Alright folks, let me tell you something straight up. Taxes are not exactly the most exciting topic in the world, but hey, they're a necessary evil. And guess what? There's a game-changer out there that can make this whole process a whole lot easier. The H&R Block Calculator is like your personal finance wizard, simplifying numbers, deductions, and credits in ways you never thought possible. So buckle up, because we're diving deep into the world of tax preparation and uncovering how this tool can save you both time and money.

Now, let's get real for a second. Tax season can be overwhelming, especially if you're juggling multiple sources of income, deductions, or credits. But what if I told you there's a solution that takes all the guesswork out of your tax prep? Enter the H&R Block Calculator. This isn't just another number-crunching app—it's a powerful tool designed to help you navigate the complexities of tax filing with ease and confidence. Whether you're a first-time filer or a seasoned pro, this calculator has got your back.

And here's the kicker: the H&R Block Calculator doesn't just spit out random numbers. It's backed by decades of expertise, offering accurate estimates and insights tailored to your specific financial situation. So if you're ready to take control of your taxes and discover hidden savings opportunities, stick around. We're about to break it all down for you step by step.

Read also:Larry Holmes The Boxing Legend Who Left An Indelible Mark On The Ring

What is the H&R Block Calculator?

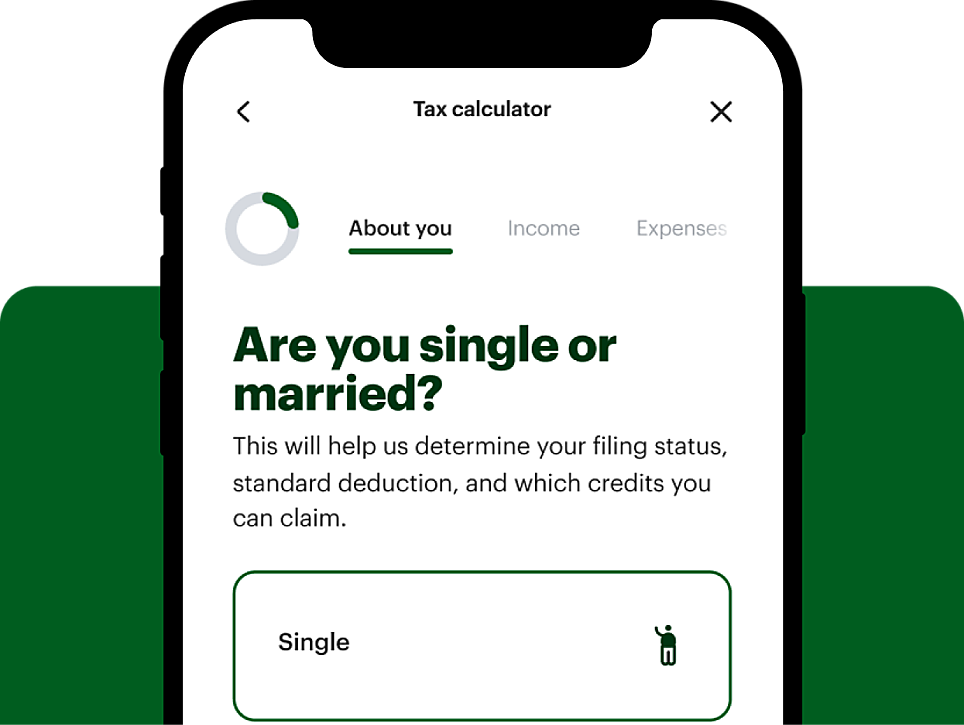

So, what exactly is this H&R Block Calculator everyone's talking about? Simply put, it's an online tool designed to help taxpayers estimate their tax returns before they even file. Think of it as a sneak peek into your financial future, allowing you to plan ahead and make informed decisions. This calculator uses a combination of your income, deductions, and credits to generate an estimated refund or tax liability, giving you a clear picture of where you stand.

But wait, there's more. The H&R Block Calculator isn't just a one-size-fits-all solution. It's customizable, meaning you can input your specific details and get results that are as unique as your financial situation. Whether you're self-employed, a student, or a full-time employee, this tool adapts to your needs and provides personalized insights.

How Does the H&R Block Calculator Work?

Alright, so you're probably wondering how this magical calculator works. Well, it's pretty straightforward. First, you'll need to gather some basic financial information, like your annual income, any deductions you're eligible for, and any credits you might qualify for. Once you have that, you simply input the data into the calculator, and voila! Within seconds, you'll have an estimate of your potential tax refund or liability.

- Gather your financial documents: W-2s, 1099s, receipts, etc.

- Input your income details: salary, bonuses, freelance earnings, etc.

- Enter your deductions: mortgage interest, student loan interest, charitable contributions, etc.

- Include any tax credits: child tax credit, earned income credit, education credits, etc.

- Review your results: the calculator will provide an estimated refund or tax owed.

And here's the best part: the H&R Block Calculator does all the heavy lifting for you. No need to worry about complex formulas or tax laws—this tool handles it all behind the scenes.

Why Use the H&R Block Calculator?

Now that you know what the H&R Block Calculator is and how it works, let's talk about why you should use it. First and foremost, it saves you time. Instead of spending hours poring over tax forms and crunching numbers, you can get an accurate estimate in a matter of minutes. Plus, it helps you avoid costly mistakes that could lead to penalties or audits down the line.

Another big advantage is the peace of mind it provides. Knowing how much you might owe or how much you could get back allows you to plan your finances accordingly. Whether you're saving for a vacation, paying off debt, or building an emergency fund, having a clear understanding of your tax situation is invaluable.

