Calculating your salary in California can feel like solving a complex puzzle, but with the right tools like the ADP Salary Calculator California, it becomes a breeze. Imagine having a financial compass that helps you navigate through taxes, deductions, and benefits. Well, that's exactly what this powerful tool does. Whether you're an employee or employer, understanding how salaries are calculated in the Golden State is crucial for financial planning.

Now, let’s face it—California has its own set of rules when it comes to payroll. From minimum wage laws to tax regulations, there’s a lot to unpack. The ADP Salary Calculator California simplifies all of this by breaking down the numbers for you. It’s like having a personal accountant right at your fingertips. You input the details, and voila! Everything falls into place.

But why stop at just crunching numbers? This calculator also gives you insights into net pay, deductions, and even projected bonuses. It’s more than just a tool; it’s your go-to resource for making informed financial decisions. So, buckle up as we dive deep into how you can master the ADP Salary Calculator California and make the most out of it.

Read also:Rebecca Muir The Rise Of A Broadcasting Icon

Understanding ADP Salary Calculator California

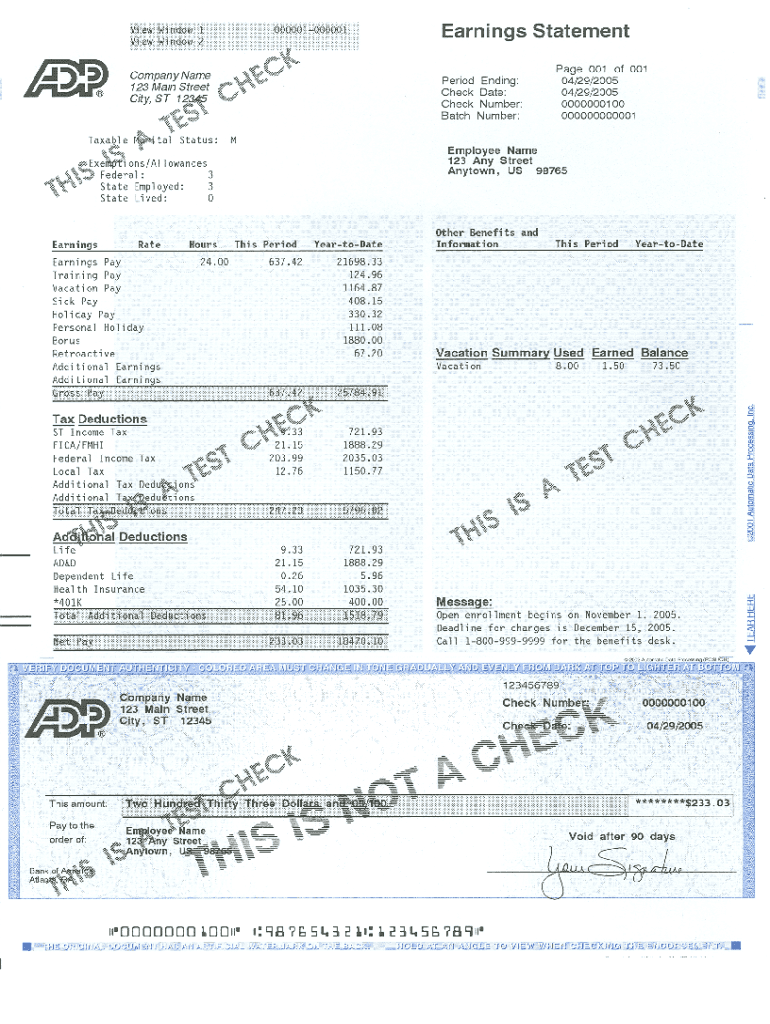

First things first, what exactly is the ADP Salary Calculator California? Simply put, it’s a digital tool designed to help both employees and employers calculate gross and net salaries based on California’s specific tax laws and regulations. It takes into account federal and state taxes, Social Security, Medicare, and any additional deductions specific to California.

Here’s the cool part: the calculator doesn’t just spit out numbers. It breaks down each component of your paycheck so you know exactly where your money is going. This level of transparency is a game-changer, especially for those trying to budget effectively.

Another great feature? It’s user-friendly. No need to be a tax expert to use it. Just enter your salary details, select your location, and let the calculator do the heavy lifting. Plus, it’s regularly updated to reflect the latest changes in tax laws, ensuring you always have the most accurate information.

Why Use ADP Salary Calculator California?

So, why should you bother using the ADP Salary Calculator California over other options? Well, there are several compelling reasons. First and foremost, accuracy. This tool is powered by ADP, a global leader in payroll and HR solutions. That means you can trust the results you get.

Then there’s convenience. With just a few clicks, you can get a detailed breakdown of your salary. No more manually calculating deductions or worrying about missing out on important details. The calculator does all the hard work for you.

Lastly, it’s a great learning tool. By seeing how different factors affect your net pay, you gain a better understanding of California’s tax system. This knowledge empowers you to make smarter financial decisions and plan for the future.

Read also:Ambika Mod Husband The Story Yoursquove Been Waiting For

How Does the Calculator Work?

Alright, let’s talk about the nitty-gritty. How exactly does the ADP Salary Calculator California work? It’s pretty straightforward, actually. You start by entering your gross salary. Then, you input details about your tax withholdings, including federal and state taxes. Don’t forget to include any additional deductions like health insurance or retirement contributions.

Once you’ve entered all the necessary information, the calculator does its magic. It applies the relevant tax rates and deductions to give you an accurate net pay figure. And that’s not all. You also get a detailed report showing how each deduction impacts your paycheck.

