Ever heard of the Luzerne County Tax Claim Bureau? If you're a homeowner in Pennsylvania, this is one stop you need to know about. Property taxes can be tricky, but understanding how the Luzerne County Tax Claim Bureau works can save you from headaches—and maybe even some cash. This guide will break it all down for you, step by step, so you're not left scratching your head.

Property taxes are one of those necessary evils we all have to deal with, but they don’t have to be confusing. Whether you’re a first-time homeowner or a seasoned property owner, the Luzerne County Tax Claim Bureau plays a significant role in managing property tax claims. In this article, we’ll dive deep into what this bureau does, why it matters, and how it impacts you.

Don’t worry, we won’t overload you with jargon or complicated legal terms. We’re here to make things simple, clear, and actionable. By the time you finish reading, you’ll be clued in on everything you need to know about Luzerne County Tax Claim Bureau. Let’s get started!

Read also:Prison Break Bellick The Story Of A Ruthless Warden And His Pursuit Of Justice

Understanding Luzerne County Tax Claim Bureau

First things first, let’s break down what exactly the Luzerne County Tax Claim Bureau is all about. This bureau is essentially the go-to department for handling property tax claims in Luzerne County, Pennsylvania. Think of it as the middleman between property owners and the county government when it comes to tax matters. They handle everything from delinquent tax claims to auctions, ensuring that property taxes are properly collected and managed.

What Does the Bureau Do?

Here’s a quick rundown of the main responsibilities of the Luzerne County Tax Claim Bureau:

- Managing delinquent property tax accounts.

- Organizing annual tax auctions for properties with unpaid taxes.

- Providing resources and information to property owners.

- Facilitating communication between property owners and the county government.

Their goal is to ensure that property taxes are paid on time and that properties don’t fall into foreclosure due to unpaid taxes. It’s a pretty crucial role, especially for homeowners who might be struggling to keep up with their tax obligations.

Why Should You Care About Luzerne County Tax Claim Bureau?

If you own property in Luzerne County, the tax claim bureau directly impacts you. Whether you’re paying your taxes on time or dealing with delinquent accounts, this bureau plays a key role in maintaining the financial health of the county. Ignoring your tax obligations can lead to serious consequences, including losing your property.

Key Reasons to Pay Attention

Here are a few reasons why the Luzerne County Tax Claim Bureau should be on your radar:

- Preventing Foreclosure: If you fall behind on your property taxes, the bureau may initiate foreclosure proceedings. Staying informed can help you avoid this nightmare scenario.

- Opportunities for Investors: For those looking to invest in real estate, the annual tax auctions hosted by the bureau can be a goldmine for finding great deals on properties.

- Resource for Homeowners: The bureau offers valuable resources and support for property owners who need assistance with their tax payments.

So, whether you’re a homeowner or an investor, the Luzerne County Tax Claim Bureau is worth paying attention to.

Read also:Michaela Conlin Husband The Inside Scoop Yoursquove Been Waiting For

How Property Taxes Work in Luzerne County

Before we dive deeper into the specifics of the Luzerne County Tax Claim Bureau, let’s take a moment to understand how property taxes work in the county. Property taxes are calculated based on the assessed value of your property and the local tax rate. The funds collected from these taxes are used to fund essential services like schools, public safety, and infrastructure.

Factors That Affect Your Property Tax Bill

Several factors influence how much you’ll pay in property taxes:

- Assessed Value: This is the value of your property as determined by the county assessor.

- Tax Rate: The millage rate, or tax rate, varies depending on the municipality and school district where your property is located.

- Exemptions: Some property owners may qualify for tax exemptions or reductions, such as senior citizens or disabled veterans.

Understanding these factors can help you better manage your property tax payments and avoid any surprises.

Dealing with Delinquent Property Taxes

Life happens, and sometimes people fall behind on their property tax payments. If you find yourself in this situation, it’s important to know how the Luzerne County Tax Claim Bureau handles delinquent accounts. The bureau offers several options to help property owners get back on track.

Options for Property Owners

Here’s what you can do if you’re struggling to pay your property taxes:

- Payment Plans: The bureau may allow you to set up a payment plan to catch up on your overdue taxes.

- Tax Amnesty Programs: Occasionally, the county offers amnesty programs that waive penalties and interest for delinquent accounts.

- Property Tax Appeals: If you believe your property has been over-assessed, you can file an appeal to reduce your tax bill.