Read also:Ambika Mod Husband The Story Yoursquove Been Waiting For

Key Features of the H&R Block Calculator

Let's dive into some of the standout features that make the H&R Block Calculator a must-have for anyone tackling their taxes:

- Customizable Inputs: Tailor the calculator to fit your unique financial situation.

- Real-Time Updates: Get the latest tax laws and regulations reflected in your calculations.

- Comprehensive Coverage: Covers a wide range of income sources, deductions, and credits.

- Mobile-Friendly: Access the calculator from anywhere using your smartphone or tablet.

- Secure and Confidential: Your data is protected with industry-leading security measures.

These features ensure that the H&R Block Calculator is not only accurate but also convenient and user-friendly. It's like having a personal tax advisor in your pocket.

How the H&R Block Calculator Helps You Save Money

Let's face it—nobody likes paying more taxes than they have to. That's where the H&R Block Calculator comes in. By identifying potential deductions and credits, this tool helps you maximize your savings and minimize your tax liability. Whether it's claiming the child tax credit, deducting student loan interest, or taking advantage of education credits, the calculator ensures you're not leaving any money on the table.

And here's another cool thing: the calculator can help you spot areas where you might be overspending on taxes. For example, if you're self-employed, it can guide you through claiming home office deductions or business expenses. These small details can add up to significant savings over time.

Who Can Benefit from the H&R Block Calculator?

Short answer? Everyone. But let's break it down a bit further:

- First-Time Filers: If you're new to the world of taxes, the calculator can help you understand the basics and avoid common mistakes.

- Self-Employed Individuals: Freelancers and entrepreneurs can use the calculator to track business expenses and deductions.

- Students: Students can benefit from education credits and deductions, all calculated effortlessly by the tool.

- Retirees: The calculator can help retirees estimate their tax liability on Social Security benefits and other retirement income.

- Investors: Investors can use the tool to calculate capital gains taxes and plan their investment strategies accordingly.

No matter who you are or what your financial situation looks like, the H&R Block Calculator has something to offer.

How Accurate is the H&R Block Calculator?

Accuracy is key when it comes to tax calculations, and the H&R Block Calculator doesn't disappoint. Backed by decades of experience and expertise, this tool uses the latest tax laws and regulations to ensure your estimates are as accurate as possible. Of course, it's important to remember that the calculator provides estimates, not guarantees. For a final determination, you'll still need to file your taxes using the appropriate forms and documentation.

That said, the H&R Block Calculator is an excellent starting point. It gives you a solid foundation to build upon and helps you identify potential issues before they become major headaches.

Common Mistakes to Avoid When Using the H&R Block Calculator

While the H&R Block Calculator is a powerful tool, there are a few common mistakes people make when using it. Here's what to watch out for:

- Incomplete Data: Make sure you input all relevant financial information to get the most accurate results.

- Overlooking Deductions: Don't forget to include all eligible deductions and credits in your calculations.

- Using Outdated Information: Always use the latest tax laws and regulations when entering your data.

- Assuming Estimates Are Final: Remember, the calculator provides estimates, not final figures. Double-check your results with a tax professional if needed.

By avoiding these pitfalls, you can ensure that your calculations are as accurate and reliable as possible.

How to Maximize Your H&R Block Calculator Experience

Ready to get the most out of your H&R Block Calculator? Here are a few tips to help you make the most of this incredible tool:

- Start Early: Don't wait until the last minute to use the calculator. The earlier you start, the more time you'll have to plan and adjust your finances accordingly.

- Stay Organized: Keep all your financial documents in one place to make data entry a breeze.

- Consult a Professional: If you're unsure about certain aspects of your tax situation, consider consulting a tax professional for additional guidance.

- Use the Calculator Regularly: Whether you're planning for next year's taxes or just curious about your current situation, the calculator is a valuable resource year-round.

By following these tips, you'll be well on your way to mastering the H&R Block Calculator and taking control of your tax prep process.

How the H&R Block Calculator Fits into Your Overall Tax Strategy

The H&R Block Calculator isn't just a standalone tool—it's part of a larger tax strategy designed to help you save money and simplify your financial life. By using the calculator in conjunction with other resources, such as tax software or professional advice, you can create a comprehensive plan that addresses all aspects of your tax situation.

For example, you might use the calculator to estimate your refund, then use that information to inform your tax software choices or guide your discussions with a tax professional. This holistic approach ensures that you're covering all your bases and maximizing your savings opportunities.

Final Thoughts and Next Steps

Alright folks, we've covered a lot of ground today. From understanding what the H&R Block Calculator is to exploring its features and benefits, we've uncovered how this powerful tool can transform your tax filing experience. Whether you're a seasoned pro or a first-time filer, the calculator offers something for everyone.

So what's next? Start by gathering your financial documents and giving the calculator a try. See how it can help you estimate your tax refund or liability and discover hidden savings opportunities. And don't forget to share your experience with others—knowledge is power, and the more people know about tools like the H&R Block Calculator, the better off we all are.

Oh, and one last thing: if you found this article helpful, feel free to drop a comment or share it with your friends. Who knows? You might just help someone else take control of their taxes and start saving big.

Table of Contents

- Maximizing Tax Savings: How the H&R Block Calculator Can Transform Your Filing Experience

- What is the H&R Block Calculator?

- How Does the H&R Block Calculator Work?

- Why Use the H&R Block Calculator?

- Key Features of the H&R Block Calculator

- How the H&R Block Calculator Helps You Save Money

- Who Can Benefit from the H&R Block Calculator?

- How Accurate is the H&R Block Calculator?

- Common Mistakes to Avoid When Using the H&R Block Calculator

- How to Maximize Your H&R Block Calculator Experience

- How the H&R Block Calculator Fits into Your Overall Tax Strategy

- Final Thoughts and Next Steps