Here’s a quick rundown of the steps:

- Enter your gross salary

- Input your tax withholdings

- Add any additional deductions

- Let the calculator do the calculations

- Review your detailed report

Key Features of ADP Salary Calculator California

Now that you know how it works, let’s talk about some of the key features that make the ADP Salary Calculator California stand out. For starters, it’s highly customizable. You can adjust the inputs to reflect your unique situation, whether you’re a full-time employee, part-time worker, or even a freelancer.

Another standout feature is its ability to handle multiple scenarios. Want to see how a raise or bonus will affect your net pay? No problem. Just tweak the inputs, and the calculator will update the results instantly. This makes it a great tool for planning and forecasting.

And let’s not forget about its reporting capabilities. The calculator generates detailed reports that you can save or print for future reference. These reports are a great way to keep track of your financial progress over time.

Breaking Down the Numbers

One of the best things about the ADP Salary Calculator California is how it breaks down the numbers. It doesn’t just give you a final net pay figure; it shows you exactly how that number was calculated. This includes:

- Federal income tax

- State income tax

- Social Security tax

- Medicare tax

- Additional deductions

Having this level of detail is incredibly helpful, especially if you’re trying to understand how changes in tax laws or deductions will impact your paycheck.

Tax Considerations in California

Speaking of tax laws, let’s talk about some of the key considerations when using the ADP Salary Calculator California. California has one of the highest state income tax rates in the country, so it’s important to factor that into your calculations. The state also has its own version of the federal FICA tax, which includes Social Security and Medicare.

Additionally, California offers several tax credits that can reduce your overall tax burden. These include the California Earned Income Tax Credit (EITC) and the Child Tax Credit. The ADP Salary Calculator California takes all of these factors into account, ensuring you get the most accurate results possible.

Understanding Withholding

Withholding is another important aspect to consider. When you use the calculator, you’ll need to input your withholding allowances. These determine how much tax is deducted from your paycheck. The more allowances you claim, the less tax is withheld. However, claiming too many allowances can result in owing taxes at the end of the year, so it’s important to get it right.

Benefits of Using ADP Salary Calculator California

There are numerous benefits to using the ADP Salary Calculator California. For one, it saves you time and effort. Instead of manually calculating your taxes and deductions, you can get accurate results in just a few minutes. This frees up more time for other important tasks.

Another benefit is increased accuracy. Manual calculations are prone to errors, but the ADP Salary Calculator California eliminates that risk. You can trust that the numbers you get are correct and up-to-date.

Lastly, it promotes financial literacy. By seeing how different factors affect your net pay, you gain a deeper understanding of California’s tax system. This knowledge empowers you to make better financial decisions and plan for the future.

Common Misconceptions About Salary Calculators

There are a few common misconceptions about salary calculators that we should address. One of the biggest is that they’re only useful for employees. Not true! Employers can also benefit from using these tools to ensure they’re accurately calculating payroll for their staff.

Another misconception is that all salary calculators are created equal. This couldn’t be further from the truth. Some calculators are more accurate and user-friendly than others. The ADP Salary Calculator California stands out because of its accuracy, customization options, and detailed reporting.

Lastly, some people think that salary calculators are only useful for calculating gross-to-net pay. While that’s certainly a key feature, they can also help with planning and forecasting. By seeing how different scenarios impact your net pay, you can make more informed decisions about your finances.

Real-Life Examples of Using ADP Salary Calculator California

Let’s look at a couple of real-life examples to see how the ADP Salary Calculator California can be used in practice. First, consider a full-time employee earning $60,000 per year. By entering this information into the calculator, they can see exactly how much of their salary will be taken out for taxes and deductions. They can also experiment with different withholding allowances to find the optimal balance.

Now, let’s say you’re an employer trying to calculate payroll for a new hire. The ADP Salary Calculator California can help you ensure that you’re accurately calculating their gross and net pay. This is especially important in California, where tax laws can be complex and constantly changing.

Case Study: Jane Doe

Take Jane Doe, for example. She’s a part-time worker in California who wants to understand how her new job will impact her finances. By using the ADP Salary Calculator California, she can see exactly how much she’ll take home after taxes and deductions. This information helps her budget effectively and plan for the future.

Tips for Maximizing Your Use of ADP Salary Calculator California

Ready to get the most out of the ADP Salary Calculator California? Here are a few tips to help you maximize its potential:

- Double-check your inputs to ensure accuracy

- Experiment with different scenarios to see how they affect your net pay

- Use the detailed reports to track your financial progress over time

- Stay up-to-date with changes in tax laws and regulations

By following these tips, you can make the most out of this powerful tool and take control of your finances.

Conclusion: Take Control of Your Finances

Calculating your salary in California doesn’t have to be a daunting task. With the ADP Salary Calculator California, you have a powerful tool at your disposal to help you navigate the complexities of payroll and taxes. Whether you’re an employee or employer, this calculator simplifies the process and gives you the information you need to make informed financial decisions.

So, what are you waiting for? Start using the ADP Salary Calculator California today and take control of your finances. And don’t forget to share this article with your friends and colleagues. The more people who understand how to use this tool, the better off we all are.

Table of Contents

- Mastering ADP Salary Calculator California: Your Ultimate Guide

- Understanding ADP Salary Calculator California

- Why Use ADP Salary Calculator California?

- How Does the Calculator Work?

- Key Features of ADP Salary Calculator California

- Breaking Down the Numbers

- Tax Considerations in California

- Understanding Withholding

- Benefits of Using ADP Salary Calculator California

- Common Misconceptions About Salary Calculators