Have you ever wondered how to log in to your BlackRock 529 account or what makes these plans so essential for your child's education? Well, buckle up because we’re diving deep into the world of BlackRock 529 plans, and by the end of this article, you’ll be a pro at navigating the platform like a champ.

Imagine this—you’ve been saving for your kid’s college education, putting aside every penny possible. But now, you need to access your BlackRock 529 account to check on your progress or make some adjustments. Sounds simple enough, right? Not so fast! Logging in can sometimes feel like solving a puzzle if you’re not familiar with the process. That’s where we come in. We’ll break it all down for you step by step so you can focus on what matters most—your child’s future.

BlackRock 529 plans are designed to help families save for higher education costs in a tax-advantaged way. With features like automatic contributions, investment options, and easy account management, these plans are more than just a savings tool—they’re a lifeline for parents who want to give their kids the best start possible. So, let’s get started and make sure you’re using your BlackRock 529 account to its full potential.

Read also:Michaela Conlin Husband The Inside Scoop Yoursquove Been Waiting For

What is BlackRock 529 Login All About?

Understanding the Basics of BlackRock 529

First things first, let’s talk about what exactly BlackRock 529 login means and why it’s important. When you set up a BlackRock 529 plan, you’re essentially creating an account that allows you to save money for educational expenses. Logging in to your account gives you access to all the tools and features you need to manage your savings effectively. It’s like having a personal finance dashboard tailored specifically for your child’s education.

Here’s the deal—BlackRock is one of the largest and most trusted financial institutions in the world. They offer a variety of investment products, including 529 plans, which are specifically designed to help families save for college. By logging into your BlackRock 529 account, you can monitor your investments, make contributions, and even change your investment strategy if needed. It’s all about giving you control over your financial future.

Why Should You Care About BlackRock 529 Plans?