It’s always better to address the issue head-on rather than ignoring it. The Luzerne County Tax Claim Bureau is there to help, so don’t hesitate to reach out if you’re having trouble.

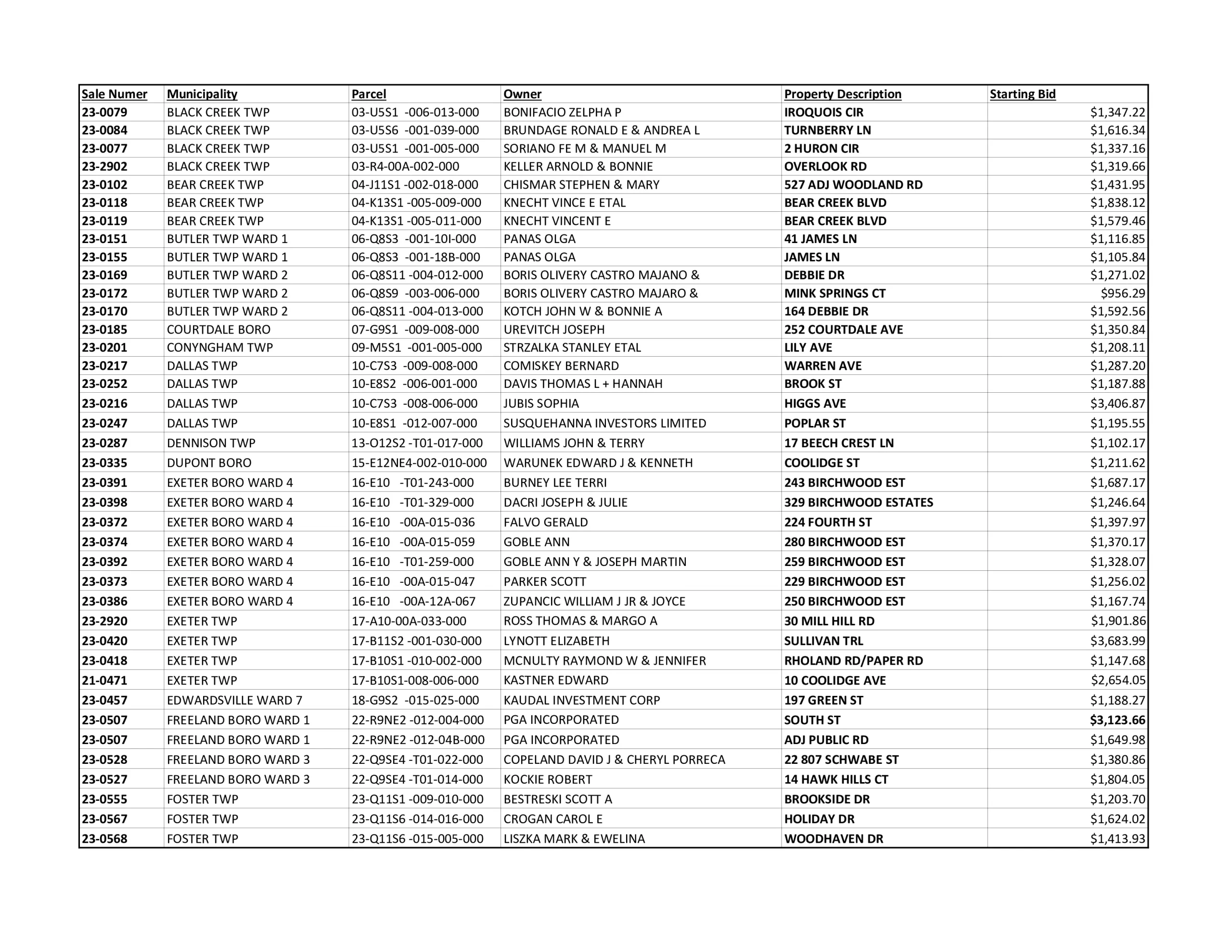

The Annual Tax Auction

One of the most exciting events hosted by the Luzerne County Tax Claim Bureau is the annual tax auction. This event gives investors and buyers the chance to purchase properties that have been foreclosed due to unpaid taxes. It’s a great opportunity for those looking to expand their real estate portfolio or find a bargain on a new home.

How the Auction Works

Here’s a brief overview of how the tax auction operates:

- Property Listings: The bureau releases a list of properties available for auction, complete with details like location, assessed value, and outstanding tax amounts.

