Emerald cards have become a game-changer in the world of personal finance. If you're looking for a powerful tool to manage your money, earn rewards, and enjoy exclusive benefits, then you're in the right place. In this article, we'll dive deep into everything you need to know about emerald cards, from their features and perks to how they can help you achieve financial freedom. So, buckle up and let's explore the world of emerald cards together!

Let's face it, life gets complicated when you're juggling multiple credit cards, loans, and expenses. That's where an emerald card steps in to save the day. It's like having a personal financial assistant in your pocket, ready to help you navigate through the chaos of modern-day spending. But what exactly makes these cards so special? Stick around, and we'll break it down for you.

From cashback rewards to travel perks, emerald cards offer a wide range of benefits that cater to almost every lifestyle. Whether you're a frequent traveler, a savvy shopper, or someone who just wants to make the most out of their daily purchases, there's something for everyone. So, without further ado, let's get started and uncover the secrets of the emerald card world!

Read also:Michaela Conlin Husband The Inside Scoop Yoursquove Been Waiting For

What Exactly is an Emerald Card?

An emerald card is more than just a piece of plastic in your wallet. It's a premium financial product designed to elevate your spending experience. Think of it as a VIP pass to exclusive discounts, cashback offers, and travel benefits. But that's not all; these cards also come with features like zero foreign transaction fees, fraud protection, and 24/7 customer support.

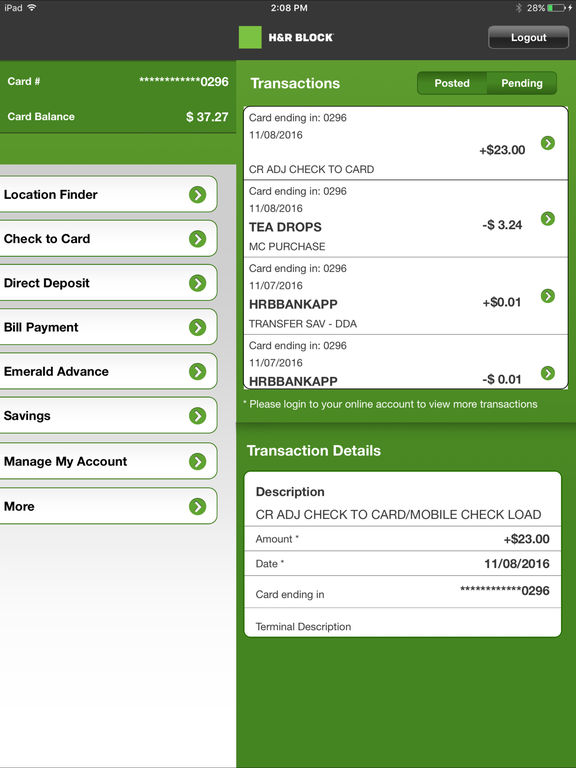

For many people, the appeal of an emerald card lies in its versatility. You can use it for everything from grocery shopping to booking flights, and still earn points or miles along the way. Plus, with advancements in technology, most emerald cards now offer mobile banking apps that let you track your spending in real-time. It's like having complete control over your finances at your fingertips.

Another cool thing about emerald cards? They often come with introductory offers, such as waived annual fees or bonus points for new users. This means you can start enjoying the perks right from day one without breaking the bank. So, whether you're a first-time cardholder or a seasoned pro, there's always something new to discover with an emerald card.

Why Should You Choose an Emerald Card?

Now that we know what an emerald card is, let's talk about why you should consider getting one. First off, these cards are designed to reward your spending habits. Unlike traditional credit cards that charge high interest rates, emerald cards focus on giving back to their users. Here are some of the top reasons why you should choose an emerald card:

- No Annual Fees: Many emerald cards offer zero annual fees, making them a cost-effective choice for everyday use.

- High Reward Rates: Earn up to 5% cashback on select categories like groceries, gas, and dining.

- Travel Perks: Get access to airport lounges, free checked baggage, and travel credits.

- Security Features: Enjoy peace of mind with fraud protection, purchase protection, and identity theft alerts.

But wait, there's more! Emerald cards also come with additional benefits like extended warranty coverage, price protection, and rental car insurance. These perks add up over time, saving you money and hassle in the long run. Plus, with the convenience of mobile banking, you can manage your account anytime, anywhere.

Key Features of an Emerald Card

1. Reward Programs

Reward programs are one of the biggest draws of an emerald card. Whether you're into cashback, points, or miles, there's a program that suits your needs. For example, some cards offer unlimited cashback on all purchases, while others let you redeem points for travel or merchandise. The choice is yours!

Read also:Prison Break Bellick The Story Of A Ruthless Warden And His Pursuit Of Justice

It's important to note that reward rates can vary depending on the card. Some cards offer higher rewards on specific categories, such as groceries or gas, while others provide a flat rate across all purchases. Be sure to read the fine print and choose a card that aligns with your spending habits.

2. Zero Foreign Transaction Fees

If you're a globetrotter, then you'll love the fact that most emerald cards come with zero foreign transaction fees. This means you can use your card anywhere in the world without worrying about extra charges. No more hidden fees or unexpected surprises when you travel abroad.

In addition to eliminating foreign transaction fees, many emerald cards also offer dynamic currency conversion (DCC) protection. This ensures that you always get the best exchange rate when making purchases in foreign currencies.