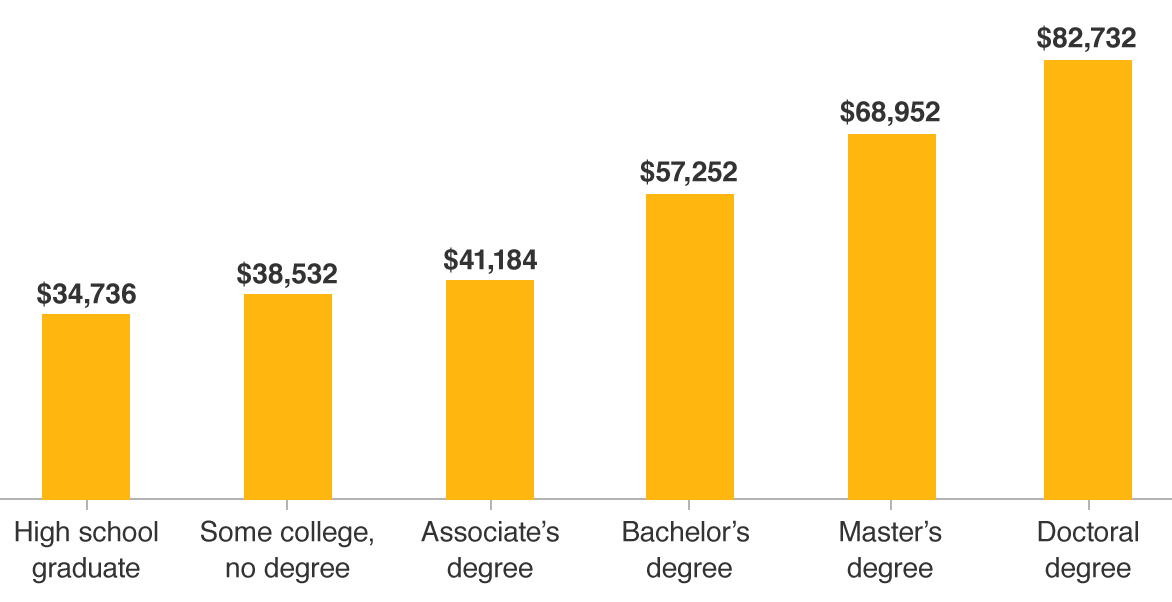

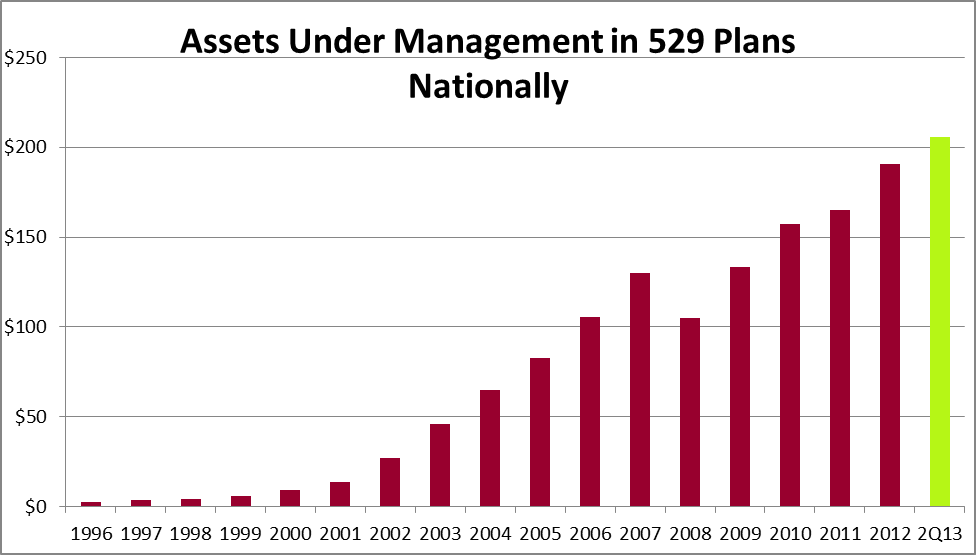

Let’s face it—college tuition isn’t getting any cheaper. In fact, the cost of higher education has been rising faster than inflation for years. That’s where BlackRock 529 plans come in. These plans offer a tax-advantaged way to save for college, which means your money can grow faster and with fewer taxes eating into your savings. Plus, many states offer additional tax benefits for contributing to a 529 plan, making it an even more attractive option.

But it’s not just about saving money—it’s about saving smart. BlackRock 529 plans give you access to a wide range of investment options, from conservative to aggressive, depending on your risk tolerance. And with tools like automatic contributions and age-based investment strategies, you can tailor your plan to fit your family’s needs and goals. It’s like having a personalized roadmap to financial success for your child’s education.

How to Access Your BlackRock 529 Account

Step-by-Step Guide to BlackRock 529 Login

Alright, so you’ve decided to log in to your BlackRock 529 account. Great choice! But where do you start? Don’t worry—we’ve got you covered with a step-by-step guide to make the process as smooth as possible.

- Head over to the official BlackRock website and click on the “Log In” button.

- Enter your username and password. If you don’t have an account yet, you’ll need to create one first.

- Once you’re logged in, you’ll be taken to your dashboard, where you can view your account balance, contribution history, and investment performance.

- From there, you can make contributions, update your investment strategy, or even transfer funds between accounts.

See? It’s not as complicated as it seems. With a few clicks, you’ll be able to access all the features and tools you need to manage your BlackRock 529 account effectively. And if you ever run into any issues, BlackRock’s customer support team is just a phone call away.

Read also:Unveiling Abby Booms Real Name The Ultimate Guide Youve Been Waiting For

Common Issues with BlackRock 529 Login

Of course, no process is perfect, and sometimes things can go wrong. Here are a few common issues you might encounter when trying to log in to your BlackRock 529 account and how to fix them:

- Forgot Password: If you can’t remember your password, don’t panic! Simply click on the “Forgot Password” link and follow the instructions to reset it.

- Account Lockout: If you’ve entered your password too many times incorrectly, your account may be temporarily locked. In this case, you’ll need to contact BlackRock’s customer support team to unlock it.

- Technical Issues: Sometimes, the website or app may experience technical difficulties. If this happens, try logging in at a different time or using a different device.

Remember, these issues are relatively rare, and BlackRock is always working to improve their platform and make it as user-friendly as possible. So, if you ever run into any problems, don’t hesitate to reach out for help.

The Benefits of Using BlackRock 529 Plans

Tax Advantages of BlackRock 529 Plans

One of the biggest advantages of using BlackRock 529 plans is the tax benefits. Contributions to these plans grow tax-free, and withdrawals are also tax-free as long as they’re used for qualified educational expenses. This means your money can grow faster without being eaten up by taxes. It’s like having a supercharged savings account specifically for college.

But that’s not all—many states offer additional tax incentives for contributing to a 529 plan. For example, some states allow you to deduct your contributions from your state income taxes, which can save you even more money. And since BlackRock partners with multiple states to offer their 529 plans, you may be eligible for these benefits no matter where you live.

