When it comes to choosing the right university, cost is a major factor that can't be ignored. University of California Irvine tuition has become a hot topic among prospective students and their families. If you're looking for a world-class education at one of the most prestigious universities in the U.S., you're in the right place. In this article, we'll break down everything you need to know about UCI tuition, financial aid, and scholarships so you can make an informed decision.

Let’s face it, college tuition can feel like a giant mystery wrapped in a riddle. One minute you're scrolling through the University of California Irvine website, and the next you're scratching your head trying to figure out how much it'll cost to attend. Well, worry no more because we've got all the answers you're looking for. From in-state to out-of-state tuition, we're diving deep into the numbers that matter.

Whether you're a high school senior dreaming of becoming an Anteater or a parent trying to budget for the future, this guide is your ultimate resource. We’ll cover everything from tuition breakdowns to hidden costs and even tips on how to save money. So grab a snack, get comfy, and let's unravel the mystery of University of California Irvine tuition together.

Read also:Ambika Mod Husband The Story Yoursquove Been Waiting For

Understanding the Basics of UCI Tuition

What You Need to Know About University of California Irvine Tuition

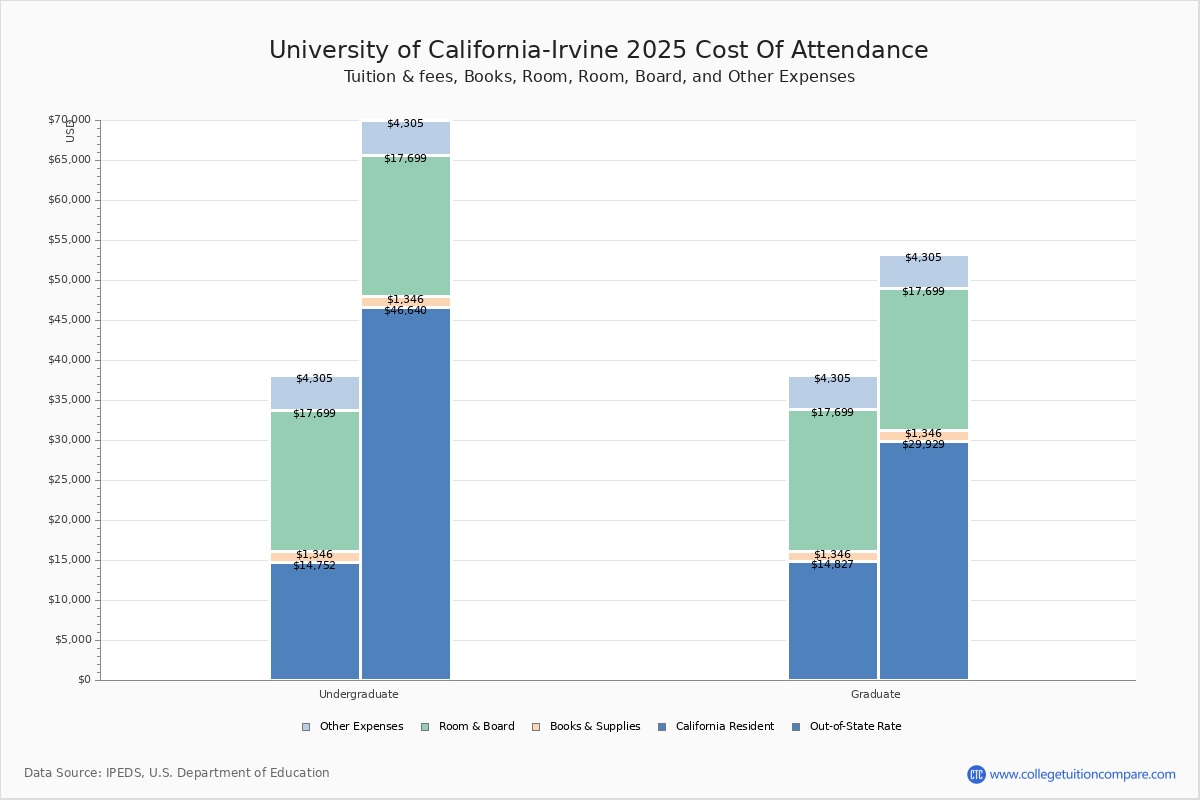

First things first, let’s talk about the basics. University of California Irvine tuition isn’t just a flat fee; it’s a combination of various charges that add up to the total cost of attendance. For the 2023-2024 academic year, the estimated tuition for California residents is around $14,256 per year. Now, before you start hyperventilating, keep in mind that this number doesn’t include fees, housing, or other expenses. Out-of-state students, on the other hand, pay significantly more, with tuition clocking in at approximately $42,840 annually. Yikes, right?

Here’s the thing though—these numbers are just the starting point. UCI offers a range of financial aid options, scholarships, and grants that can significantly reduce the overall cost. So don’t let the sticker price scare you away. Let’s break it down further to see what you’re really paying for.

Tuition Breakdown: What’s Included?

Now that we’ve got the basics covered, let’s dive into the nitty-gritty of what’s included in University of California Irvine tuition. Tuition fees cover the cost of your classes, but there’s more to the story. UCI charges additional fees for things like campus facilities, health services, and student activities. These fees can add up quickly, so it’s important to factor them into your budget.

For example, the Student Services Fee is around $352 per quarter, while the Campus-Based Health Insurance Fee is about $665 per quarter. There’s also the Transportation and Parking Fee, which can range from $15 to $270 depending on your needs. And let’s not forget about the quarterly registration fee of $144. All these little fees add up, so be sure to account for them when planning your finances.