- Bidding Process: Bidders compete to purchase the properties, with the highest bidder winning the auction.

- Redemption Period: After the auction, the original property owner has a redemption period during which they can pay off their taxes and reclaim their property.

Participating in the tax auction requires some research and preparation, but it can be a lucrative venture for those who know what they’re doing.

Resources for Property Owners

The Luzerne County Tax Claim Bureau offers a wealth of resources to help property owners navigate the complexities of property taxes. From online tools to in-person assistance, there are plenty of ways to get the support you need.

Where to Find Help

Here are some of the resources available through the bureau:

- Online Portal: The bureau’s website provides access to tax records, payment options, and important updates.

- Customer Service: You can reach out to the bureau’s customer service team for personalized assistance with your tax questions.

- Workshops and Seminars: The bureau occasionally hosts educational events to help property owners stay informed about tax laws and procedures.

Taking advantage of these resources can make managing your property taxes a lot easier.

Common Questions About Luzerne County Tax Claim Bureau

We’ve gathered some of the most frequently asked questions about the Luzerne County Tax Claim Bureau to help you better understand their role and responsibilities.

FAQs

Q: What happens if I don’t pay my property taxes?

If you fail to pay your property taxes, the Luzerne County Tax Claim Bureau may place a lien on your property. If the taxes remain unpaid, the property could be sold at a tax auction.

Q: Can I appeal my property tax assessment?

Yes, you can file an appeal if you believe your property has been over-assessed. The Luzerne County Tax Claim Bureau can provide guidance on the appeal process.

Q: How often does the tax auction take place?

The tax auction is held annually, usually in the spring. Be sure to check the Luzerne County Tax Claim Bureau’s website for exact dates and details.

Understanding Property Tax Exemptions

For some property owners, tax exemptions can provide much-needed relief. The Luzerne County Tax Claim Bureau administers several exemption programs designed to help specific groups of individuals.

Types of Exemptions

Here are some of the most common exemptions:

- Homestead Exemption: Reduces the taxable value of your primary residence.

- Senior Citizen Exemption: Offers tax relief to homeowners over a certain age.

- Disabled Veterans Exemption: Provides tax breaks for disabled veterans and their families.

If you think you might qualify for an exemption, contact the Luzerne County Tax Claim Bureau to learn more about the application process.

Staying Informed About Property Taxes

The world of property taxes can be overwhelming, but staying informed is the key to avoiding trouble. The Luzerne County Tax Claim Bureau provides regular updates and notifications to keep property owners in the loop.

Ways to Stay Updated

Here are a few tips for staying informed:

- Subscribe to Email Alerts: Sign up for the bureau’s email newsletter to receive important updates directly in your inbox.

- Follow Social Media: The bureau maintains active social media accounts where they share news and announcements.

- Check the Website Regularly: The Luzerne County Tax Claim Bureau’s website is a treasure trove of information, so make it a habit to visit often.

By staying informed, you can avoid surprises and make better decisions when it comes to your property taxes.

Kesimpulan

And there you have it—everything you need to know about the Luzerne County Tax Claim Bureau. Whether you’re a homeowner trying to stay on top of your property taxes or an investor looking to capitalize on tax auctions, this bureau plays a vital role in the world of real estate. Remember, knowledge is power, so don’t hesitate to reach out to the bureau if you have questions or need assistance.

Before you go, here’s a quick recap of the key points we covered:

- The Luzerne County Tax Claim Bureau manages property tax claims and auctions in the county.

- Delinquent property taxes can lead to foreclosure, but the bureau offers options for catching up on payments.

- The annual tax auction is a great opportunity for investors and buyers to find properties at a discount.

- Resources like payment plans, tax exemptions, and educational workshops can help property owners manage their tax obligations.

Now that you’re armed with this information, it’s time to take action. If you found this article helpful, don’t forget to share it with others who might benefit from it. And if you have any questions or comments, feel free to drop them below. Let’s keep the conversation going!

Daftar Isi

- Understanding Luzerne County Tax Claim Bureau

- Why Should You Care About Luzerne County Tax Claim Bureau?

- How Property Taxes Work in Luzerne County

- Dealing with Delinquent Property Taxes

- The Annual Tax Auction

- Resources for Property Owners

- Common Questions About Luzerne County Tax Claim Bureau

- Understanding Property Tax Exemptions

- Staying Informed About Property Taxes

- Kesimpulan