Investment Options and Flexibility

Another great feature of BlackRock 529 plans is the wide range of investment options available. Whether you’re a conservative investor who prefers low-risk options or an aggressive investor who’s willing to take on more risk for potentially higher returns, BlackRock has something for everyone. You can choose from a variety of mutual funds, ETFs, and other investment vehicles to build a portfolio that fits your needs and goals.

Plus, BlackRock offers tools like age-based investment strategies, which automatically adjust your portfolio as your child gets closer to college age. This means you can start with a more aggressive strategy when your child is young and gradually shift to a more conservative approach as they get older. It’s all about giving you the flexibility to manage your investments the way you want.

Managing Your BlackRock 529 Account

Setting Up Automatic Contributions

One of the easiest ways to make sure you’re saving consistently for your child’s education is by setting up automatic contributions to your BlackRock 529 account. This way, you can schedule regular contributions from your bank account without even thinking about it. It’s like setting it and forgetting it—except in this case, you’re setting it and watching your savings grow.

Here’s how to set up automatic contributions:

- Log in to your BlackRock 529 account.

- Go to the “Contributions” section and select “Set Up Automatic Contributions.”

- Enter the amount and frequency of your contributions (e.g., monthly, quarterly).

- Link your bank account and confirm the details.

By automating your contributions, you can ensure that you’re consistently adding to your savings without the hassle of remembering to do it manually. And the best part? You can always adjust or pause your contributions if your financial situation changes.

Monitoring Your Investment Performance

Once you’ve set up your BlackRock 529 account, it’s important to keep an eye on your investment performance. After all, you want to make sure your money is growing as expected and that your investment strategy is still aligned with your goals. Thankfully, BlackRock makes it easy to monitor your account with their user-friendly dashboard.

Here’s what you can do:

- Check your account balance regularly to see how much you’ve saved so far.

- Review your contribution history to ensure everything is on track.

- Track your investment performance to see how your portfolio is doing.

- Adjust your investment strategy if needed to stay on course.

Remember, investing is a long-term game, and it’s normal for your portfolio to experience ups and downs. But by keeping an eye on your investments, you can make informed decisions and adjust your strategy as needed to stay on track for your child’s education.

Additional Features of BlackRock 529 Plans

Account Transfers and Beneficiary Changes

Sometimes, life throws you a curveball, and you may need to make changes to your BlackRock 529 account. Whether it’s transferring funds between accounts or changing the beneficiary, BlackRock makes it easy to do so. Here’s what you need to know:

- Account Transfers: If you have multiple BlackRock 529 accounts, you can transfer funds between them to consolidate your savings or adjust your investment strategy.

- Beneficiary Changes: If your child decides not to go to college or receives a scholarship, you can change the beneficiary to another family member without penalty.

These features give you the flexibility to adapt to changing circumstances and make the most of your savings. And since BlackRock handles all the paperwork for you, it’s a stress-free process.

Withdrawals and Qualified Expenses

When the time comes to use your BlackRock 529 savings, you’ll want to make sure you’re following the rules for qualified expenses. Qualified expenses include things like tuition, room and board, books, and other education-related costs. By sticking to these guidelines, you can ensure that your withdrawals are tax-free and penalty-free.

Here’s how to make a withdrawal:

- Log in to your BlackRock 529 account.

- Go to the “Withdrawals” section and select “Request Withdrawal.”

- Enter the amount you want to withdraw and specify the qualified expense it’s for.

- Confirm the details and submit your request.

It’s that simple! And if you ever have questions about what qualifies as a qualified expense, BlackRock’s customer support team is always available to help.

Conclusion: Take Control of Your Child's Education Savings

So there you have it—everything you need to know about BlackRock 529 login and how to make the most of your account. By understanding the benefits of these plans, setting up automatic contributions, and monitoring your investment performance, you can ensure that you’re on track for your child’s education. And with features like account transfers and beneficiary changes, you have the flexibility to adapt to changing circumstances and make the most of your savings.

Now it’s your turn—take action and start managing your BlackRock 529 account today. Whether you’re just getting started or looking to make some adjustments, the tools and resources are all there to help you succeed. So what are you waiting for? Log in, take control, and give your child the gift of a bright future.

And don’t forget to share this article with your friends and family who may be interested in learning more about BlackRock 529 plans. Together, we can help more families save for college and achieve their financial goals. Cheers to a brighter future!

Table of Contents