Additional Costs Beyond Tuition

Speaking of additional costs, let’s talk about the big ones that can make or break your budget. Housing at UCI is a major expense, especially if you’re living on campus. On-campus housing can range from $6,000 to $9,000 per year, depending on the type of accommodation you choose. Off-campus housing is often cheaper, but it comes with its own set of challenges like commuting and utilities.

Then there’s the cost of textbooks and supplies, which can set you back anywhere from $1,000 to $2,000 per year. And let’s not forget about personal expenses like food, transportation, and entertainment. All these extras can add up to a significant amount, so it’s crucial to have a solid budget in place before you start your UCI journey.

Read also:Ari Melber Wedding Pictures A Sneak Peek Into The Love Story

Financial Aid Options for UCI Students

Exploring Grants and Scholarships

Alright, let’s talk about the good stuff—financial aid. UCI offers a variety of grants and scholarships to help students cover the cost of tuition and other expenses. The Federal Pell Grant is a great option for students with financial need, providing up to $6,895 per year. Then there’s the Cal Grant, which is available to California residents and can cover up to $14,256 in tuition costs.

UCI also has its own scholarship programs, such as the Regents Scholarship and the Chancellor’s Award. These scholarships are highly competitive but can make a huge difference in reducing your overall cost. Additionally, there are numerous private scholarships available through organizations, companies, and community groups. It’s worth taking the time to research and apply for as many scholarships as possible.

Understanding Out-of-State Tuition

Now let’s address the elephant in the room—out-of-state tuition. If you’re not a California resident, you’ll be paying significantly more to attend UCI. But don’t despair; there are ways to reduce the cost. One option is to become a California resident after your first year, which can qualify you for in-state tuition rates. Another option is to apply for the Western Undergraduate Exchange (WUE) program, which offers reduced tuition rates for students from western states.

It’s important to note that out-of-state students are eligible for the same financial aid and scholarship opportunities as in-state students. So be sure to explore all your options and don’t be afraid to ask for help. The UCI financial aid office is there to assist you every step of the way.

How to Qualify for In-State Tuition

For out-of-state students, qualifying for in-state tuition can mean the difference between a manageable budget and a financial burden. To qualify as a California resident, you must meet certain criteria, such as living in the state for at least one year prior to enrollment and demonstrating financial independence. There are also exceptions for certain groups, such as military personnel and their dependents.

It’s a good idea to start the residency process as soon as possible, as it can take time to gather the necessary documentation. Be sure to consult with the UCI admissions office to ensure you’re on the right track. With a little effort and planning, you can significantly reduce your University of California Irvine tuition costs.

Student Loan Options

Let’s face it, not everyone can afford to pay for college out of pocket. That’s where student loans come in. Federal student loans are a popular choice because they offer low interest rates and flexible repayment options. The Direct Subsidized Loan is available to students with financial need, while the Direct Unsubsidized Loan is available to all eligible students.

Private student loans are another option, but they come with higher interest rates and less flexible terms. It’s important to carefully consider your options and only borrow what you absolutely need. Remember, student loans are an investment in your future, so make sure you’re making a smart financial decision.

Tips for Managing Student Loan Debt

Managing student loan debt can be overwhelming, but there are strategies to help you stay on top of it. First, create a budget that includes your loan payments. This will help you stay organized and avoid missing payments. Second, consider income-driven repayment plans, which adjust your monthly payments based on your income.

Finally, don’t forget about loan forgiveness programs. Certain careers, such as teaching and public service, may qualify you for loan forgiveness after a set number of years. It’s worth exploring all your options to find the best solution for your financial situation.

Hidden Costs of Attending UCI

As we’ve mentioned before, University of California Irvine tuition isn’t the only cost you’ll need to consider. There are plenty of hidden costs that can sneak up on you if you’re not prepared. One of the biggest surprises is the cost of dining on campus. UCI offers several meal plans, but they can be pricey, especially if you’re eating out frequently.

Another hidden cost is transportation. If you’re living off-campus, you’ll need to factor in the cost of commuting to and from campus. This can include gas, car maintenance, and parking fees. And let’s not forget about the cost of extracurricular activities, such as joining clubs or participating in sports. These activities can enhance your college experience, but they come with a price tag.

How to Save Money While Attending UCI

Now that we’ve covered the hidden costs, let’s talk about how to save money while attending UCI. One of the easiest ways to save is by taking advantage of free resources on campus, such as the library, fitness center, and student organizations. Many of these resources are already included in your tuition fees, so why not use them?

Another tip is to buy used textbooks or rent them instead of purchasing new ones. You can also look for discounts on campus events and activities. And don’t forget about the UCI student ID card, which can get you discounts at local businesses and attractions. With a little creativity and planning, you can enjoy all that UCI has to offer without breaking the bank.

Conclusion: Making the Most of Your UCI Experience

So there you have it, everything you need to know about University of California Irvine tuition and how to make the most of your college experience. Remember, the cost of tuition is just one piece of the puzzle. With the right financial aid, scholarships, and budgeting strategies, you can make attending UCI a reality. And don’t forget to take advantage of all the resources and opportunities available to you as a student.

Now it’s your turn to take action. Leave a comment below and let us know what you think about UCI tuition. Are there any other tips or tricks you’d like to share? And be sure to share this article with your friends and family who might find it helpful. Together, we can make college more accessible and affordable for everyone.

Table of Contents

- Understanding the Basics of UCI Tuition

- Tuition Breakdown: What’s Included?

- Additional Costs Beyond Tuition

- Financial Aid Options for UCI Students

- Exploring Grants and Scholarships

- Understanding Out-of-State Tuition

- How to Qualify for In-State Tuition

- Student Loan Options

- Tips for Managing Student Loan Debt

- Hidden Costs of Attending UCI

- How to Save Money While Attending UCI