love to hear from you! And while you’re at it, check out some of our other articles for more tips and tricks on managing your finances like a pro.

Table of Contents

- What Exactly is BB&T Online?

- Why Choose BB&T Online for Your Banking Needs?

- Setting Up Your BB&T Online Account: Step by Step

- Exploring the Features of BB&T Online

- Mobile Banking with BB&T Online

- Security Features: Keeping Your Data Safe

- Managing Finances with BB&T Online

- Customer Support: Your Go-To Team

- Common FAQs About BB&T Online

- Final Thoughts: Why BB&T Online is Worth It

:max_bytes(150000):strip_icc()/BBT_Recirc-4d8d2ccbd14e469784bd357c7b0a9f41.jpg)