3. Security and Protection

Security is a top priority for emerald card issuers. That's why these cards come equipped with advanced fraud detection systems, purchase protection, and identity theft alerts. You can rest assured knowing that your information is safe and secure.

Many emerald cards also offer additional protections like extended warranty coverage, price protection, and return protection. These features can save you money and hassle if something goes wrong with your purchase. Plus, with 24/7 customer support, you can always reach out for assistance if needed.

4. Travel Benefits

Let's talk about travel benefits, shall we? Emerald cards are a dream come true for frequent travelers. From airport lounge access to travel credits, these cards offer a wide range of perks that make traveling a breeze. Here are some of the top travel benefits you can expect:

- Airport lounge access

- Free checked baggage

- Travel credits

- Hotel discounts

- Rental car insurance

These benefits not only enhance your travel experience but also save you money in the long run. Who wouldn't want to enjoy a stress-free trip with all the extras covered?

How to Choose the Right Emerald Card for You

With so many emerald cards on the market, choosing the right one can be overwhelming. But don't worry, we've got you covered. Here are some tips to help you find the perfect card for your needs:

- Assess Your Spending Habits: Determine where you spend the most money and choose a card that rewards those categories.

- Consider the Annual Fee: While some cards charge an annual fee, others waive it for the first year or offer enough rewards to offset the cost.

- Look for Introductory Offers: Take advantage of sign-up bonuses, waived fees, and other introductory offers to maximize your benefits.

- Check for Travel Perks: If you're a frequent traveler, look for cards that offer airport lounge access, travel credits, and other travel-related benefits.

Remember, the best card for you is the one that aligns with your lifestyle and financial goals. Take your time to research and compare different options before making a decision.

Emerald Card vs. Traditional Credit Cards

So, how does an emerald card stack up against traditional credit cards? Let's break it down:

First off, emerald cards typically offer better rewards and benefits than traditional credit cards. They're designed to reward your spending habits and provide value beyond just credit. Plus, many emerald cards come with zero annual fees, making them a more cost-effective choice for everyday use.

Another advantage of emerald cards is their focus on security and protection. With advanced fraud detection systems and additional protections like extended warranty coverage, price protection, and return protection, you can feel confident knowing that your information is safe and secure.

Lastly, emerald cards often offer more travel benefits than traditional credit cards. From airport lounge access to travel credits, these cards cater specifically to frequent travelers. So, if you're someone who loves to explore the world, an emerald card might be the perfect companion for your adventures.

Common Misconceptions About Emerald Cards

There are a few misconceptions about emerald cards that we need to address. First off, some people think that emerald cards are only for wealthy individuals. This couldn't be further from the truth! While these cards do offer premium benefits, they're accessible to anyone who meets the credit requirements.

Another misconception is that emerald cards are too complicated to use. In reality, most emerald cards are designed to be user-friendly, with mobile banking apps and online portals that make managing your account a breeze. Plus, with 24/7 customer support, you can always reach out for assistance if needed.

Finally, some people worry about the potential for overspending with an emerald card. While it's true that credit cards can lead to debt if not used responsibly, the key is to set a budget and stick to it. By doing so, you can enjoy all the benefits of an emerald card without falling into financial trouble.

How to Maximize Your Emerald Card Benefits

Now that you know all about emerald cards, let's talk about how to make the most of your benefits. Here are a few tips to help you maximize your rewards:

- Use Your Card for Everyday Purchases: The more you use your card, the more rewards you'll earn. Just be sure to pay off your balance in full each month to avoid interest charges.

- Take Advantage of Introductory Offers: Sign up for new cards during promotional periods to earn bonus points or cashback.

- Track Your Spending: Use the mobile app or online portal to monitor your spending and ensure you're maximizing your rewards.

- Redeem Your Rewards Wisely: Whether you choose cashback, points, or miles, make sure you're redeeming your rewards in a way that provides the most value.

By following these tips, you can make the most of your emerald card and enjoy all the benefits it has to offer. Remember, the key is to use your card responsibly and strategically to maximize your rewards.

Emerald Card Statistics and Trends

Let's take a look at some interesting statistics and trends in the world of emerald cards:

- According to a recent survey, 75% of emerald card users report earning more rewards than with traditional credit cards.

- Over 60% of emerald cardholders use their cards for travel-related expenses, taking full advantage of the travel benefits.

- The global credit card market is expected to reach $1.7 trillion by 2025, with premium cards like emerald cards driving much of the growth.

These numbers show that emerald cards are not only popular but also here to stay. As more people discover the benefits of these cards, we can expect to see even more innovation and competition in the market.

Conclusion

In conclusion, emerald cards offer a wide range of benefits that cater to almost every lifestyle. From cashback rewards to travel perks, these cards provide value beyond just credit. By choosing the right card and using it responsibly, you can enjoy all the benefits without falling into financial trouble.

So, what are you waiting for? Start exploring the world of emerald cards today and take your financial game to the next level. And don't forget to share this article with your friends and family so they can benefit from the knowledge too. Together, let's make smart financial decisions and achieve financial freedom!

Table of Contents

- What Exactly is an Emerald Card?

- Why Should You Choose an Emerald Card?

- Key Features of an Emerald Card

- How to Choose the Right Emerald Card for You

- Emerald Card vs. Traditional Credit Cards

- Common Misconceptions About Emerald Cards

- How to Maximize Your Emerald Card Benefits

- Emerald Card Statistics and Trends

- Conclusion