- After a tough 2024 with high inflation and reduced consumer spending, Mastercard has predicted increased consumer spending in 2025

- The payment technology company listed the factors that would trigger the increased spending

- Notwithstanding, the impact of inflation will still be seen in the choice of what Nigerians will spend on

Legit.ng journalist Ruth Okwumbu-Imafidon has over a decade of experience in business reporting across digital and mainstream media.

Consumer spending in Nigeria will rise by 6% in 2025. This is the projection from payment technology firm, Mastercard.

Explaining what would trigger increased spending, the tech company observed that there would be increased remittance inflow to drive spending upwards.

Read also:18 Senators Take Fresh Action On Tinubus Tax Reform Bills

This projection was contained in the Mastercard Economics Institute’s 2025 Economic Outlook for Nigeria: Steering through Change.

The annual report also identified other factors that would trigger economic changes. Key among them are the expected shifts in fiscal and monetary policies, which will in turn moderate towards an equilibrium in Nigeria's inflation and growth rates.

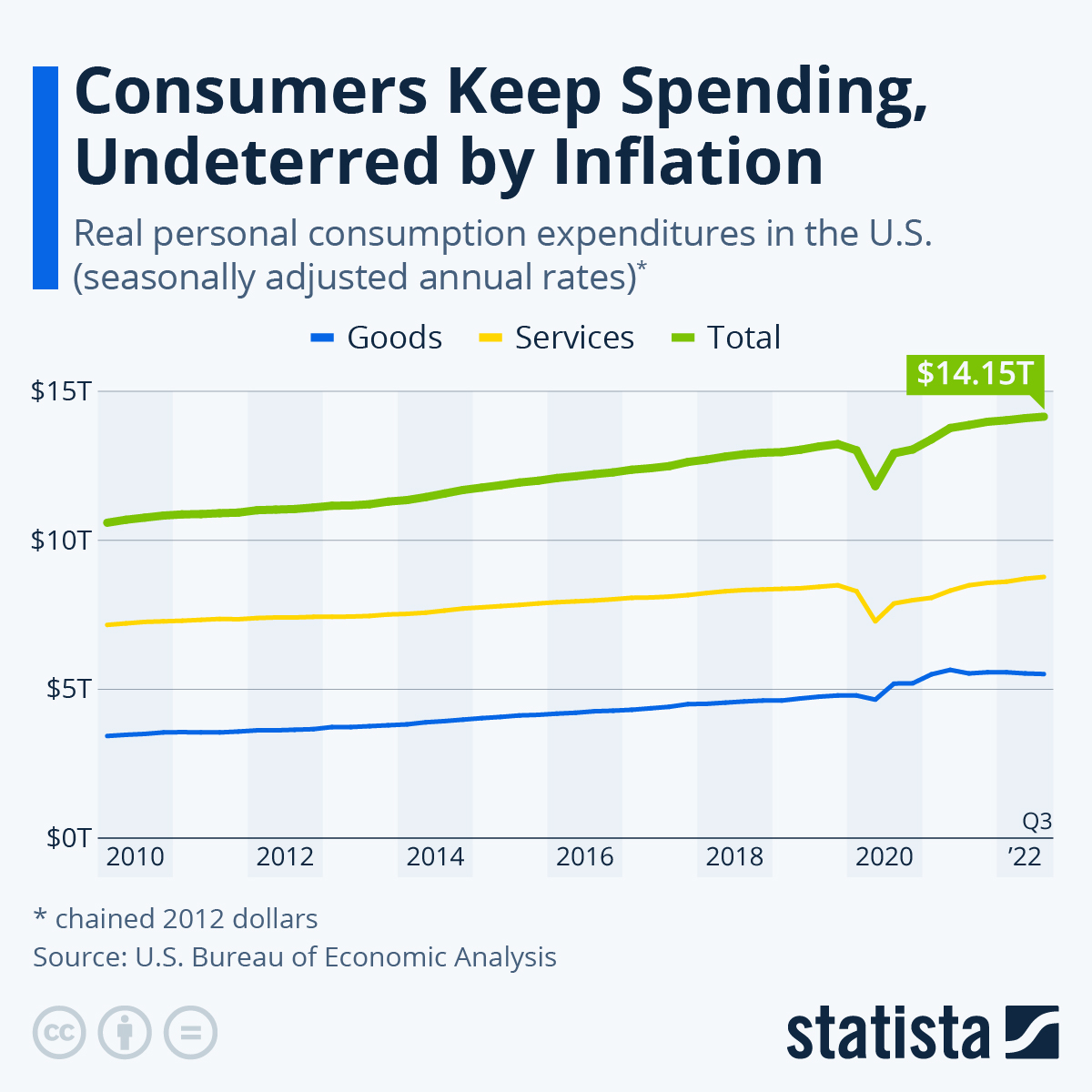

Inflation and consumer spending

Recall that food inflation closed 2024 at 39.93% while Headline inflation was 34.8% as at November 2024.

This led to a drop in consumer spending across industries, as Nigerians had to prioritise food over other needs.

Despite the projected growth in consumer spending, Mastercard's report says inflation will still play a major role in what people spend on.

Mastercard report predict that households will continue to prioritise essential goods and services, while luxury and other discretionary expenses will take the back seat.

Read also:Joe Rogans Daughters A Closer Look Into The Life Of The Comedy Legends Family

Remittances to increase as more Nigerians Japa

The report projects that increased emigration (Japa) would lead to an increased inflow of remittances, and Nigeria would rely on the multiple players in digital payments to enhance the ease, efficiency and security.

The report states;

“The last few years saw significant movement in people and, by extension, capital. While migration results in a loss of human capital, it also generates substantial remittances, which serve as a lifeline for low- and middle-income communities in developing economies."

The World Bank confirms that global remittances surged from $128bn in 2000 to $857bn in 2023, and projects another 3% growth in remittance from 2024 and 2025.

In Nigeria, the ‘japa’ trend accounts for the recent increase in remittance inflows.

Payment solutions providers will play key role

It described digital payments and mobile banking solutions as vital players in reaching underserved communities with financial services.

Other influencing factors include the large youth population and the robust informal economy.

Mastercard projects GDP growth

The Mastercard report projects a 2.9% GDP growth for Nigeria, below the global average of 3.2%, caused by multiple economic challenges.

Consumer Price Inflation is expected to moderate to 22.1% compared to 33% in 2024, but will still be high enough to pose a challenge for businesses and households, the Punch reports.

Commenting on the report in a statement, chief economist, EEMEA, Mastercard, Khatija Haque, described Nigeria's economy as resilient.

Haque noted that it also highlights the nation's growth potential, and the need to ensure financial inclusion.

Increased consumer spending based on 70k minimum wage

In related news, Nigerian manufacturers are projecting a 10% growth in 2025 on the backdrop of a stable forex market.

They project that the implementation of the minimum wage across Nigeria will improve purchasing power and consumer spending in 2025.

Leaders in the industry called on the government to address teething challenges like rising energy costs and multiple taxation in order to ease the business environment.